Summary:

Bitcoin's price dropped below $95,000, reversing earlier gains.

Over 26,000 BTC worth $2.4 billion were liquidated by short-term holders.

Data shows short-term holders are increasingly favoring liquidation over accumulation.

The Accumulation vs. Distribution metric indicates a shift in investor behavior.

Demand from STHs has been declining since early December, affecting market trends.

Bitcoin's price experienced a sharp decline, dropping below $95,000 on January 8. This downturn wiped out the gains made earlier in the week when Bitcoin briefly surpassed $100,000.

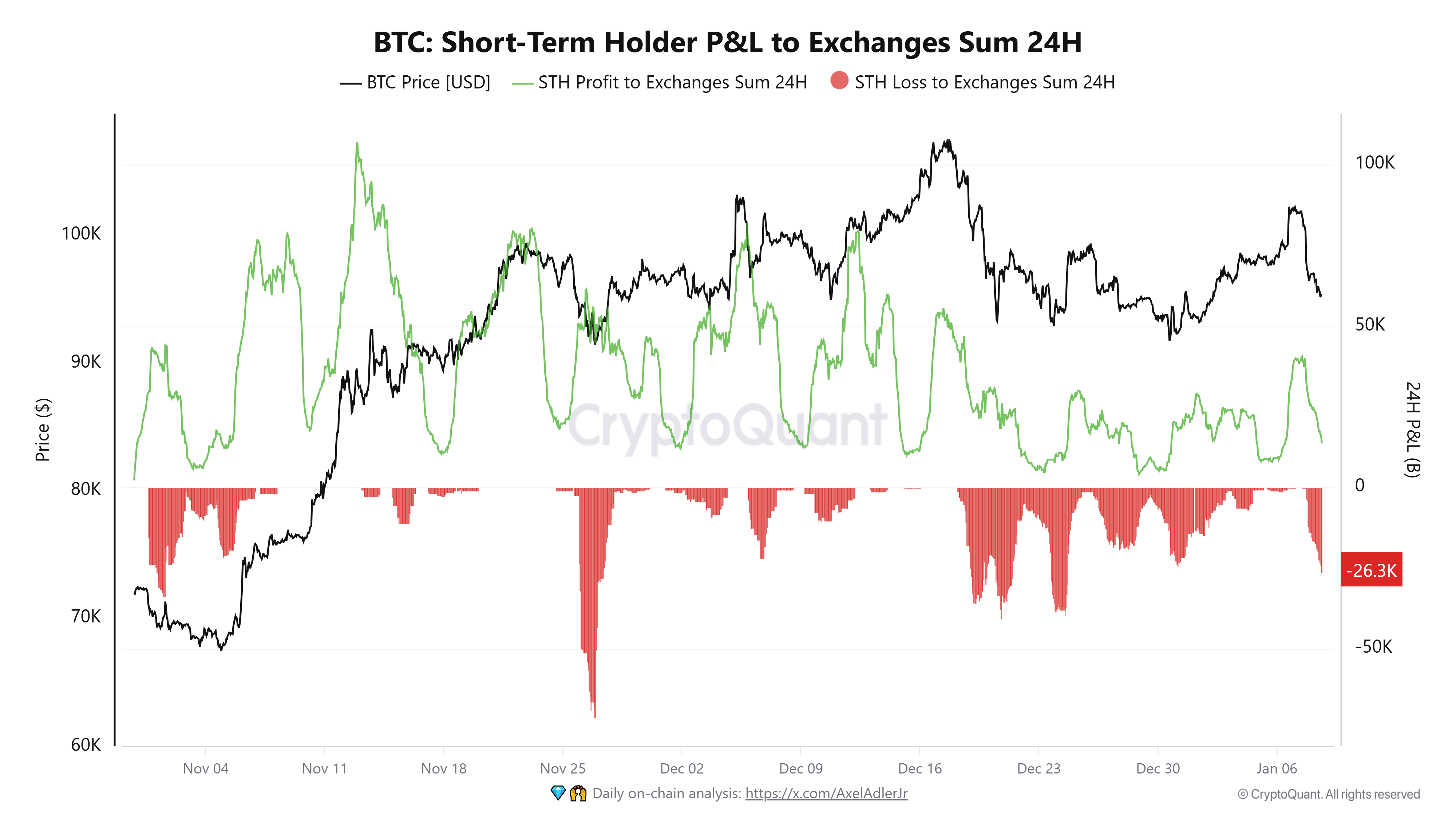

Data from CryptoQuant indicates that short-term holders (STHs)—defined as investors holding Bitcoin for less than 155 days—were significant contributors to this sell-off. Over 26,000 BTC, valued at more than $2.4 billion, were moved to exchanges at a loss.

Source: CryptoQuant

Source: CryptoQuant

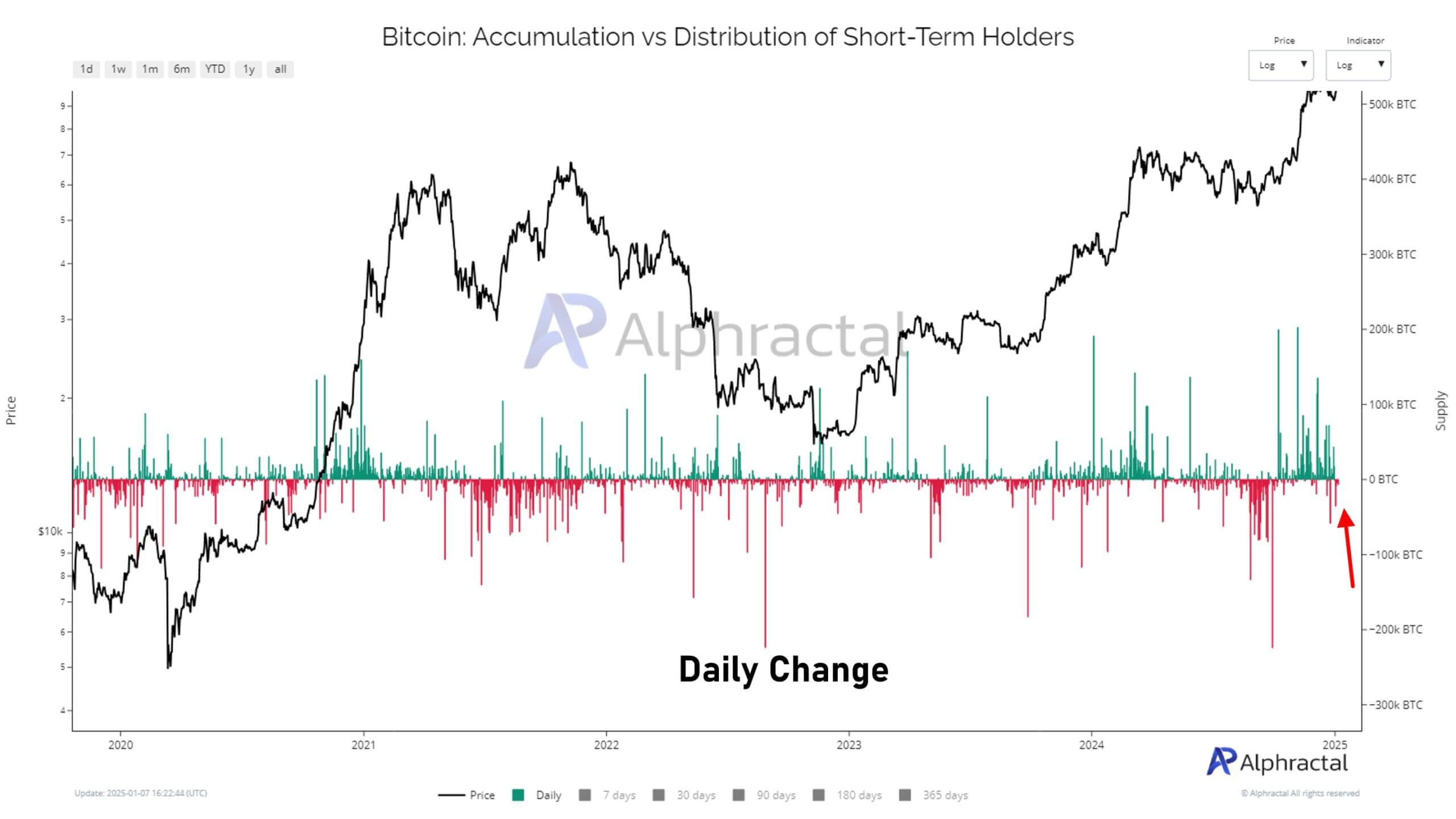

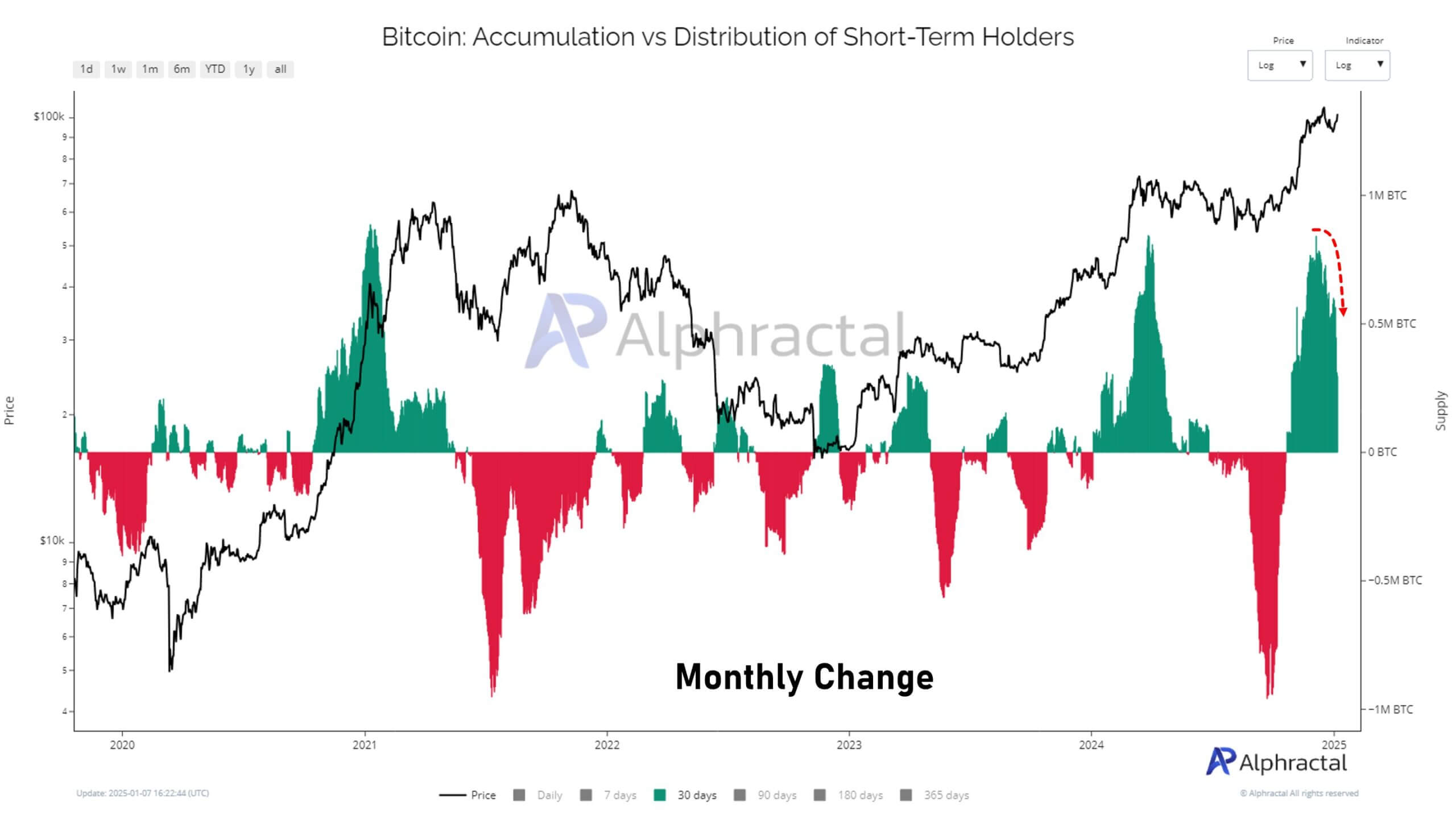

Further analysis from Alphractal revealed that this wave of selling pressure aligns with a broader decline in accumulation trends among short-term holders. The “Accumulation vs. Distribution of STH” metric indicates a growing preference among STHs for liquidating rather than accumulating their Bitcoin holdings.

Source: Alphractal

Source: Alphractal

Notably, STH accumulation has been in a steady decline since December 5. This diminishing demand from short-term holders is closely linked to Bitcoin’s recent price volatility, highlighting the impactful role these investors have on market trends.

Source: Alphractal

Source: Alphractal

Comments