Summary:

Bitcoin prices have fallen sharply, hitting around $92,000 after reaching $100,000 earlier this week.

Arthur Hayes predicts a market crash in late March, suggesting it’s time to sell.

Market sentiment is shifting back to high-risk as traders reassess Federal Reserve interest rate cuts.

The U.S. Treasury's account nearing depletion could exacerbate market declines.

Elon Musk's warning has added pressure to Bitcoin's recent price decline.

Bitcoin and Crypto Prices Take a Dive

Bitcoin and cryptocurrency prices have experienced a significant decline, closely following the downward trend in stock markets. This downturn has been exacerbated by Tesla billionaire Elon Musk's unexpected warning regarding Bitcoin's price.

Earlier this week, Bitcoin reached a peak of $100,000, only to plummet to around $92,000. This drop comes despite a massive investment from a Wall Street bank, which had raised hopes for Bitcoin's future. Now, as the crypto market braces for an upcoming announcement from Musk, legendary investor Arthur Hayes has forecasted a market crash in late March.

Predictions from Arthur Hayes

Arthur Hayes, co-founder of the crypto derivatives platform BitMex, has written in his blog that it may be time to sell Bitcoin during the late stages of the first quarter and to wait for better liquidity conditions in the third quarter. He believes that Bitcoin's price movements are intricately linked to changes in dollar liquidity. As the Treasury's account nears depletion and the U.S. approaches the debt ceiling, he expects further downward pressure on prices.

Market Reactions

Traders are currently reassessing the 2025 outlook for Federal Reserve interest rate cuts, driven by strong U.S. economic data. The sentiment in the market has shifted, and many now view Bitcoin as a high-risk asset again, especially considering the possibility of prolonged elevated interest rates.

Petr Kozyakov, CEO of Mercuryo, commented on the situation, noting that the anticipated market corrections have arrived sooner than expected. This shift indicates a return to cautious trading as enthusiasm about Bitcoin's potential as a strategic reserve fades.

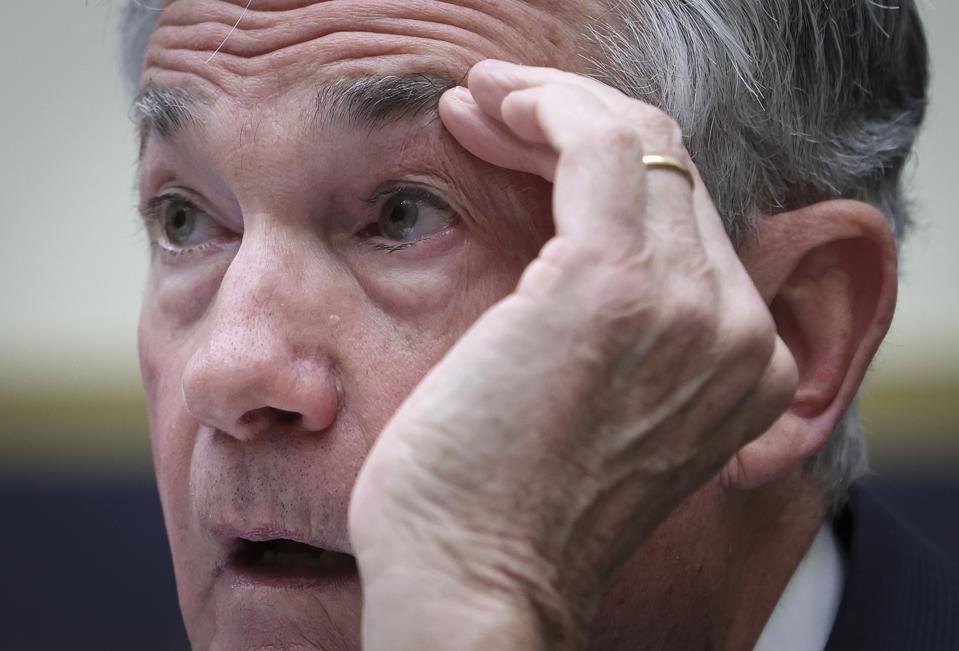

Federal Reserve chair Jerome Powell is predicted to help support the bitcoin price until the end of the first quarter of 2025.

With the crypto market's volatility and the looming economic pressures, investors are urged to stay vigilant and prepared for potential price fluctuations ahead.

Comments