Summary:

Bitcoin trading below $94,000 after a 5% decline this week.

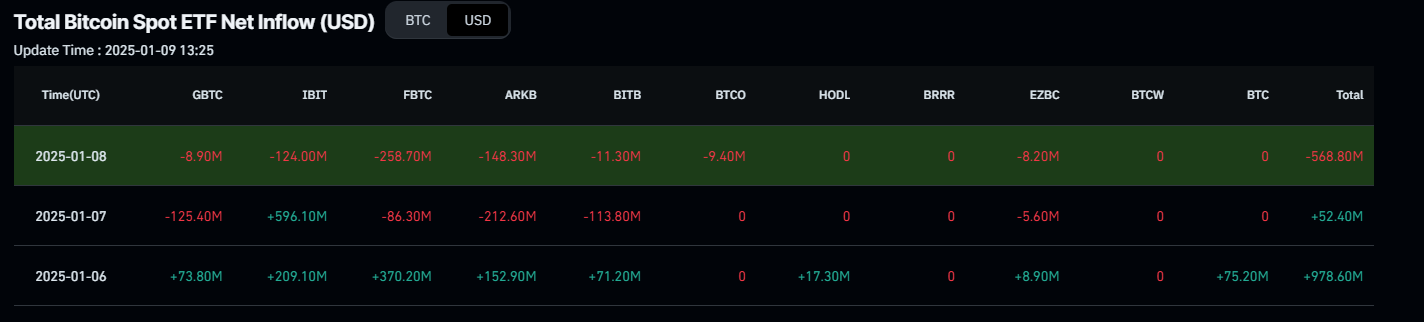

$568 million outflow from Bitcoin US spot ETFs indicates weakening demand.

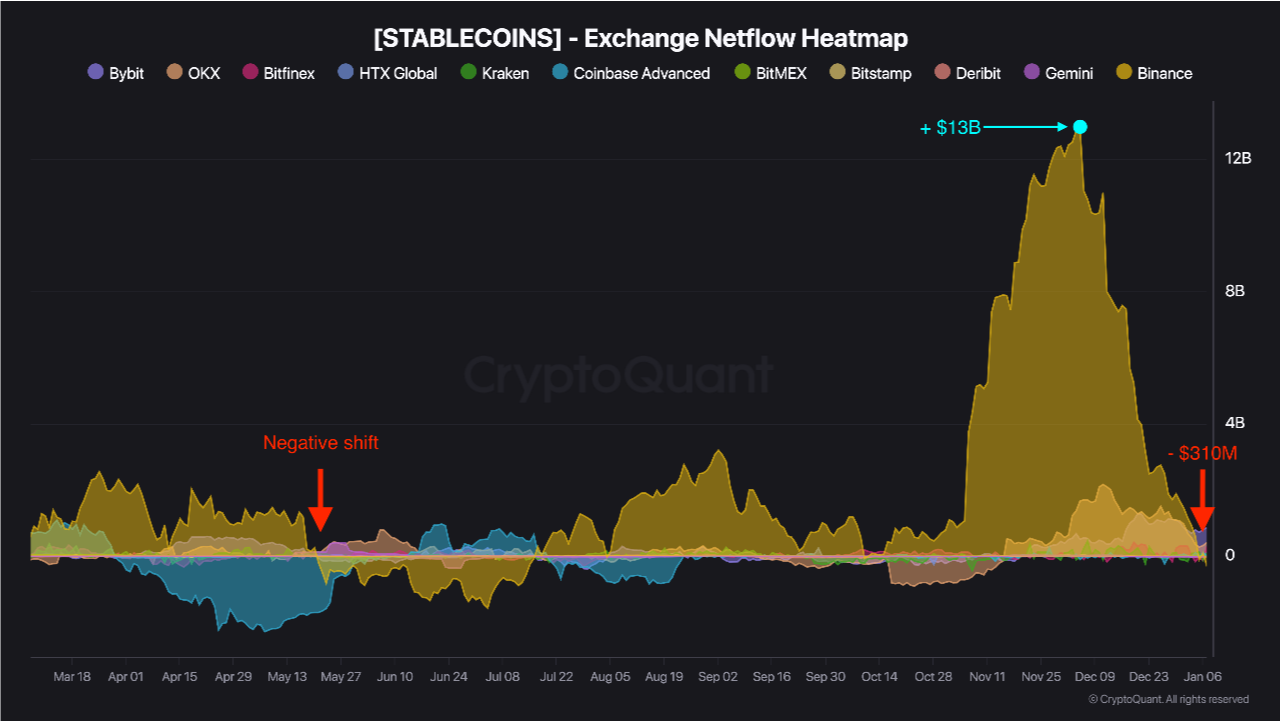

Stablecoin inflows decreasing, suggesting reduced buying pressure.

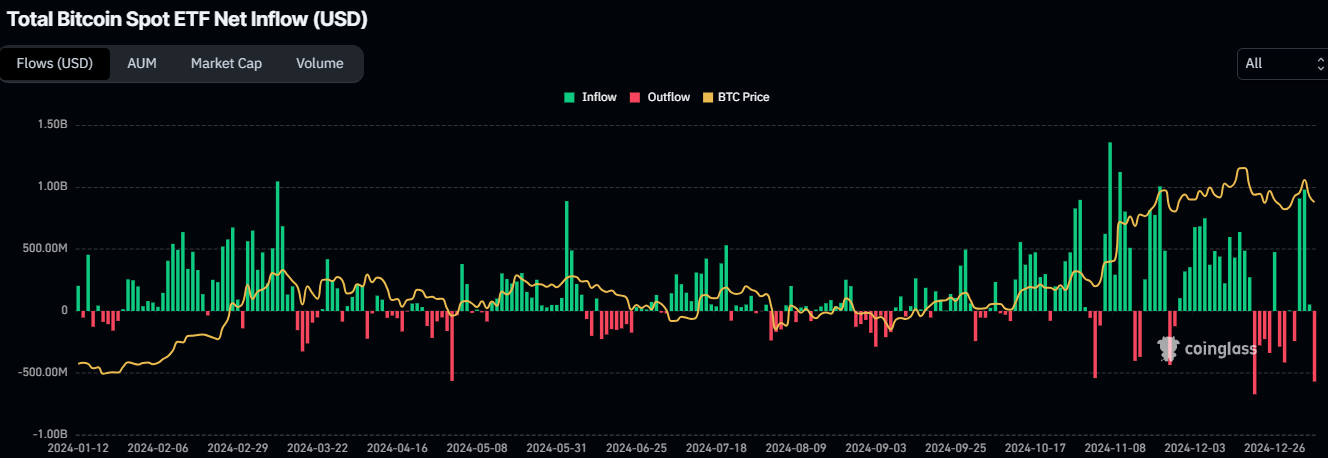

Historical trends show potential for a price crash similar to May 2024.

Upcoming Trump inauguration could act as a market catalyst.

Current Bitcoin Price: $93,500

- Bitcoin continues to edge down, trading below the $94,000 level on Thursday after falling more than 5% this week.

- Bitcoin US spot ETFs recorded an outflow of over $568 million on Wednesday, indicating decreasing demand.

- CryptoQuant data shows that reducing stablecoin inflows signals a weakening buying pressure.

Weakening Institutional Demand

Bitcoin's price has been trading in the red for the third consecutive day, falling below $94,000. This correction may indicate a weakening institutional demand. According to Coinglass, the $568.80 million outflow from Bitcoin spot ETFs on Wednesday is the highest since December 19. If this trend continues, it could lead to further declines in Bitcoin’s price.

Another concerning trend is the decrease in stablecoin reserves on Binance. From a $13 billion inflow on December 5, reserves have dropped to a $310 million outflow on Tuesday. This behavior suggests that investors are either securing their capital or locking in profits.

Potential for a Price Decline

Historically, a similar trend occurred in May 2024, leading to a sharp price decline from $71,900 to $64,300. If the current trend continues, we might see a similar crash soon.

Despite the bearish outlook, caution is advised for traders in short positions. The upcoming Donald Trump presidential inauguration on January 20 could act as a significant market catalyst, potentially driving Bitcoin's volatility.

In an exclusive interview, Dr. Sean Dawson, Head of Research at Derive.xyz, stated: “The upcoming inauguration could serve as a significant market catalyst, potentially driving volatility in Bitcoin and Ethereum.”

Bitcoin Price Forecast: Bears Eyeing the $90K Mark

Bitcoin price has dropped 7% from Tuesday to Wednesday, closing below $95,060. Currently, it trades around $93,500. If BTC continues its downward trend and closes below the 38.2% Fibonacci retracement level at $92,493, it may extend the decline to test the psychological level of $90,000.

The Relative Strength Index on the daily chart is at 43, indicating bearish momentum, while the MACD shows a bearish crossover, suggesting a downtrend.

If BTC manages to recover and close above $100,000, it could retest the all-time high of $108,353 from December 17, 2024.

Comments