Summary:

New taxes on business-class flights, crypto trades, and plastics proposed at UN climate talks.

Negotiations aim to raise $1.3 trillion annually by the 2030s for developing nations.

Potential revenues from cryptocurrency taxation could reach $5 billion.

Global stock trading levies could generate $418 billion a year.

The polluter pays principle is emphasized for climate funding solutions.

Taxing the High Emitters

World leaders at the United Nations climate talks in Azerbaijan are being urged to consider new taxes on business-class air travel, large stock and cryptocurrency trades, and plastic production. These measures aim to help finance the transition to cleaner economies and address climate change.

The Financial Goal

The discussions are centered around raising substantial funds from developed nations to assist developing countries in adapting to climate change. The goal is to negotiate how much financial support will be provided annually and determine which countries will be donors or recipients. The current target is to replace a fund set to expire in 2025, which allocates $100 billion annually, with a staggering requirement of $1.3 trillion per year by the 2030s, as indicated by the G77 nations.

Challenges of Negotiation

The negotiation process has been complicated by political shifts, including the election of Donald Trump, which may lead to the U.S. withdrawing from agreements. The Australian Climate Change and Energy Minister, Chris Bowen, is tasked with advancing these stalled negotiations alongside Egypt's Yasmine Fouad. Experts have compared the current discussions to World War I, indicating the complexity and high stakes involved.

Innovative Financial Solutions

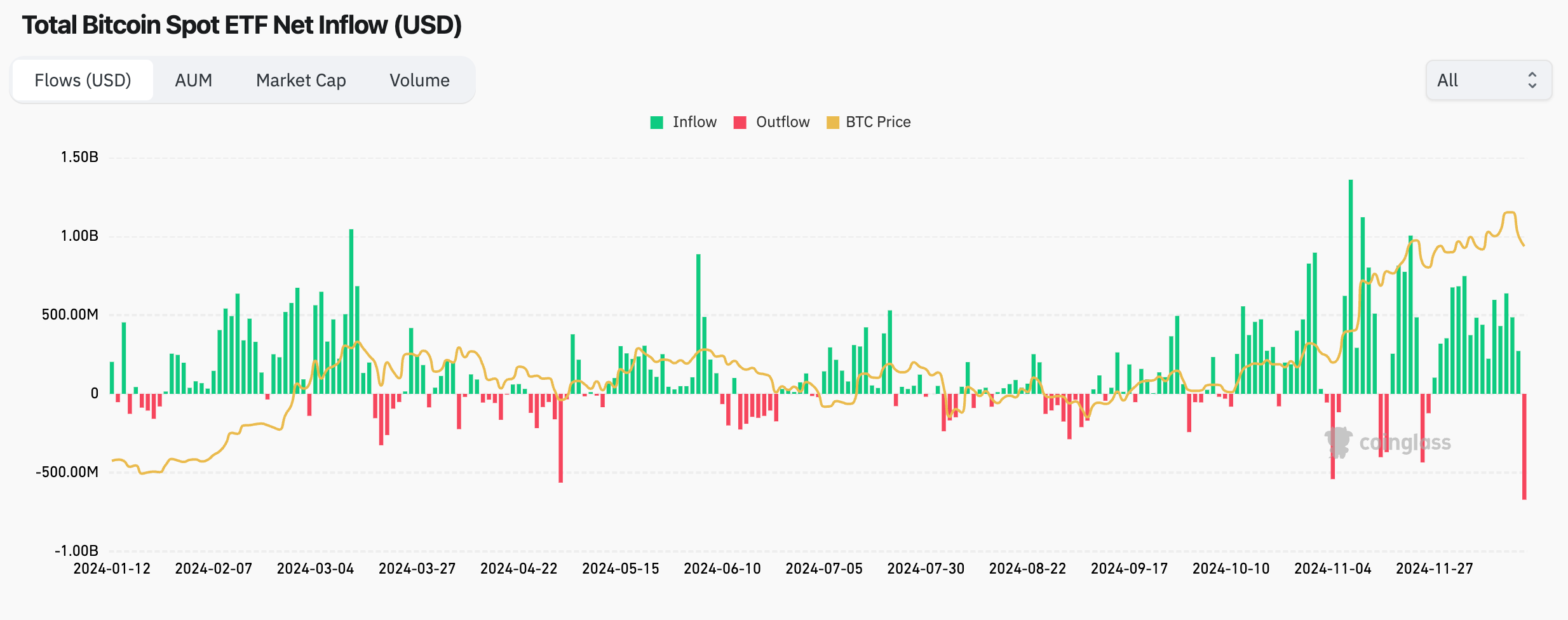

A report from the Global Solidarity Levies taskforce suggests that international taxation on high-emitting sectors, including cryptocurrencies—which added 1% to global energy demand last year—could raise significant revenue. For instance, charging $0.045 per kWh on cryptocurrency energy use could generate $5 billion. Other proposed levies include:

- $418 billion from a global stock and bond trading levy.

- $210 billion from fossil fuel extraction taxes.

- Up to $200 billion from international shipping and aviation levies by 2035.

Polluter Pays Principle

The task force emphasizes the “polluter pays” principle, suggesting that industries responsible for emissions should contribute to the financial solutions for climate stabilization. They propose specific measures such as:

- Targeted aviation levies based on flight distance and class.

- A $60 to $90 per tonne levy on new plastic polymer production, potentially yielding $25 to $35 billion annually.

Dr. Wesley Morgan from the University of New South Wales states, “It is the grand bargain of global climate negotiations. Wealthy nations that contributed most to emissions must help developing countries pursue cleaner futures.”

Comments