Summary:

Glassnode's report reveals similarities between current and past Bitcoin cycles.

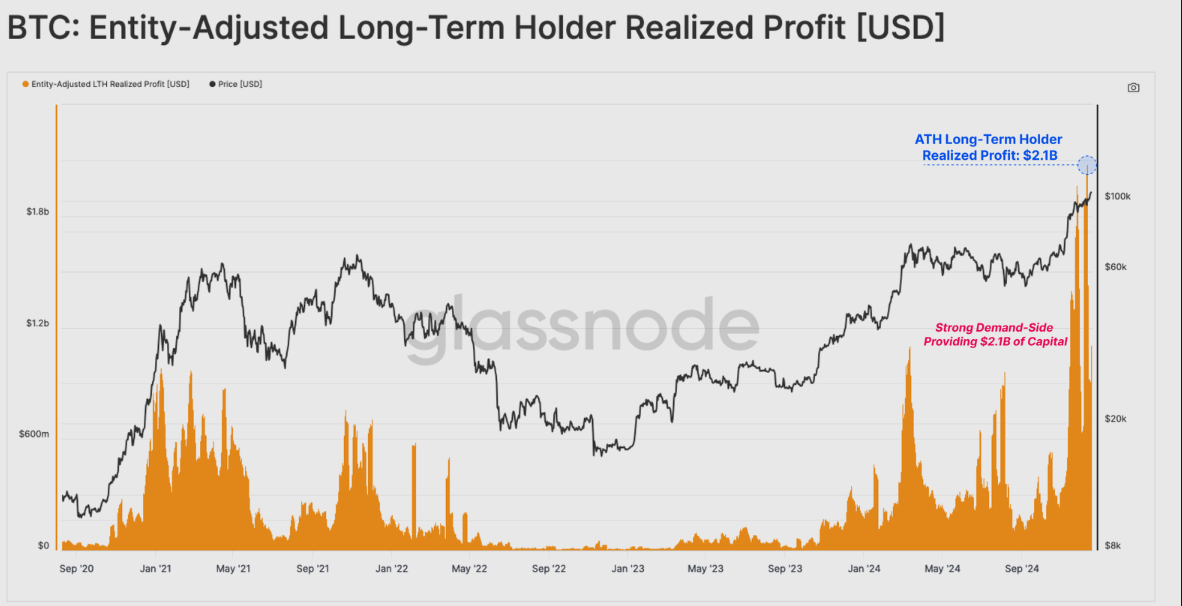

Long-term holders realized $2.1 billion in profits as Bitcoin surged to $100K.

The least volatile cycle in Bitcoin's history shows reduced selling pressure.

Increased institutional interest and spot Bitcoin ETFs contribute to market stability.

New market entrants account for 38.5% of total sell-side pressure.

Bitcoin's Current Trajectory Mirrors Past Cycles

Glassnode's latest Week on Chain report highlights the intriguing parallels between Bitcoin's current uptrend and earlier cycles, despite evolving market conditions.

During the recent rally that pushed Bitcoin to the $100K milestone, long-term holders capitalized on their investments, realizing a staggering $2.1 billion in profits.

The Market Dynamics at Play

In 2024, Bitcoin has experienced a phenomenal year with returns exceeding 130%. Glassnode's analysis suggests that the price movements resemble those seen in the 2015-2018 and 2018-2021 cycles.

Interestingly, while sustained price increases typically bring about selling pressure, this cycle has shown a reduced pace of selling. The most significant drawdown occurred on August 5, 2024, with a 32% drop from its peak.

Moreover, this has been Bitcoin's least volatile cycle to date, with most drawdowns capping at -25% from local highs, indicating a more stable market environment. This stability may be attributed to a surge in institutional interest and the recent introduction of spot Bitcoin ETFs.

Demand Outstripping Supply

Despite the profit-taking by long-term holders, demand remains robust, with an estimated $2.1 billion of fresh capital flowing into the market daily. The influx of new investors, particularly those who acquired Bitcoin in the last six months to a year, has contributed significantly to sell-side pressure, accounting for 38.5% of total selling.

In summary, Glassnode notes that the redistribution of coins from older investors typically occurs during the later stages of bull markets, suggesting that the current conditions may be indicative of a maturing market phase.

:max_bytes(150000):strip_icc()/WhattoExpectFromBitcoinandCryptocurrencyMarketsin2025-12ed9a9f2e8c42a5b2477933ea62fe0d.jpg)

Comments