Summary:

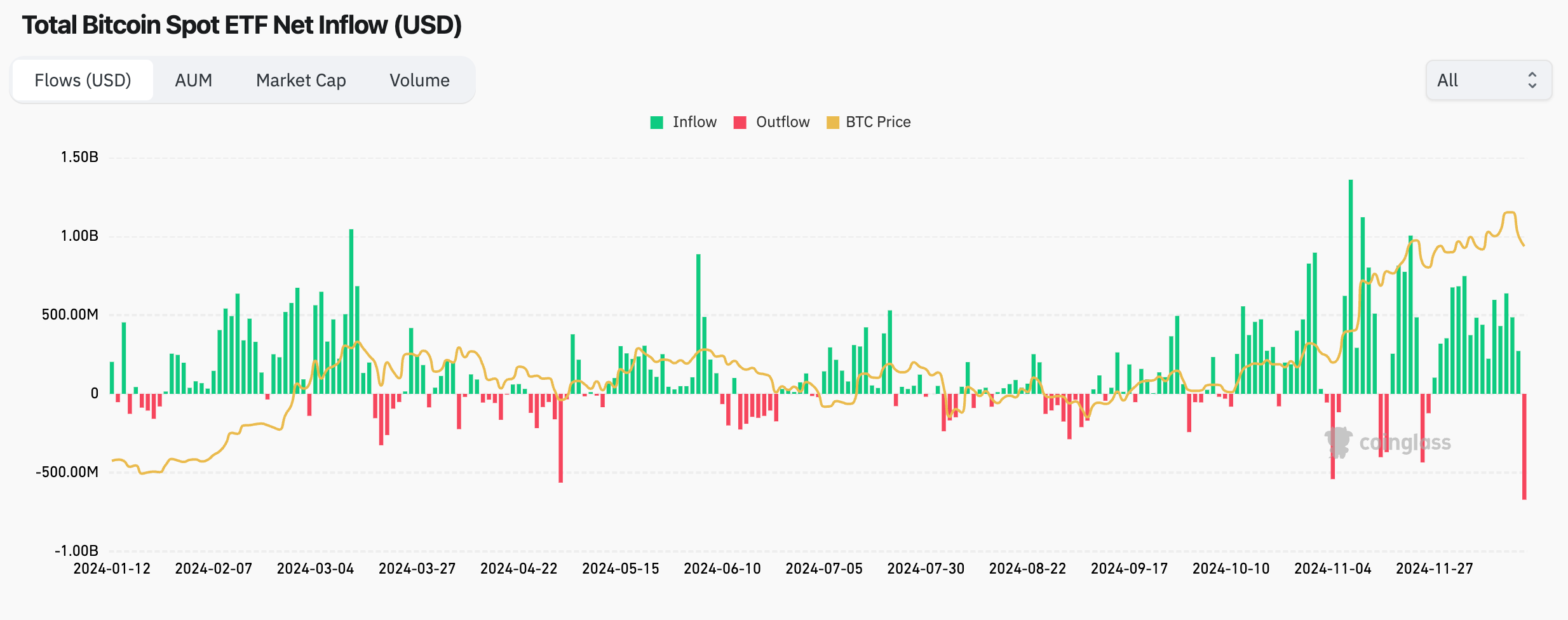

Record outflow of $671.9 million from U.S. spot bitcoin ETFs.

Bitcoin price fell below $100,000, down nearly 10% from recent highs.

CME futures premium dropped to 9.83%, signaling weakening demand.

Fidelity's FBTC and Grayscale's GBTC led the outflows with $208.5 million and $188.6 million lost.

Ether ETFs also saw a notable outflow of $60.5 million.

Spot Bitcoin ETFs Experience Unprecedented Withdrawals

The U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETFs) faced a staggering record outflow of $671.9 million on Thursday, marking the largest single-day withdrawal since their inception on January 11. This decline comes as bitcoin's price plunged below $100,000, extending its post-Fed losses.

CME Futures Premium Indicates Weak Demand

The CME futures premium has also diminished, dropping into single digits, which signals a decrease in short-term demand. Investors ended a 15-day streak of inflows, with Fidelity's FBTC and Grayscale's GBTC leading the outflows, losing $208.5 million and $188.6 million, respectively. Other funds also experienced significant withdrawals, with BlackRock's IBIT reporting a zero figure for the first time in weeks.

Bitcoin's price fell to $96,000, down nearly 10% from its recent high of $108,268 earlier this week. This bearish sentiment is reflected in the derivatives market, where the annualized premium in CME's regulated one-month bitcoin futures fell to 9.83%, the lowest in over a month.

Impact on Ether ETFs

Additionally, Ether ETFs witnessed a net outflow of $60.5 million, marking the first decline since November 21. Ether has suffered a 20% drop since exceeding $4,100 before the Fed's recent decision.

Market Implications

The decline in the futures premium suggests that cash-and-carry arbitrage strategies involving long positions in ETFs and short positions in CME futures are yielding lower returns, indicating that ETFs may continue to face weak demand in the near term.

:max_bytes(150000):strip_icc()/WhattoExpectFromBitcoinandCryptocurrencyMarketsin2025-12ed9a9f2e8c42a5b2477933ea62fe0d.jpg)

Comments