Summary:

XRP could see a withdrawal of the SEC appeal by January 15, pushing it past $3.5505.

New SEC Chair Paul Atkins may support ending the Ripple case, affecting XRP's price.

A ruling against the Programmatic Sales of XRP could lead to increased regulatory oversight.

Bitcoin's (BTC) demand is rising due to speculation on a Strategic Bitcoin Reserve (SBR).

BTC closed at $94,373, with price trends influenced by U.S. economic data.

The best-case scenario for XRP is a potential withdrawal of the SEC appeal by January 15, which could push the token past its record high of $3.5505 set on January 18. However, if the SEC proceeds with an opening brief, the new SEC Chair Paul Atkins and the incoming Commissioners could vote to withdraw the case.

XRP may face selling pressure if the SEC presents a strong case for appeal, potentially dropping below $2. A closed SEC meeting and internal vote to withdraw could support XRP reaching new record highs. It's important to note that an agency vote, rather than just the Chair's decision, determines the continuation or withdrawal of the appeal.

Programmatic Sales of XRP Ruling Sets Precedent

The SEC's appeal hinges on the critical Programmatic Sales of XRP ruling. In July 2023, Judge Analisa Torres ruled that these sales did not meet the third prong of the Howey Test, which sets a precedent for the digital asset space in the U.S. If this ruling is overturned, XRP may fall under the SEC's regulatory oversight, leading to potential de-listing by exchanges to avoid securities law violations. This could also hinder pending XRP-spot ETF applications.

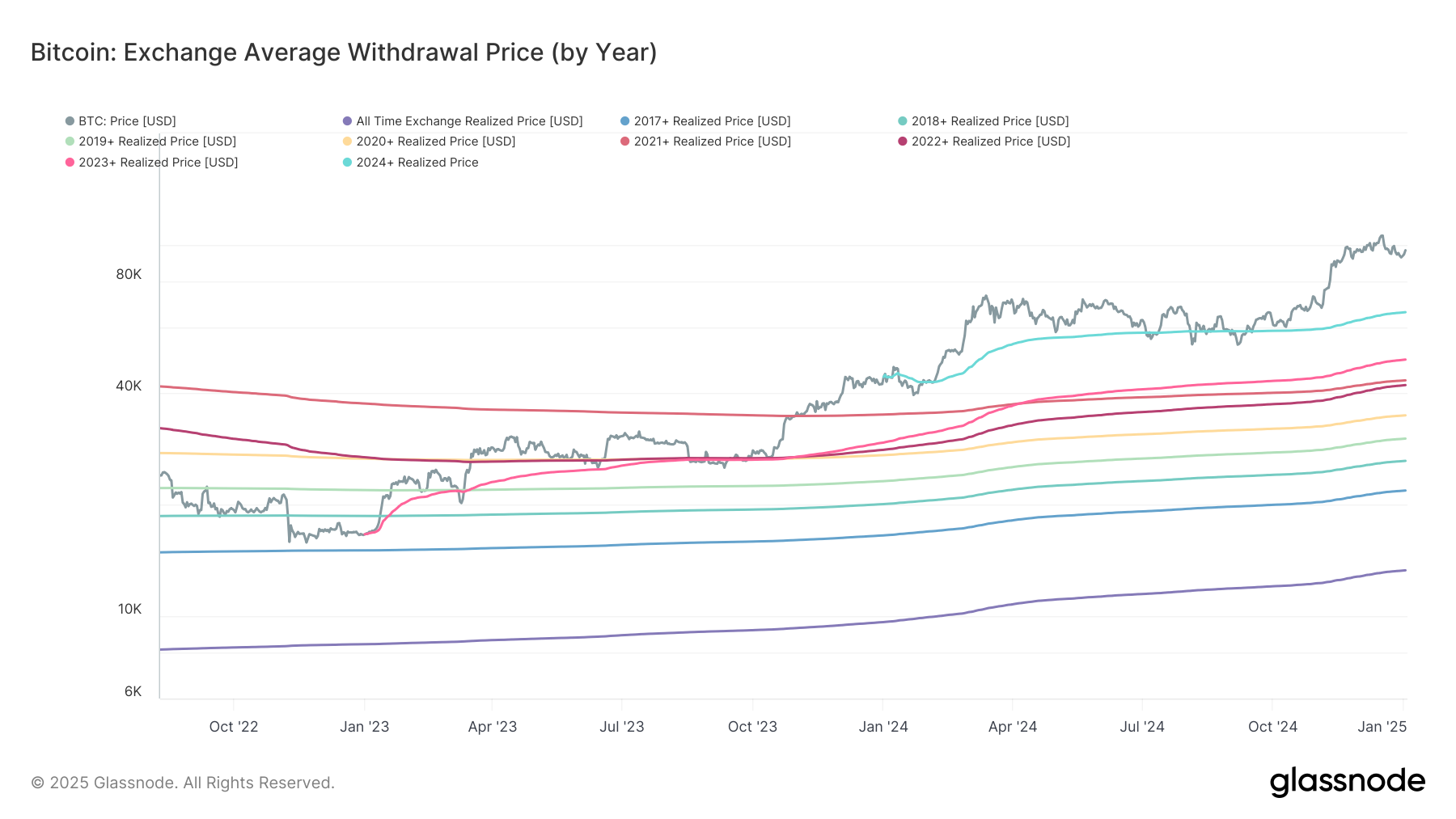

Bitcoin and a Strategic Reserve

Meanwhile, Bitcoin (BTC) has started 2025 positively, driven by speculation regarding major economies potentially adopting a Strategic Bitcoin Reserve (SBR) based on Trump’s plans. Metaplanet CEO Simon Gerovich mentioned that if the U.S. makes BTC a strategic reserve asset, other countries, including Japan, may follow suit, significantly affecting BTC supply and demand.

Trump’s upcoming inauguration speech could be pivotal for BTC's near-term price trends, especially if he emphasizes BTC as a strategic reserve asset.

Bitcoin Price Outlook

On January 1, BTC rose by 1.06%, closing at $94,373. The near-term price trajectory will depend on U.S. economic data and ETF market flows. Positive labor market data could decrease expectations for a Q1 2025 Fed rate cut, affecting demand for BTC and BTC-spot ETFs. Conversely, weaker labor conditions could push BTC towards $100,000. As Trump's inauguration approaches, discussions related to the SBR will also be crucial.

Comments