Summary:

SEC approved multiple spot Ether ETFs in July 2024, but market response was muted.

Bitcoin surged over 50% in 2024, while Ether only climbed around 15%.

$80 million outflow from Ether ETFs highlights low institutional interest.

Bitcoin continues to dominate the crypto landscape, attracting billions in investments.

Ether struggles to establish a consistent narrative that resonates with investors.

When the SEC announced the approval of multiple spot Ether ETF products in July 2024, market sentiment was overwhelmingly positive. This marked a significant milestone as both Bitcoin and Ether received ETF approvals within the same year. However, the market response for Ether has been notably muted compared to the dramatic price increases witnessed by Bitcoin, which has maintained a substantial uptick despite ongoing volatility.

Outflows and Underperformance

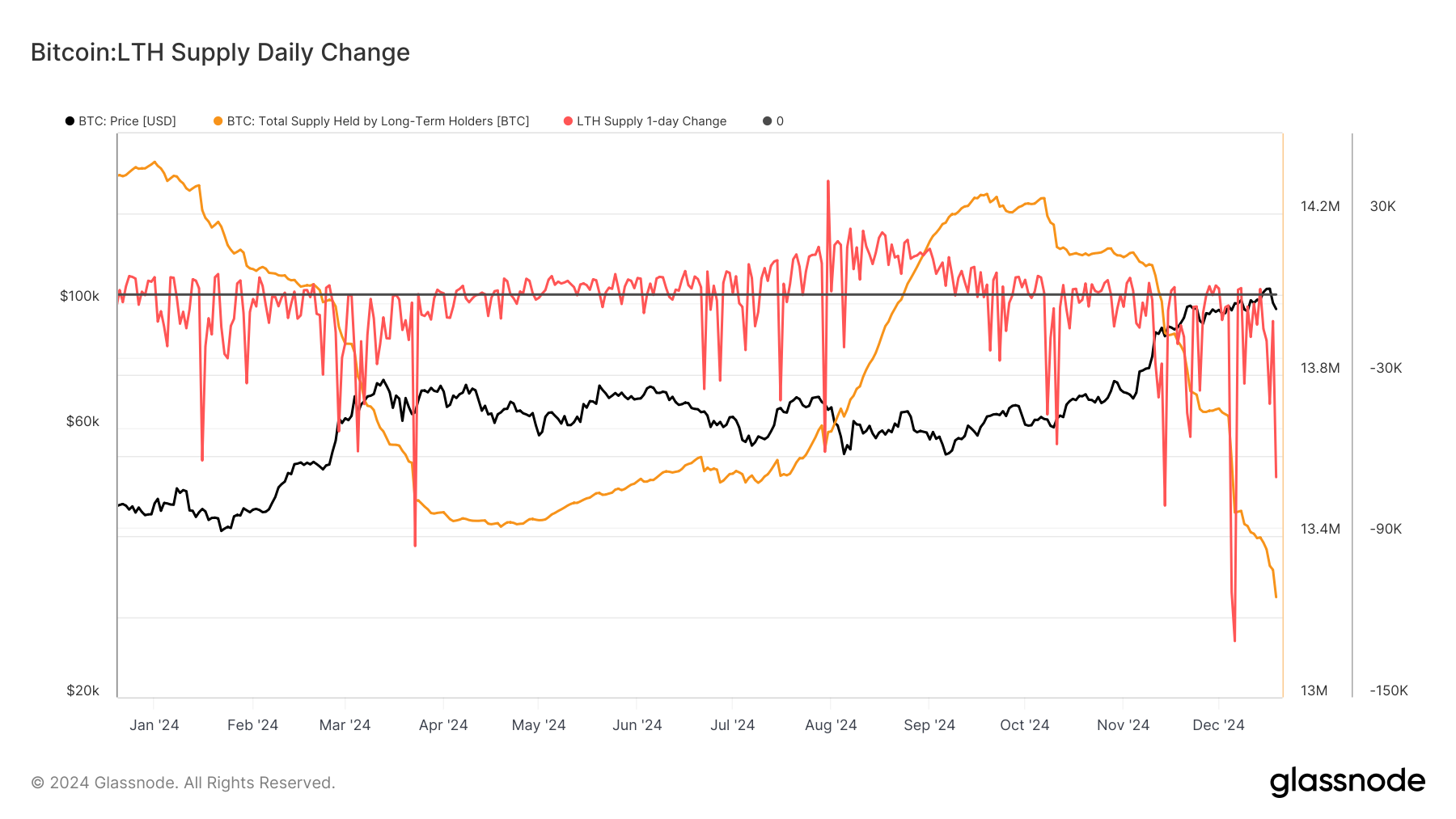

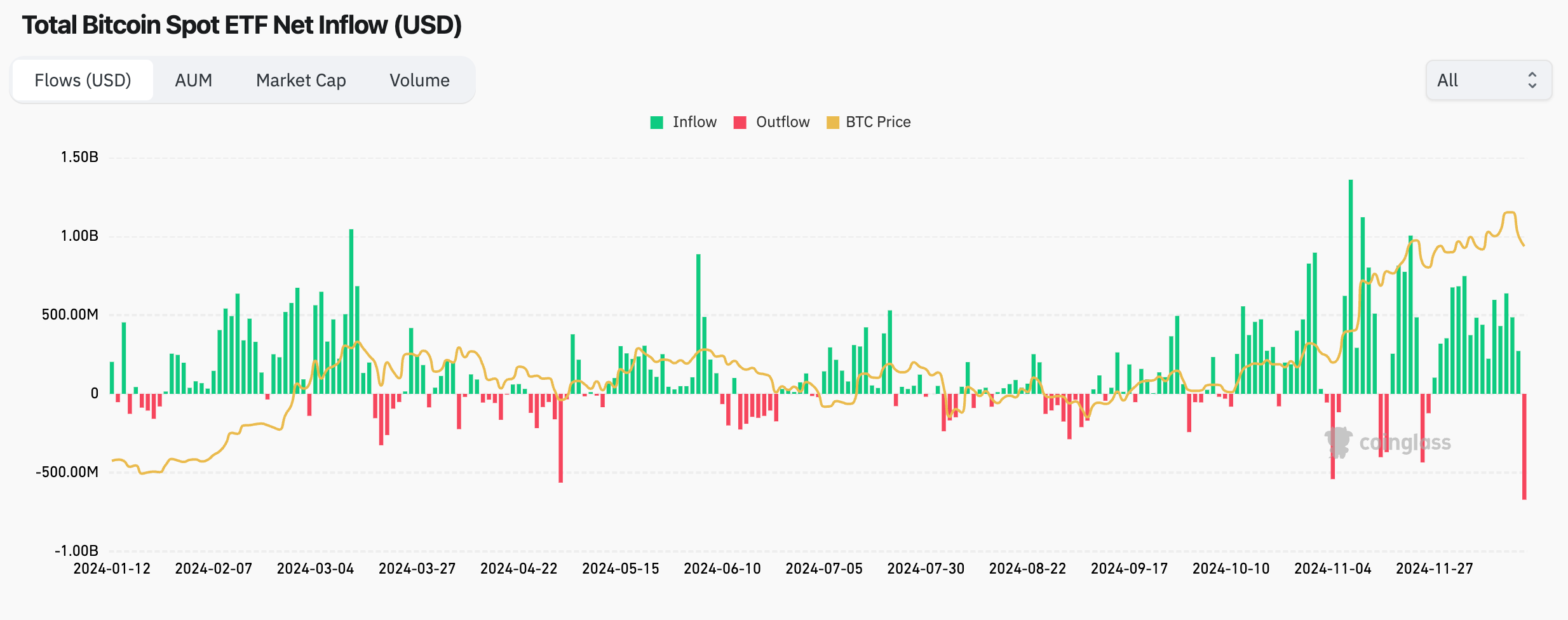

Ether ETFs have faced substantial outflows, including an alarming $80 million outflow in a single day— the highest since July 2024. In stark contrast, Bitcoin has surged over 50% in 2024, while Ether has only managed a 15% increase, failing to reach its previous all-time highs set in 2021. This contrast showcases that the launch of spot Ether ETFs has not generated the expected enthusiasm.

Bitcoin's Dominance

Despite the rapid expansion of the crypto market, Bitcoin remains the unquestioned leader in both media and institutional discussions. Bitcoin ETFs have attracted billions, significantly boosting its price, whereas institutional investors continue to prioritize Bitcoin, as seen with companies like Microstrategy and Blackrock focusing solely on Bitcoin investments.

The Narrative Gap

The narrative surrounding Bitcoin has remained consistent and compelling, often presented as digital gold or a store of value. In contrast, Ether has struggled to establish a clear and consistent narrative that resonates with mainstream investors. While Ethereum serves as the backbone for many key applications in the crypto space, its messaging has not captured the same level of institutional interest.

Price Paradox of Ether

Ether's role as a currency for numerous Layer 2 applications brings about a price paradox. Serving both as a medium of exchange and an investment asset, Ether faces downward price pressure due to its usage in various applications including stablecoins, DeFi, DAOs, and NFTs. This paradox, coupled with the muted market response post-ETF approval, suggests that institutional preference will likely remain skewed towards Bitcoin for the foreseeable future.

Crypto ETFs represent a positive advancement for the sector, yet they do not all yield equal returns.

Comments