Summary:

Bitcoin reached an all-time high of USD 106,000.

Bitcoin Halving event is a key factor behind the surge.

Halving reduces the mining reward for validating transactions by half.

Bitcoin's supply is capped at 21 million tokens, with only 1.5 million left to mine in the next 116 years.

Historically, halving events lead to increased market value.

Even as I write this article, Bitcoin has made history by reaching a new all-time high of USD 106,000, breaking its previous record from December 5th, 2024. Clearly, Bitcoin’s position in the fast-changing cryptocurrency world is being cemented like no other cryptocurrency. One of the key factors attributed to this phenomenal surge is the “Bitcoin Halving” event that took place in April 2024.

What is Bitcoin Halving?

Bitcoin was designed with a capped supply of 21 million tokens. Halving, a built-in feature in Bitcoin’s code, reduces the speed at which new Bitcoin are released into circulation. This event does not decrease the number of Bitcoin already in circulation; instead, it cuts the reward for miners validating transactions by half.

The Science Behind Bitcoin Halving

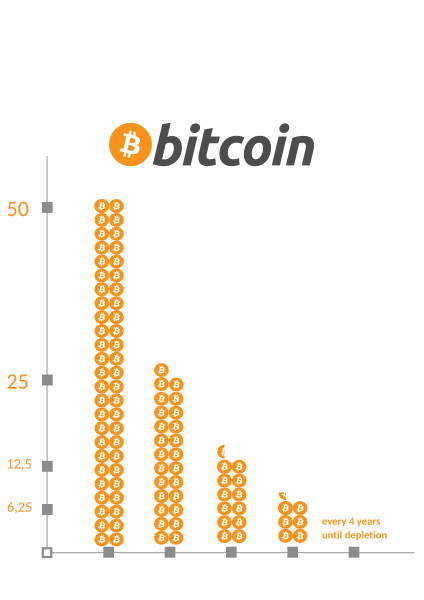

Bitcoin operates on Blockchain technology, where “blocks” of information are created through a process known as mining. Miners compete to validate transactions and are rewarded with newly minted Bitcoin approximately every 10 minutes. However, every 210,000 blocks added to the blockchain triggers a halving event, occurring roughly every four years, which halves the mining reward.

Image: Wikimedia Commons

Image: Wikimedia Commons

This mechanism is crucial for preventing fraudulent transactions and controlling inflation, while also maintaining Bitcoin's limited supply. With about 19.5 million Bitcoin already mined, the last Bitcoin is projected to be mined around 2140, meaning only 1.5 million will be created in the next 116 years.

Market Dynamics: Is Halving a Good Thing?

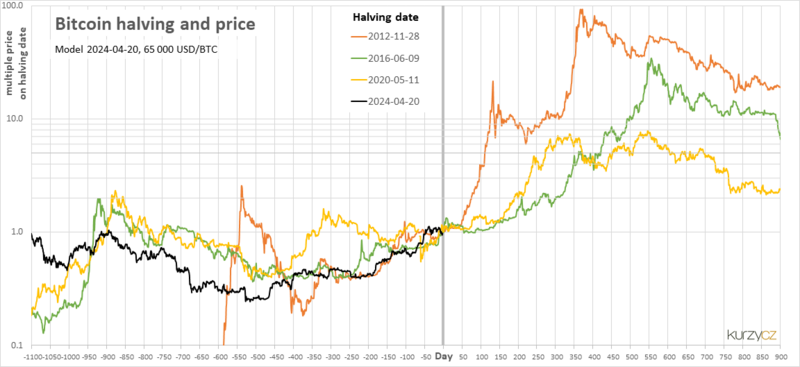

Historically, there have been four halving events, with the last one on April 19th, 2024. Each halving reduces the mining reward to maintain the value and scarcity of Bitcoin, often leading to increased market value. This is due to a decrease in supply when demand remains steady or increases.

| Year | Mining Reward (BTC) | |------|---------------------| | 2009 | 50 | | 2012 | 25 | | 2016 | 12.5 | | 2020 | 6.25 | | 2024 | 3.125 | | 2028 | 1.56 | | 2140 (approx.) | 0.00000001 |

However, there are concerns regarding the mining process itself as halving rewards impact profitability, potentially increasing the risk of a 51% attack. Conversely, a reduction in rewards also leads to lower energy consumption and a smaller environmental impact.

Interestingly, after the recent halving, the expected price surge did not materialize, possibly due to higher interest rates and inflation affecting investors. The question on everyone’s mind now is: could Bitcoin hit the USD 1 million mark? While ambitious, the crypto's price could climb higher, especially after breaking its own records in late 2024.

:max_bytes(150000):strip_icc()/WhattoExpectFromBitcoinandCryptocurrencyMarketsin2025-12ed9a9f2e8c42a5b2477933ea62fe0d.jpg)

Comments