Summary:

Cryptocurrency market faces challenges after rate cut announcement.

Bitcoin dipped below $60,000 amidst geopolitical tensions.

Anticipated rate cuts could benefit the crypto market.

Robinhood, BlackRock, CME, and NVIDIA are key stocks to watch.

The cryptocurrency market is currently facing challenges despite a brief recovery after the Federal Reserve's rate cut announcement in September. Bitcoin (BTC), which briefly surpassed $63,000, has dipped below $60,000 this week due to various factors, including a four-day outflow from U.S. spot Bitcoin ETFs and ongoing geopolitical tensions in the Middle East.

Bitcoin Price Retreats From Recent Highs

Bitcoin traded at $61,136.95 on Thursday but fell below $60,000 earlier in the day. This decline marks the sixth consecutive day of price drops, following a peak of $73,750 on March 14. Despite recent setbacks, Bitcoin has achieved a 44.6% year-to-date return.

Cryptocurrency Stocks Poised to Grow

The cryptocurrency market stands to benefit from anticipated Federal Reserve rate cuts. Lower interest rates typically favor growth assets like cryptocurrencies as they reduce the opportunity cost of holding non-yielding assets. Investors are optimistic about a potential 50 basis point rate cut, signaling positive momentum for the crypto market.

4 Crypto Stocks With Growth Potential

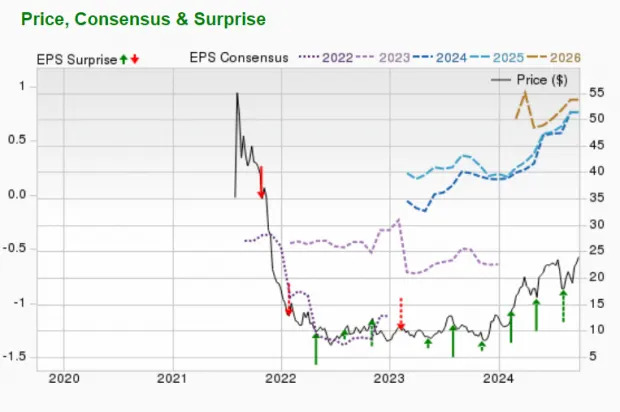

Robinhood Markets

Robinhood Markets operates a platform allowing users to trade various assets, including cryptocurrencies. With an expected earnings growth rate exceeding 100%, it currently holds a Zacks Rank #1 (Strong Buy).

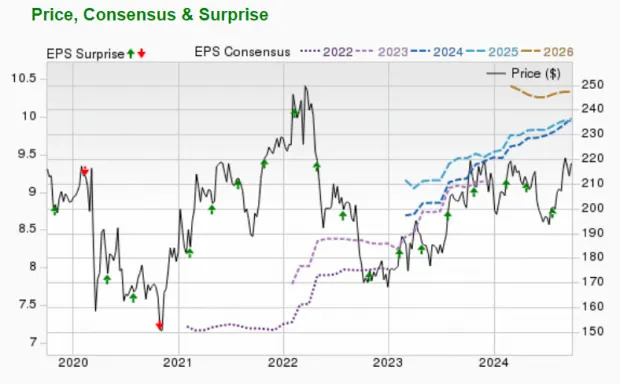

BlackRock

BlackRock, a major investment manager, has engaged in the Bitcoin ETF race since June 2023. Its expected earnings growth rate stands at 9.6%, and it currently holds a Zacks Rank #3.

CME Group

CME Group Inc. offers options for cryptocurrency futures contracts. The expected earnings growth rate for CME is 7.3%, with a current Zacks Rank #3.

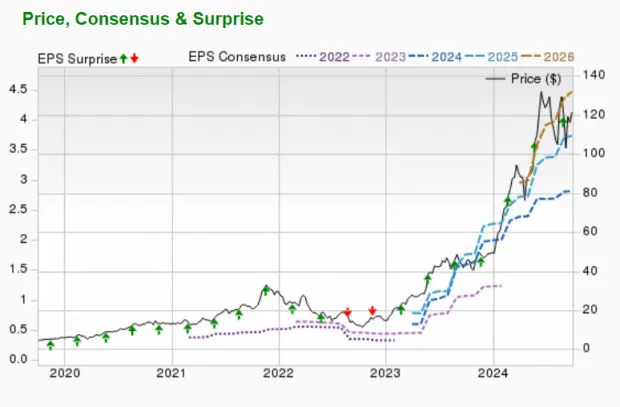

NVIDIA

NVIDIA, a leader in visual computing technologies, is focused on solutions that support high-performance computing. It has an expected earnings growth rate of over 100% and currently holds a Zacks Rank #3.

:max_bytes(150000):strip_icc()/WhattoExpectFromBitcoinandCryptocurrencyMarketsin2025-12ed9a9f2e8c42a5b2477933ea62fe0d.jpg)

Comments