Summary:

Short-term bitcoin holders are facing heightened unrealized losses as market pressure increases.

Despite overall market resilience, this group is under significant financial strain.

Average cost basis for these investors is between $59,000 and $65,000, above current spot prices.

Further market weakness is expected until the spot price reclaims the STH cost basis of $62.4k.

Short-term holders may become a primary source of sell-side pressure if conditions worsen.

A recent report from Glassnode, led by researchers Ukuriaoc and Cryptovizart, highlights growing stress among short-term bitcoin (BTC) holders. As market pressure mounts, these investors are experiencing heightened unrealized losses, which may drive future sell-side activity.

Glassnode: Unrealized Losses Climb for Short-Term Bitcoin Investors

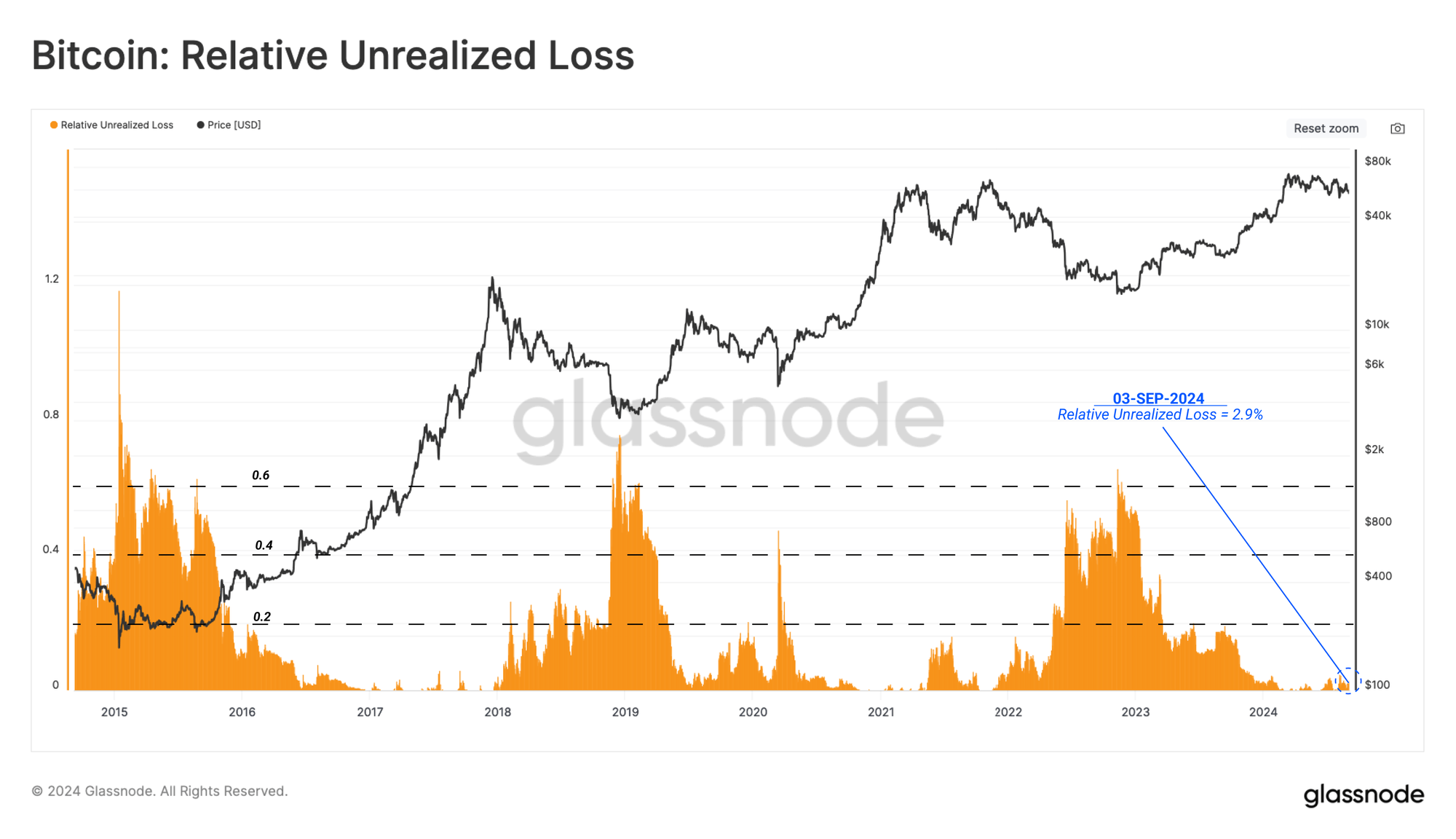

According to Glassnode’s onchain analysis, short-term bitcoin holders are currently bearing the brunt of unrealized losses in the bitcoin market. Despite overall market losses remaining historically low, this specific cohort faces significant financial strain. With downward pressure increasing over the past three months, unrealized losses for short-term holders have consistently risen. Glassnode’s report states:

However, even for this cohort, the magnitude of their Unrealized Losses relative to the market cap is not yet in full-scale bear market territory and more closely resembles the choppy 2019 period.

The broader market continues to show resilience, with unrealized profits still six times greater than losses across the investor landscape. However, short-term holders, especially those who purchased in the past six months, are notably vulnerable.

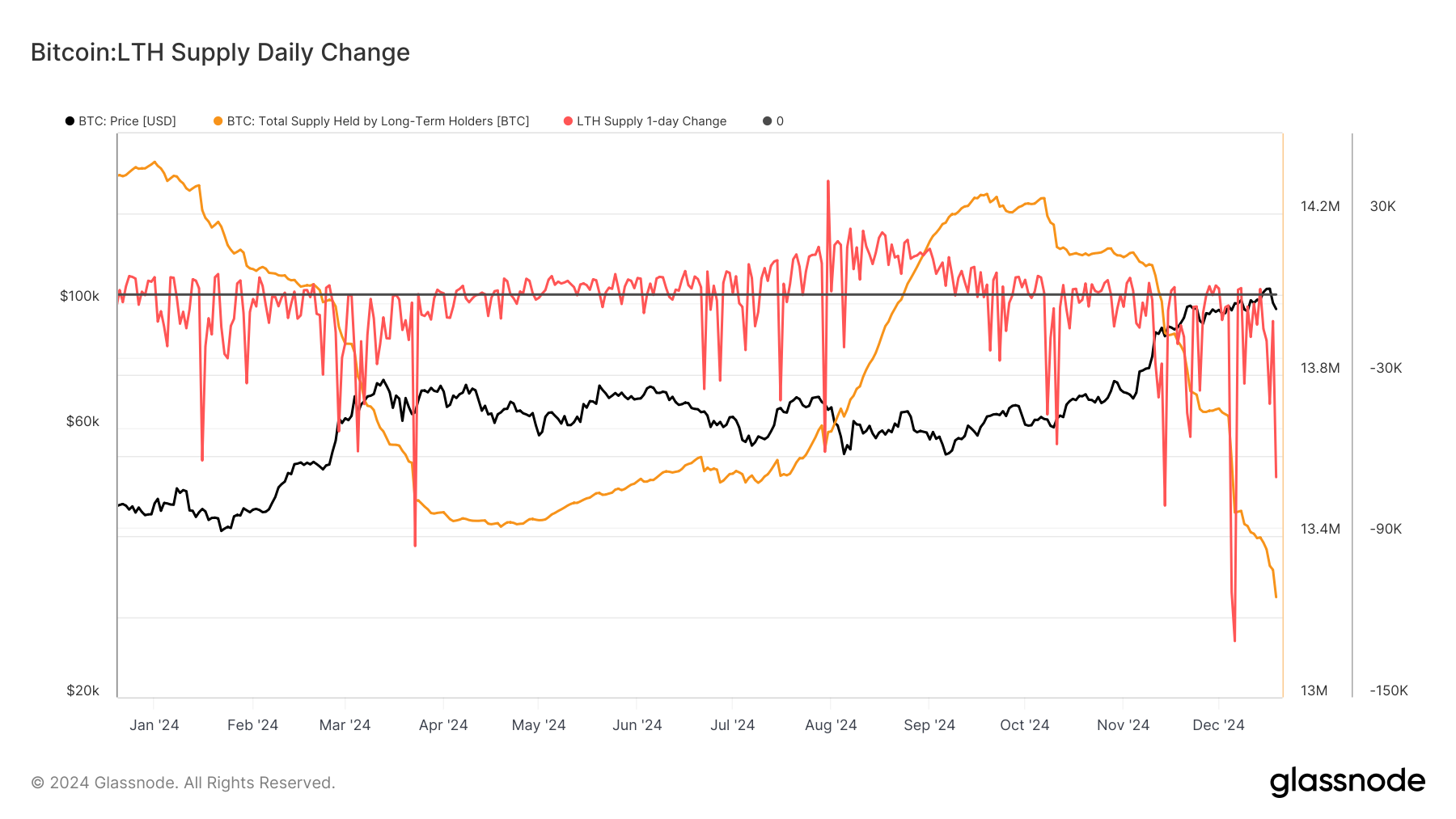

The average cost basis for these investors ranges between $59,000 and $65,000, well above the current spot price of bitcoin. This trend suggests that until the spot price climbs above their breakeven point, these investors are expected to remain under pressure.

“Generally speaking, until the spot price reclaims the STH cost basis of $62.4k, there is an expectation for further market weakness,” Glassnode’s onchain analysis details.

Despite these challenges, Glassnode’s analysis shows that realized profit and loss-taking activities remain minimal. The Sell-Side Risk Ratio, a key indicator of market behavior, suggests that most coins being transacted are near their original acquisition prices. This metric typically precedes heightened volatility, indicating potential turbulence in the near future as the market searches for equilibrium. The report emphasizes that short-term holders are likely to be the primary source of sell-side pressure if market conditions worsen.

What do you think about Glassnode’s latest analysis? Share your thoughts and opinions about this subject in the comments section below.

Comments