Summary:

Ripple's RLUSD stablecoin aims to enhance cross-border payments.

SEC uncertainty surrounds RLUSD's regulatory status.

XRP price rose to $2.4842 following RLUSD's launch.

Bitcoin reaches a new high of $107,471 after MicroStrategy's purchase.

US BTC-spot ETF market sees record inflows of $218.7 million.

Ripple has introduced RLUSD, an enterprise-grade stablecoin designed to enhance cross-border payments. Backed by US dollar deposits, government bonds, and other cash equivalents, RLUSD will undergo third-party audits for transparency. Ripple aims to strengthen connections between fiat and crypto, positioning RLUSD as a formidable competitor against traditional payment systems like SWIFT.

Will the SEC Target Ripple’s Stablecoin?

The launch comes amid uncertainty regarding the SEC's stance on RLUSD, which was previously labeled an unregistered crypto asset. Investors are hopeful that the incoming SEC Chair, Paul Atkins, may shift the regulatory landscape, especially with Gary Gensler's upcoming departure.

XRP Price Volatility and Regulatory Impact

On December 16, XRP rose by 1.62%, closing at $2.4842. The launch of RLUSD has significantly boosted demand for XRP. Future price movements will be heavily influenced by the SEC's appeal decisions, with potential highs of $3.5505 or lows near $1 depending on regulatory outcomes.

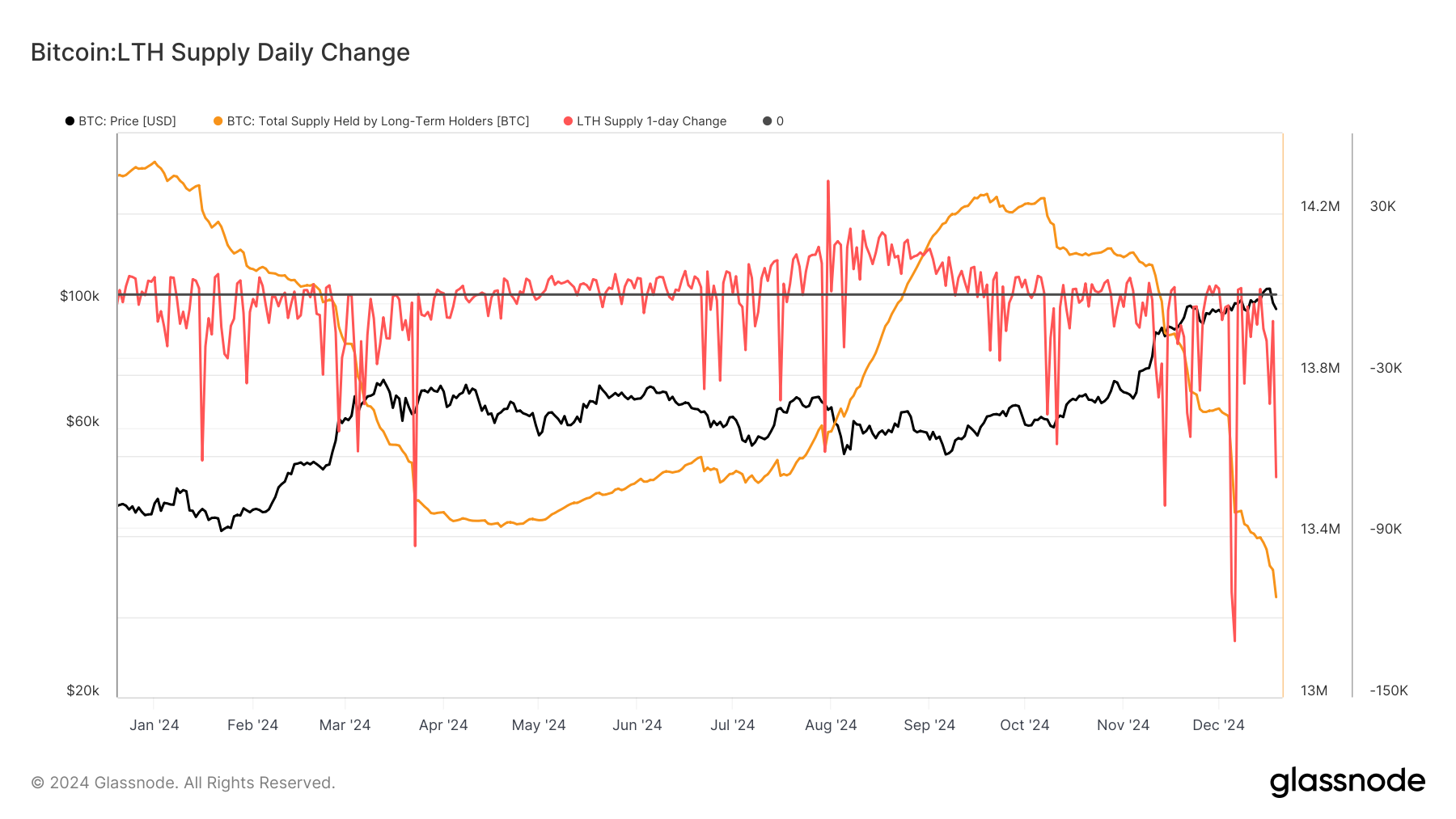

Bitcoin Hits New Record High Amid MicroStrategy Move

On the same day, Bitcoin (BTC) surged to a new high of $107,471 following MicroStrategy's acquisition of 15,350 BTC. This purchase coincided with news of MicroStrategy's inclusion in the Nasdaq 100, further driving BTC demand. Analyst Tony Sycamore noted the potential for a pullback but emphasized the ongoing bullish sentiment.

US BTC-Spot ETF Market Extends Inflow Streak

The US BTC-spot ETF market is experiencing a significant inflow streak, with net inflows totaling $218.7 million. This trend, coupled with MicroStrategy's purchases, is contributing to Bitcoin's rising prices.

Bitcoin Price Outlook

As of December 16, BTC's price trajectory will depend on developments surrounding the Strategic Bitcoin Reserve and ETF market trends. A large US government BTC sale could create downward pressure, potentially bringing prices below $100,000.

Comments