Summary:

MSTR's bullish skew has shifted to neutral, signaling a market sentiment change.

Call options are now trading at parity with puts, indicating reduced bullish sentiment.

MSTR's share price has declined over 44% from its peak.

MicroStrategy holds 446,400 BTC, but its stock performance is lagging behind BTC.

Investors are hesitant to pay a premium for MSTR shares when Bitcoin can be bought directly.

Market Sentiment Shift

Traders are no longer chasing upside in Nasdaq-listed MicroStrategy (MSTR), a leveraged play on Bitcoin (BTC), indicating a cautious shift in market sentiment.

MSTR's 250-day put-call skew has bounced to zero from -20% in just three weeks, according to data from Market Chameleon. This change means that call options, which traders typically use to gain asymmetric upside from potential rallies, are now trading at parity with puts that offer downside protection, contrasting the unusually high premiums observed just weeks ago.

In essence, the sentiment has flipped from uber-bullish to neutral.

Declining Share Prices

The change in sentiment coincides with MSTR's share price decline of over 44%, dropping to $289 from a record high of $589 on November 21. Valuation has decreased 34% in the past two weeks alone, as reported by TradingView.

Markus Thielen, founder of 10x Research, commented: "With MicroStrategy shares now down 44% from their peak and other companies adopting Bitcoin as a treasury asset strategy at a much smaller scale, the Bitcoin tailwind generated by this narrative appears to be losing steam."

MicroStrategy's Bitcoin Holdings

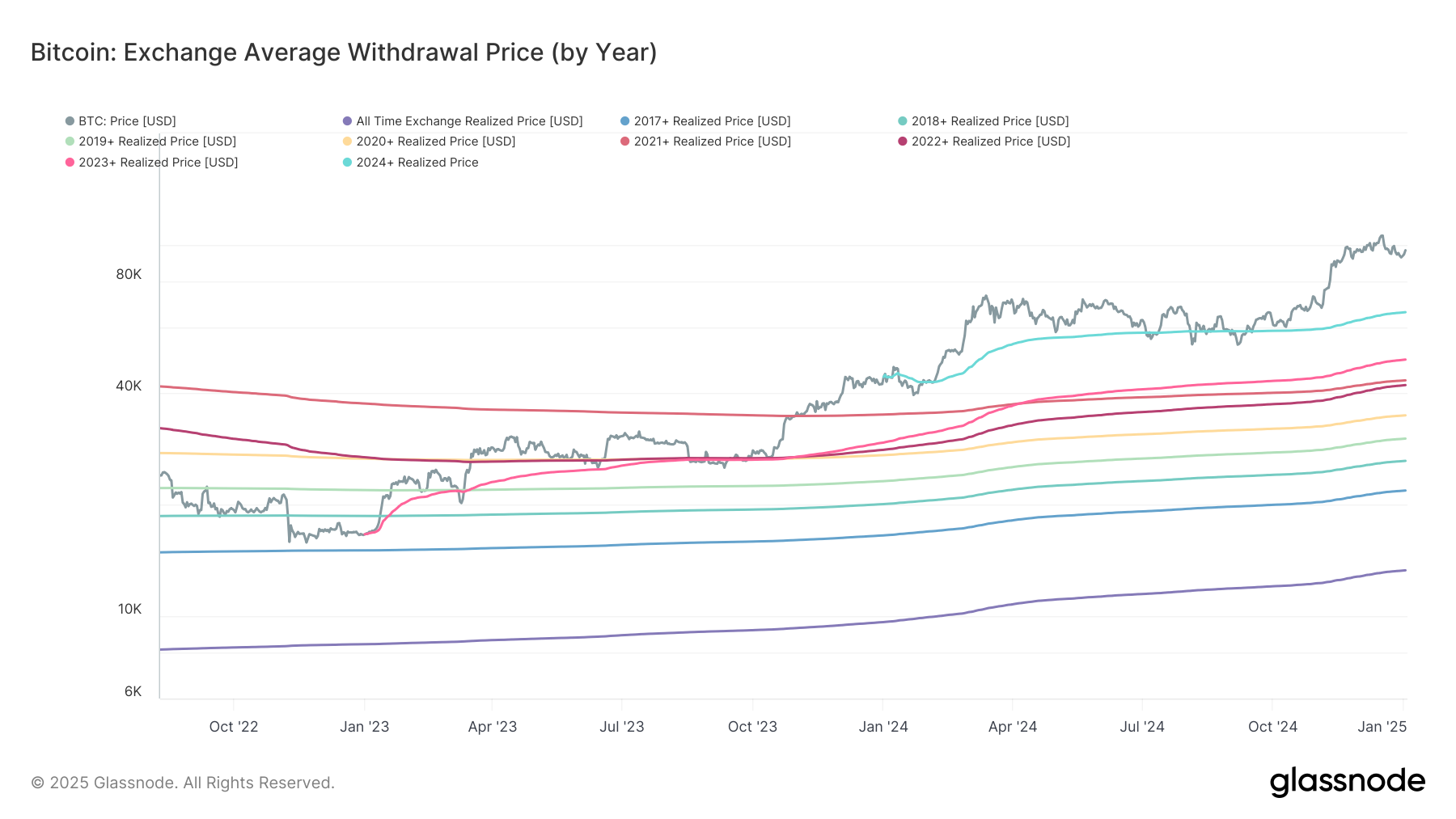

MicroStrategy began accumulating Bitcoin in 2020, amassing 446,400 BTC (valued at $42.6 billion) often through debt sales. Thus, MSTR is perceived as a leveraged bet on BTC, ending 2024 with a 346% gain, vastly outperforming BTC's 121% rise.

However, the end-of-year performance was disappointing. MSTR fell by 25% in December while BTC only dropped by 3%, indicating a weakening appeal for MSTR as a leveraged bet on BTC.

Thielen noted, "The stock’s underperformance, despite substantial Bitcoin acquisitions, indicates that investors are no longer willing to pay an implied price of $200,000 (or more) per Bitcoin through MicroStrategy when it can be purchased directly at a much lower cost."

Comments