Summary:

Bitcoin whale moves $530 million after 44 months of dormancy.

Transaction fee for the massive transfer was only $45.93.

MicroStrategy purchases $1.5 billion in Bitcoin, increasing holdings.

Fidelity Investments acquires $250 million in Ethereum, boosting ETF inflows.

A Dormant Bitcoin Whale Returns

A Bitcoin (BTC) whale that has been inactive for nearly 44 months has come back to life, transferring over $530 million worth of Bitcoin, as revealed by on-chain data from Arkham Intelligence. This transaction marks a significant event for the crypto community.

The Details of the Transaction

The whale, who last made a transaction in April 2021, moved its substantial BTC holdings into two new addresses. The breakdown of the transfer shows one address now holds $420 million, while the other contains 1,000 BTC, approximately $107 million. The total fee for this massive transfer? Just $45.93.

“A whale that has been dormant for over three years has just moved $530 million of Bitcoin into two new addresses.”

MicroStrategy and Fidelity's Latest Moves

In addition to this notable transaction, Arkham Intelligence also reported on MicroStrategy’s recent Bitcoin acquisition. The business intelligence firm has purchased $1.5 billion worth of Bitcoin at an average price of $100,400, adding around 15,350 BTC to its holdings. As of December 15, MicroStrategy holds a total of 439,000 BTC at an average price of $61,725 per Bitcoin.

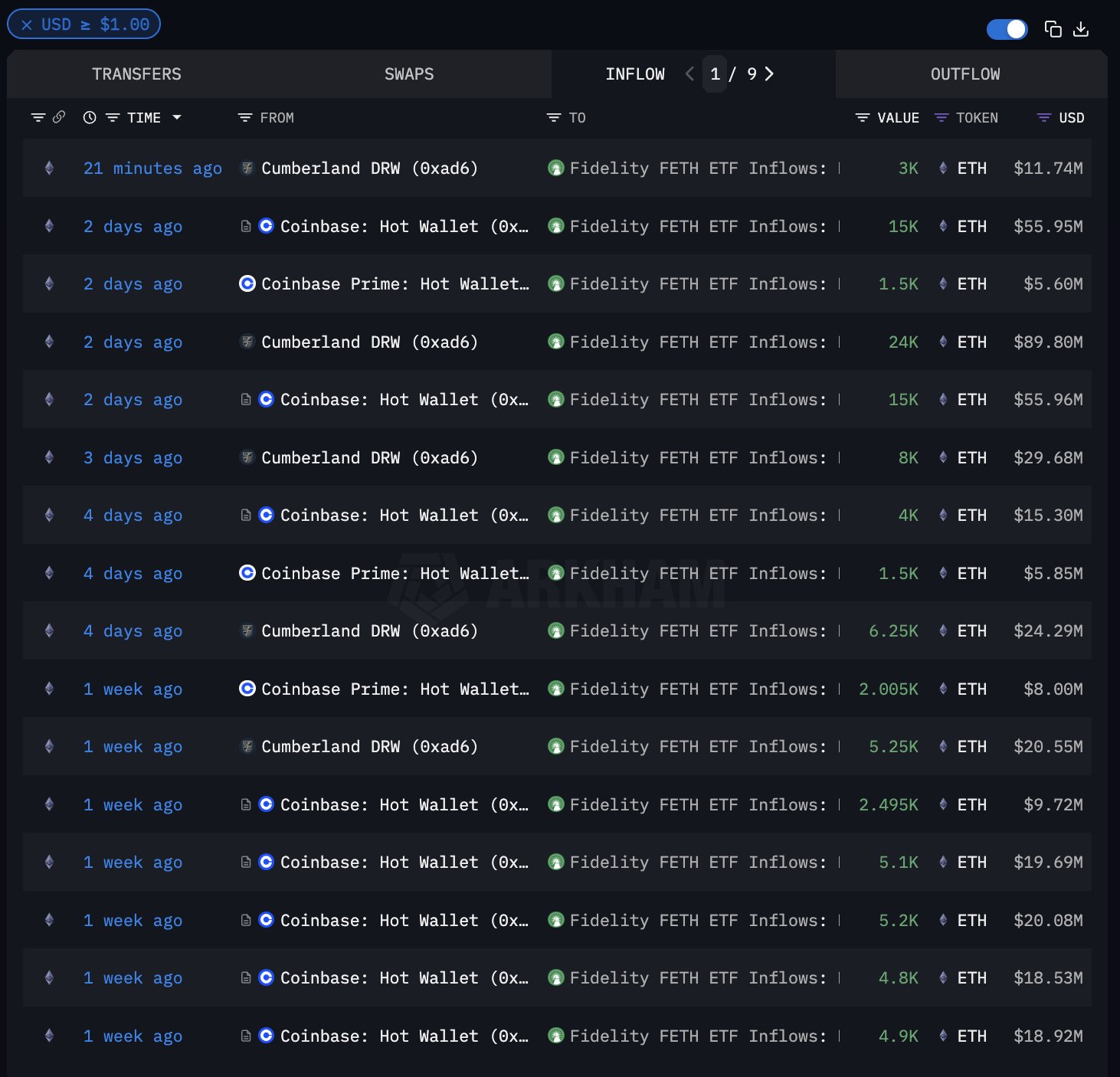

Moreover, Fidelity Investments made headlines by acquiring $250 million worth of Ethereum (ETH) last week, representing 16% of the inflows into its spot Ethereum exchange-traded fund (ETF). As of December 16, the total inflows of Ethereum into Fidelity’s ETH ETF have reached $1.38 billion.

Current Market Prices

At the time of writing, Bitcoin is trading at $106,850, while Ethereum is priced at $3,988.

Comments