Summary:

Isaac Newton's investment failure in the South Sea bubble serves as a cautionary tale for modern investors.

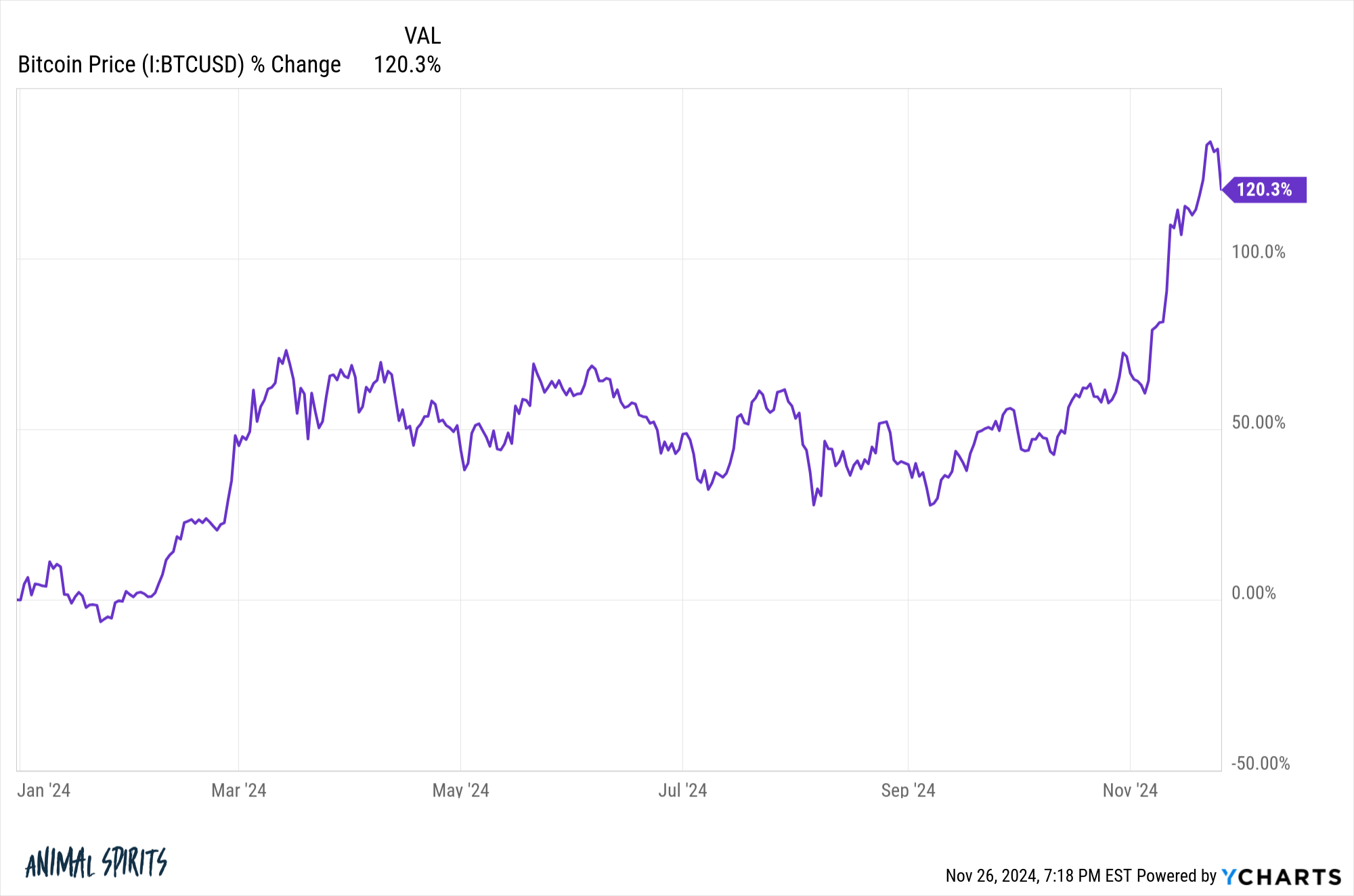

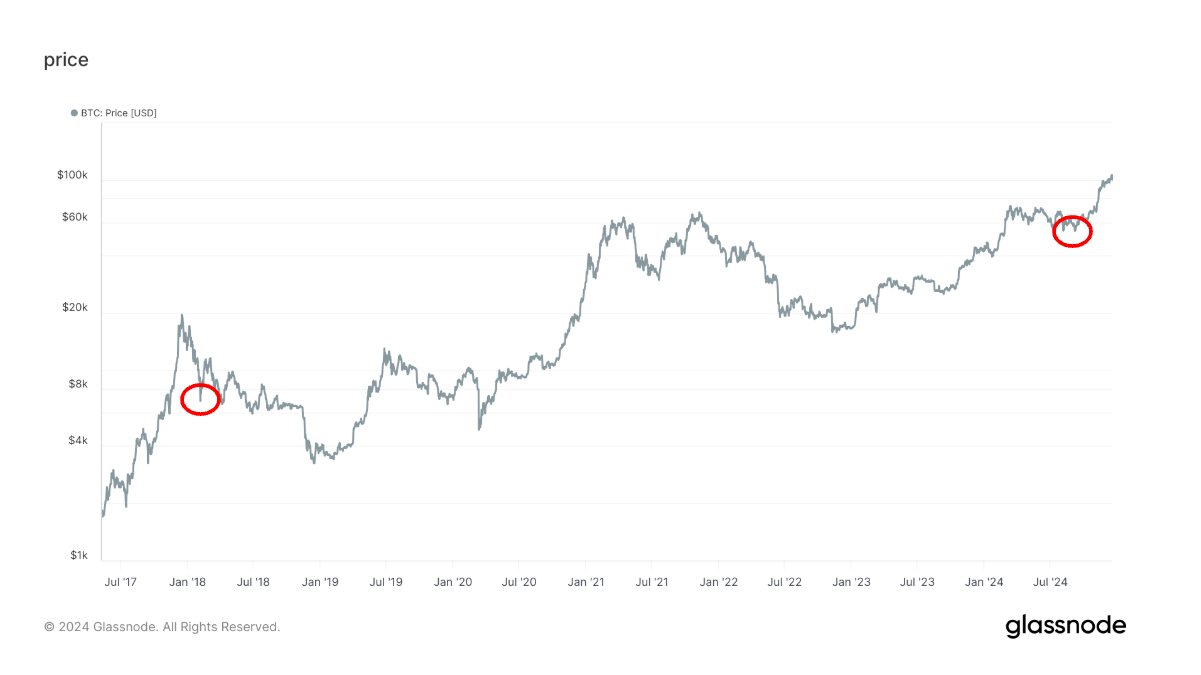

Investing in Bitcoin at $100,000 raises questions about FOMO and timing.

Chasing performance often leads to regret, as demonstrated by Newton's experience.

Consider why you're investing now, especially if you weren't interested at lower prices.

A reader recently inquired:

I’m thinking of adding bitcoin to my portfolio via one of the new ETFs but it feels like I’ve already missed the boat with the insane run-up this year. Is it too late to add? I don’t want to be a muppet.

This question brings to mind a lesson from history, specifically Isaac Newton. Known for his monumental contributions across various fields, Newton also dabbled in monetary policy and was involved with the Royal Mint. He died wealthy, yet his legacy is mostly marred by a significant investment blunder in the South Sea bubble.

Newton famously stated, “I can calculate the motion of heavenly bodies, but not the madness of people,” highlighting how even the brightest minds can be swayed by market emotions.

Despite a successful investment strategy before his South Sea Company venture, Newton lost a staggering amount—equivalent to £20 million today—after succumbing to FOMO (Fear of Missing Out) and jumping back into the market at inflated prices.

This leads us to the current Bitcoin dilemma. If you're considering investing in Bitcoin now, around $100,000, it raises questions about your investment strategy.

- Why now? If you were uninterested at lower prices, why is the current price appealing?

- Is it FOMO? Chasing performance often leads to regret.

While Bitcoin could continue its upward trajectory, remember that investing should be based on sound principles rather than emotional reactions.

For further insights, check out the latest episode of Ask the Compound where we discuss investing strategies, diversification, and more.

For deeper exploration of Bitcoin strategies, read about why I’m selling some Bitcoin here.

Comments