Summary:

Bitcoin is facing a critical test above $54,000; failure to hold could lead to a deeper correction.

CryptoQuant CEO Ki Young Ju highlights a significant decline in US demand affecting Bitcoin's price.

Ju predicts a potential recovery in Q4 2024, emphasizing the need for increased demand.

Currently, Bitcoin is trading at $54,404, with crucial support at this level.

A break below $54,404 may signal a bearish shift, while reclaiming $60,000 could revive bullish momentum.

Bitcoin is currently facing a critical test, having retraced over 19% from recent highs and is now holding above a key demand level around $54,000. This price point is crucial for maintaining market structure; failure to hold could lead to a deeper correction.

Insights from CryptoQuant CEO

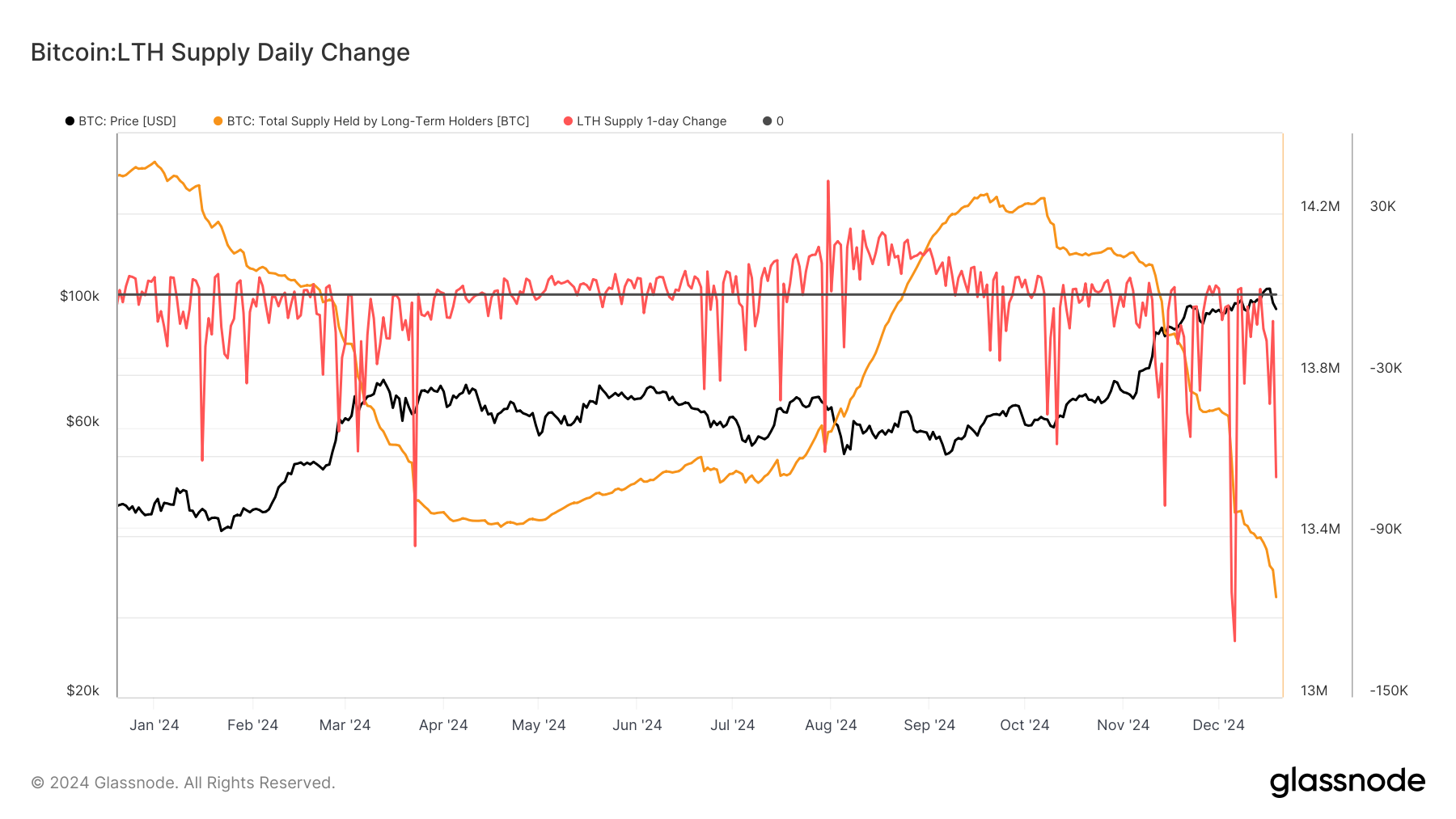

Analysts and investors are actively sharing insights, with Ki Young Ju, the CEO of CryptoQuant, providing crucial data that sheds light on Bitcoin's struggles to maintain its value. His analysis highlights on-chain metrics that clarify the reasons behind the current market challenges.

US Demand: A Key Factor for Bitcoin's Future

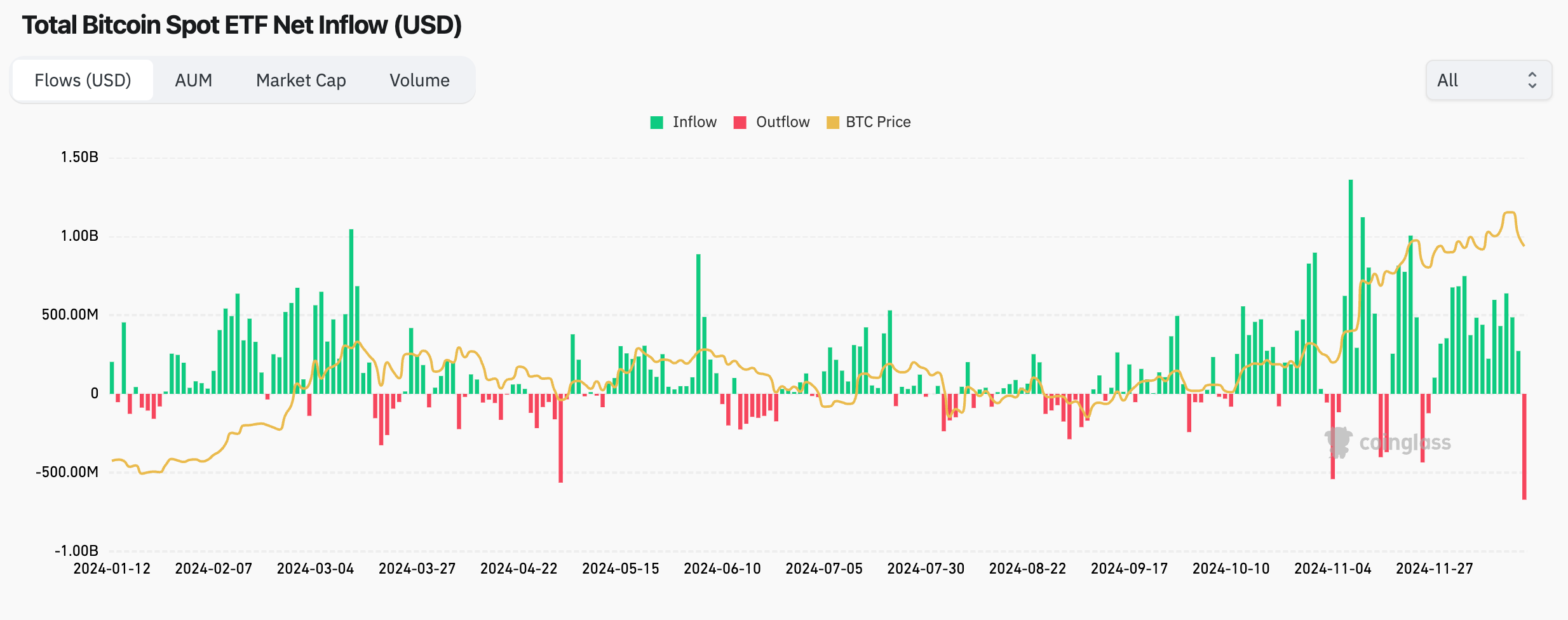

Bitcoin is experiencing significant selling pressure, largely due to a decline in demand. Data shared by Ju indicates that Coinbase’s Bitcoin spot trading volume has returned to pre-spot ETF levels, indicating a substantial dip in US demand, which is essential for sustaining bullish momentum. Ju emphasizes that for Bitcoin's bull cycle to regain strength, a rebound in US demand is crucial, predicting a potential recovery in Q4 2024.

Coinbase BTC spot trading volume dominance is back to pre-spot ETF levels. | Source: Ki Young Ju on X

Coinbase BTC spot trading volume dominance is back to pre-spot ETF levels. | Source: Ki Young Ju on X

Technical Analysis of Bitcoin

Currently, Bitcoin is trading at $54,404, maintaining a critical support level. If BTC fails to hold this support, a deeper correction could be on the horizon. Currently trading below the 4-hour 200 moving average (MA) at $59,263, reclaiming this level is vital for reviving bullish momentum. A decisive break above $60,000 could spark renewed demand, while a drop below $54,404 may indicate a bearish shift in the market.

BTC trading below the 4H 200 MA. | Source: BTCUSD chart on TradingView

BTC trading below the 4H 200 MA. | Source: BTCUSD chart on TradingView

Comments