Summary:

El Salvador became the first country to adopt bitcoin as legal tender on 7 September 2021.

The decision transformed El Salvador into a beacon for financial innovation.

The country holds 5,748.8 bitcoins in national reserves and continues to invest in bitcoin.

El Salvador has initiated a Bitcoin certification programme for 80,000 government employees.

El Salvador's Chivo wallet is promoting financial inclusion for the unbanked population.

El Salvador's Bold Bitcoin Experiment: A Global Game Changer

El Salvador’s integration of Bitcoin positions it as a pioneer in the shift towards cryptocurrency-driven economies.

On 7 September 2021, El Salvador became the first country in the world to adopt bitcoin as legal tender, sparking global discussions about the role of cryptocurrencies in national economies. This groundbreaking decision transformed El Salvador into a beacon for financial innovation as other nations began to closely monitor its bold experiment. Initially seen as a monetary gamble, El Salvador’s decision has evolved into a strategy with far-reaching implications, both domestically and internationally. While the International Monetary Fund (IMF) and other financial institutions have raised concerns about potential risks, El Salvador’s commitment to cryptocurrency adoption has set a precedent by reshaping global economic systems.

From Experiment to National Strategy

When El Salvador made bitcoin legal tender, it was an ambitious experiment aimed at solving several economic challenges. The country, reliant on remittances and with a significant part of its population unbanked, saw cryptocurrency as a way to promote financial inclusion. Today, with 5,748.8 bitcoins held in national reserves, El Salvador’s leadership continues to buy bitcoin, signalling confidence in the long-term potential of the digital asset. In this way, the initial idea of bitcoin adoption has transformed from a simple test into a cornerstone of the nation’s financial strategy. El Salvador is now laying the foundation for broader economic development by positioning itself as a crypto-friendly environment.

Economic Impact: Benefits and Challenges

El Salvador’s embrace of bitcoin has left a significant mark on its economy, though it has not been without its challenges. One of the major benefits has been the ability to streamline remittances, allowing Salvadorians abroad to send money home using bitcoin, cutting out the traditional intermediaries and lowering fees. This move has made remittances faster, more affordable, and more accessible.

The country has also witnessed a surge in foreign investment, as businesses interested in cryptocurrency see El Salvador as an attractive hub. Crypto enthusiasts and digital nomads have flocked to the country, boosting tourism and putting El Salvador on the global map as a bitcoin-friendly destination.

Moreover, El Salvador’s innovation goes beyond adopting bitcoin; it has ventured into the creation of bitcoin bonds and infrastructure projects like ‘Bitcoin City’. President Nayib Bukele’s vision for Bitcoin City includes a tax-free, crypto-friendly zone designed to attract foreign investment. If successful, Bitcoin City could become a global hub for digital finance, further cementing El Salvador’s position at the forefront of this financial revolution.

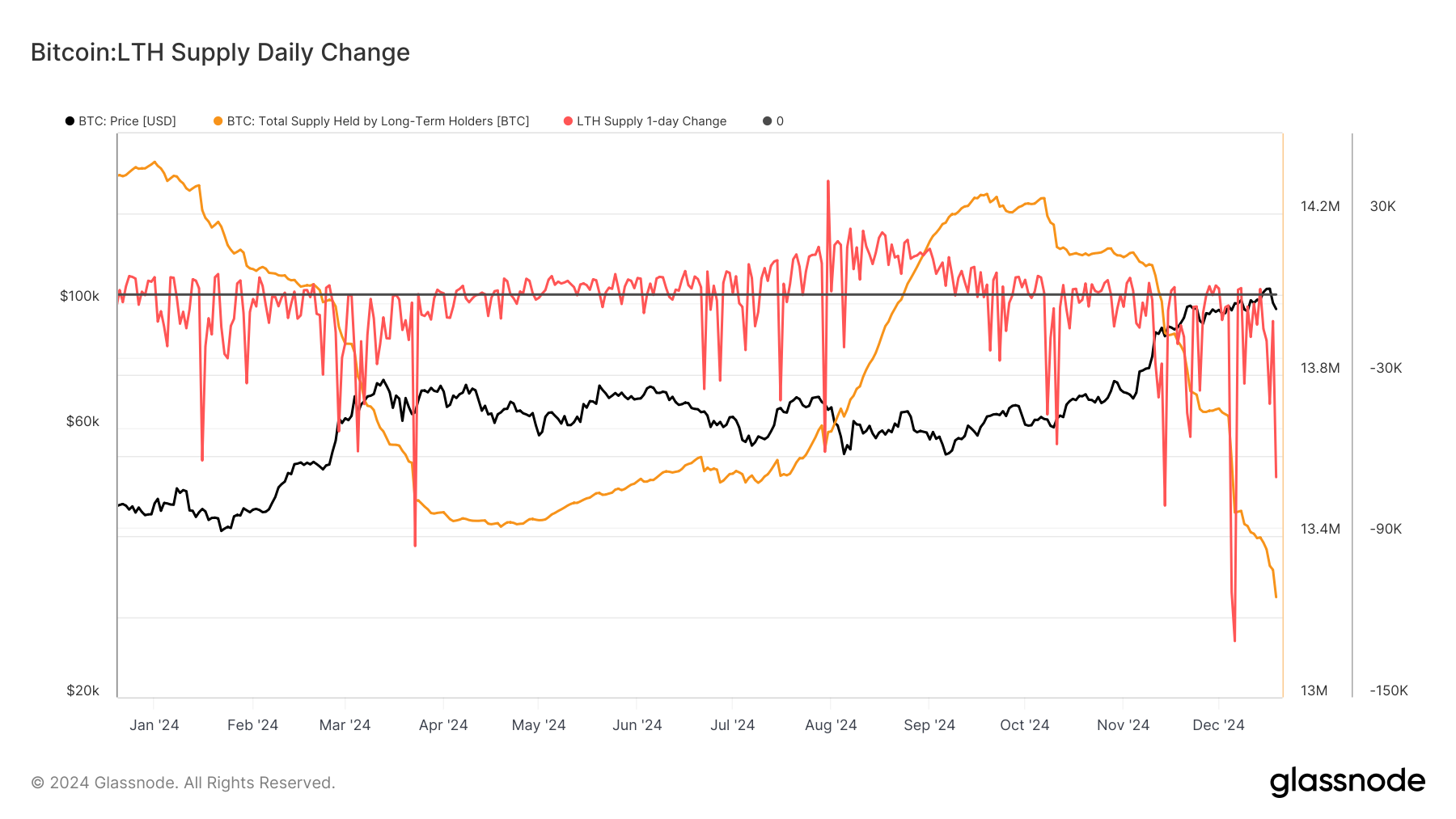

However, bitcoin volatility remains a persistent issue. Critics argue that heavy reliance on such a fluctuating asset could jeopardize financial stability. Unpredictable price swings in the crypto market pose a risk, potentially leading to instability in the national economy. While El Salvador continues to bet on bitcoin’s long-term success, these challenges highlight the need to carefully navigate the balancing act between innovation and economic resilience.

Educating for a Bitcoin Future

One of the latest initiatives El Salvador has undertaken is its Bitcoin certification programme. Spearheaded by the National Bitcoin Office (ONBTC), the programme aims to educate 80,000 government employees on the intricacies of bitcoin and blockchain technology. This strategic move underscores the nation’s commitment to integrating bitcoin into its broader governance structure.

By equipping civil servants with essential knowledge, El Salvador ensures that bitcoin adoption is not just a top-down policy but becomes deeply embedded in the daily functioning of the state. This educational initiative is expected to create a ripple effect across other sectors, solidifying El Salvador’s place as a leader in the global crypto space.

Global Influence and Partnerships

El Salvador’s progressive approach to cryptocurrency is beginning to influence other nations. For example, Argentina has recently started collaborating with El Salvador to learn from its experience. This collaboration is a testament to the growing recognition of El Salvador’s pioneering role in this space. As more countries begin to explore cryptocurrency adoption, El Salvador’s approach provides a practical case study, proving that integrating digital assets into a national economy can have tangible benefits.

Regulatory Challenges and Criticism

Despite the enthusiasm surrounding Bitcoin adoption, El Salvador has faced significant criticism from international organizations. The IMF has been particularly vocal, warning that the adoption of cryptocurrency as legal tender poses risks to financial stability, consumer protection, and market integrity. However, the country has responded by reinforcing its regulatory frameworks and increasing transparency around its bitcoin activities. While the road is not without obstacles, El Salvador’s approach showcases a willingness to navigate these complexities and maintain its position as a leader in the crypto space.

El Salvador’s Chivo Wallet Project

One of the most significant elements of El Salvador’s bitcoin adoption is the introduction of the Chivo wallet, which plays a pivotal role in promoting financial inclusion. Chivo, the government-backed digital wallet, allows Salvadorians to easily access and use bitcoin, providing a crucial gateway to financial services for those previously excluded from the traditional banking system.

To help citizens become familiar with the cryptocurrency, the government offered USD $30 worth of bitcoin to each individual through the Chivo wallet. However, public reception was mixed, with a poll indicating that 70% opposed the initiative, and only 15% expressed confidence in bitcoin. The Chivo wallet empowers even the unbanked population to participate in the digital economy, laying the foundation for a more inclusive financial ecosystem.

The Broader Global Implications

El Salvador’s bold experiment is already making waves across the world. The Central African Republic has followed in its footsteps, adopting bitcoin as legal tender. As other nations watch closely, it is becoming clear that El Salvador’s approach could inspire a global movement towards cryptocurrency-driven economies. For countries struggling with inflation or financial exclusion, bitcoin adoption represents an alternative path.

A Leader in the New Digital Financial Order

El Salvador’s decision to adopt bitcoin as legal tender has positioned the country at the forefront of a financial revolution. What started as a daring experiment has blossomed into a comprehensive national strategy with global implications. Despite challenges, El Salvador’s proactive approach sets a powerful example for other countries, showcasing how digital currencies can drive economic progress.

Comments