Summary:

Coinbase has a different business model than MicroStrategy, thriving regardless of Bitcoin's price.

The last Bitcoin halving event has historically led to significant market rallies.

Coinbase reported an 88.46% year-over-year revenue increase, reaching $5.24 billion in 2024.

The crypto market is fueled by regulatory support from President Trump, boosting Coinbase's prospects.

Coinbase's diverse revenue streams make it less vulnerable to Bitcoin price fluctuations compared to MicroStrategy.

Coinbase's Unique Advantage

As a crypto brokerage, Coinbase (NASDAQ:COIN) operates with a distinct business model compared to firms like MicroStrategy (NASDAQ:MSTR), which heavily depend on Bitcoin's price performance due to their asset reserve strategies. Unlike MicroStrategy, Coinbase benefits from cryptocurrency transactions regardless of whether users profit or lose. This means that during Bitcoin's bull runs, Coinbase is set to see a significant increase in revenue from the heightened trading activity.

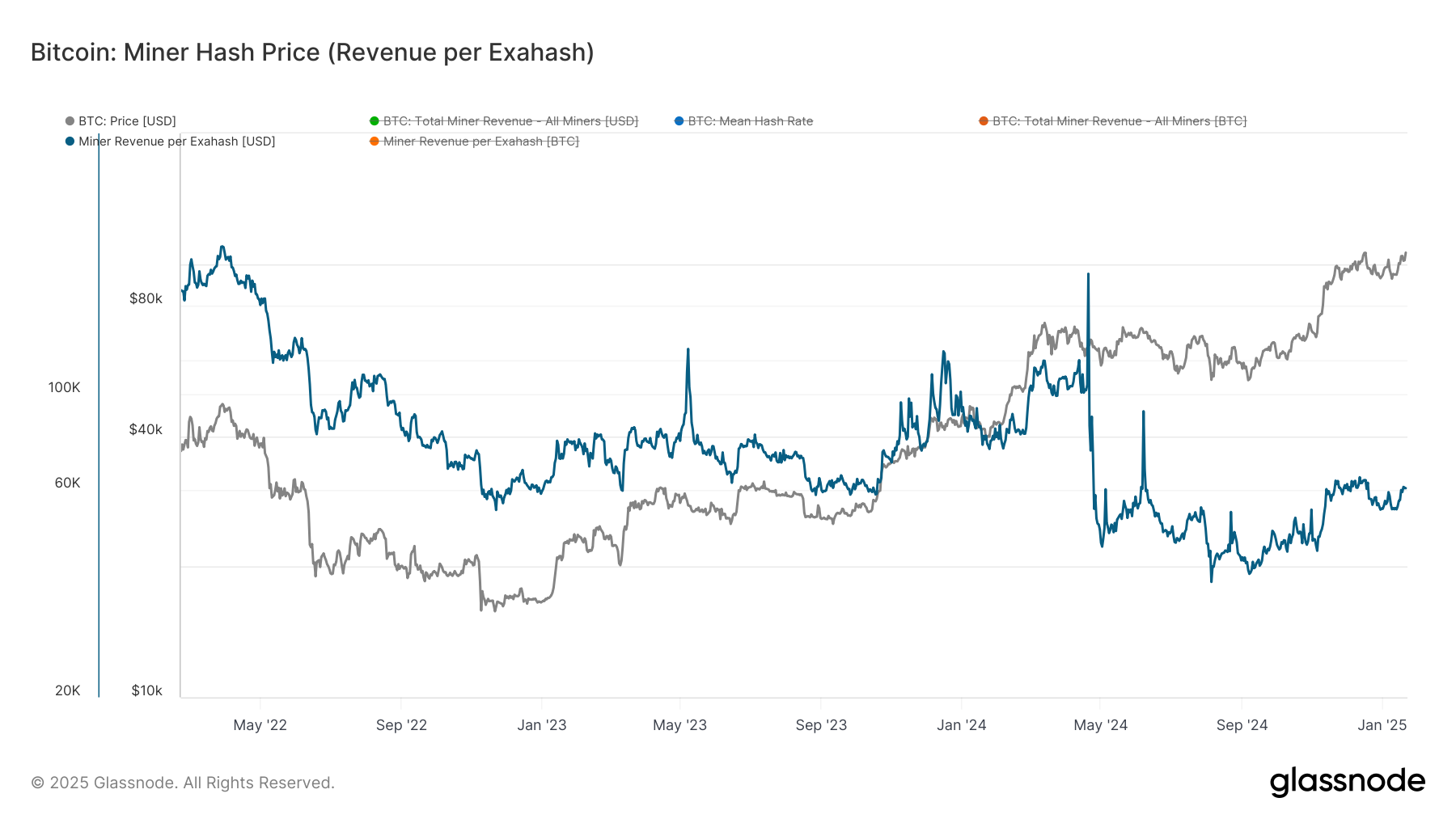

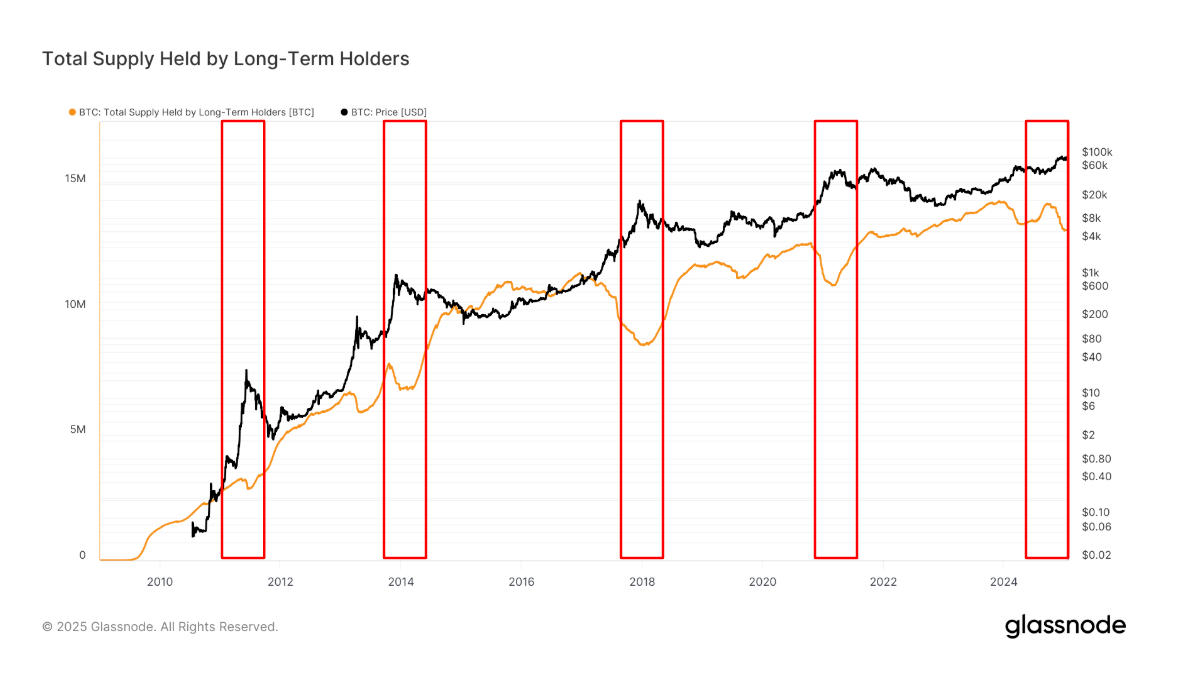

The Impact of Bitcoin Halving Events

Bitcoin's system includes a halving event that reduces mining rewards to maintain a controlled supply and curb inflation. Historically, these events have been followed by Bitcoin rallies, with other altcoins typically following suit in the subsequent year. The most recent halving occurred on April 19, 2024, reducing the block reward to 3.125 Bitcoin per block, and as expected, this has propelled the crypto market into a surge.

Coinbase's Revenue Growth

The surge in trading activity has led to a remarkable 88.46% year-over-year increase in Coinbase's total revenue, reaching $5.24 billion in 2024. Coinbase has diversified its revenue streams across the spectrum of crypto businesses, generating income not only from trading fees but also from staking and DeFi products, attracting a wide range of users from retail to institutional investors.

The Role of Regulation and Market Sentiment

One year post-halving is critical as capital floods into the crypto market. This time, the Bitcoin bull is further fueled by support from President Trump, creating a favorable regulatory environment for the entire cryptocurrency ecosystem. Coinbase is expected to benefit from this support, enhancing its revenue potential.

Comparing Business Models

In my view, Coinbase is better positioned to thrive compared to MicroStrategy. MicroStrategy's business model does not generate significant revenue and is highly vulnerable to Bitcoin's price swings, which can lead to catastrophic losses (as seen with previous drops). In contrast, Coinbase is less affected by Bitcoin's volatility; as long as trading volumes remain high, it continues to generate revenue from transaction fees, whether users are buying or selling.

Conclusion

Coinbase's robust business model and diverse revenue streams position it for sustained growth, while MicroStrategy’s reliance on Bitcoin exposes it to greater risk. The future looks promising for Coinbase amidst the evolving crypto landscape.

Comments