Summary:

Over 1 million Bitcoin sold by long-term holders since September.

Long-term holders have turned the $100,000 psychological resistance into support.

Market volatility spiked due to Trump's inauguration.

Long-term holders sold down from 14.2 million BTC to 13.1 million BTC.

Monitoring sales cessation could indicate a market top.

Bitcoin Sales by Long-Term Holders Have Reached a Turning Point

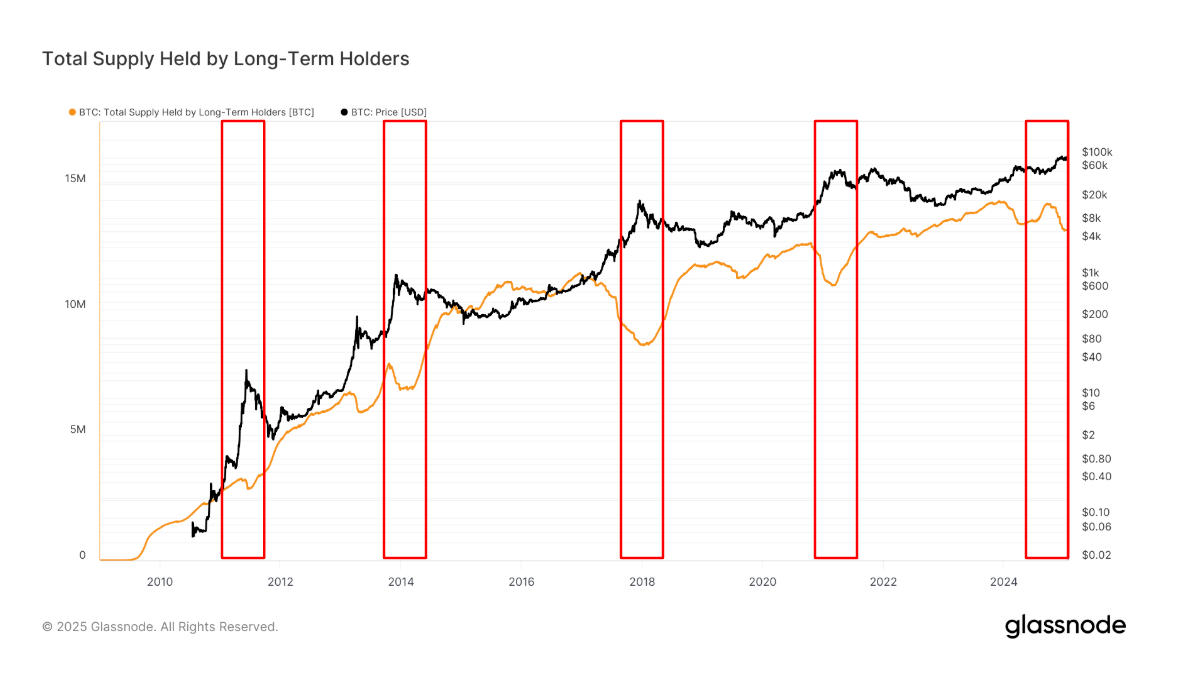

Over 1 million Bitcoin have been sold by long-term holders since September, marking a significant shift in market dynamics. According to James Van Straten, a Senior Analyst at CoinDesk, long-term holders of Bitcoin (BTC) appear to have concluded their recent selling activities, which has contributed to the transformation of the $100,000 psychological resistance price into a support level for the first time.

Recent Market Volatility

Since January 17, the largest cryptocurrency has remained above $100,000, despite experiencing extreme volatility attributed to President Donald Trump's inauguration. This volatility has seen a notable increase, with reports indicating a spike in market fluctuations.

Who Are Long-Term Holders?

Long-term holders are defined as investors who have retained their Bitcoin for over 155 days. They have traditionally been a major source of selling pressure in the market, often regarded as "smart money" due to their tendency to buy during price dips and sell during market peaks. Recent research from CoinDesk reveals that these holders possessed 14.2 million BTC in September, but this number has dropped to 13.1 million BTC.

A Key Trend to Monitor

The crucial trend to observe is when these long-term holders cease selling, as this typically signals a market top. Historical patterns from previous years, including 2013, 2017, 2021, and 2024, suggest that this behavior often indicates a peak in the Bitcoin market cycle.

Comments