Summary:

Bitcoin's sell-side risk has hit a minimum zone, indicating reduced selling pressure.

The sell-side risk ratio has plummeted below 20,000, contrasting sharply with previous peaks.

Healthy network activity indicates a vibrant market, with daily net profits around $500 million.

Short-term holders are mostly profitable, providing price support against declines.

The market is described as being in a pivotal state, indicating potential for sudden shifts.

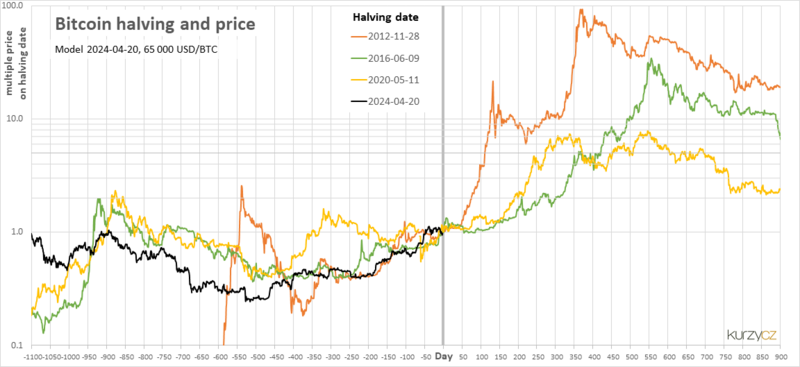

Unpacking the Low Bitcoin Sell-Side Risk in the Current Market Scenario

In the swiftly evolving realm of cryptocurrencies, the behavior of sellers, especially during volatile market conditions, provides critical insights into the future direction prices might head. Recently, Bitcoin (BTC), the pioneer and most significant cryptocurrency by market capitalization, has exhibited intriguing trends in sell-side risk, shedding light on market sentiment and potential future movements.

Bitcoin Sell-Side Risk Hits "Minimum Zone"

Recent analyses from Axel Adler Jr., a contributor at the onchain analytics platform CryptoQuant, reveal a significant decline in the number of individuals or entities inclined to sell Bitcoin. Despite price movements bringing BTC within striking distance of its all-time high, the willingness among holders to sell has hit remarkably low levels. The sell-side risk ratio, a metric devised to quantify selling pressure, has descended into what Adler categorizes as the "minimum zone".

- Understanding Sell-Side Risk: This measure provides a distilled image of potential selling pressure on Bitcoin, with lower numbers indicating a reduced likelihood of sell-off events.

Since reaching its peak at around $73,000, the demeanor of Bitcoin holders has drastically shifted. Adler highlights a significant reduction in potential sellers, entering a phase over the past six months that evidences minimal sell-side risk. The ratio has plummeted below 20,000, starkly contrasted against nearly 80,000 during the peak period in March.

This trend is visually represented in graphs shared by Adler, underscoring the reduced desire among Bitcoin holders to part with their holdings, even amidst potentially profit-locking price points.

Implications of Reduced Sell-Side Risk

The downward movement in sell-side risk is paralleled by healthy network activity levels, debunking theories suggesting a "dead" Bitcoin network. Onchain data denotes a substantial daily tally of around $500 million in net profits, dwarfing the amount in realized losses.

- Analyzing Network Activity: This indicates vibrant and profitable interactions within the network, emphasizing the robust value creation and exchange that Bitcoin facilitates daily.

Moreover, the STH (short-term holders) cost basis analysis indicates that most short-term investors are now "in the black," finding themselves in a profitable position compared to recent history where losses were frequently realized.

Short-Term Holders and Price Support

The dynamics between STHs and the broader market are paramount for understanding potential price movements. The fact that the majority of STHs are currently holding profitable positions suggests a level of support that could buffer against drastic price declines. However, the market remains in what The Bitcoin Researcher describes as a "pivotal state," indicating that while there’s support, the potential for sudden shifts in investor behavior still exists.

FAQs

- What is sell-side risk?

Sell-side risk refers to the potential selling pressure in the market, quantified by examining the onchain realized profits and losses divided by the realized cap of Bitcoin. - Why is the sell-side risk low despite high prices?

The low sell-side risk despite near all-time high prices suggests a strong holder sentiment, with many believing in the long-term value of Bitcoin, thus reducing their willingness to sell. - How do short-term holders affect Bitcoin’s price?

Short-term holders can significantly influence Bitcoin’s price through their reactions to volatility. If many decide to sell, it could lead to a decrease in price, while holding or buying can support or increase the price. - What does a "pivotal state" in the market signify?

A "pivotal state" indicates a critical juncture where the market could swing in either direction based on upcoming events, changes in investor sentiment, or macroeconomic factors.

Engaging with authoritative sources such as CryptoQuant or BGeometrics can provide deeper insights into these trends and metrics as they evolve.

Comments