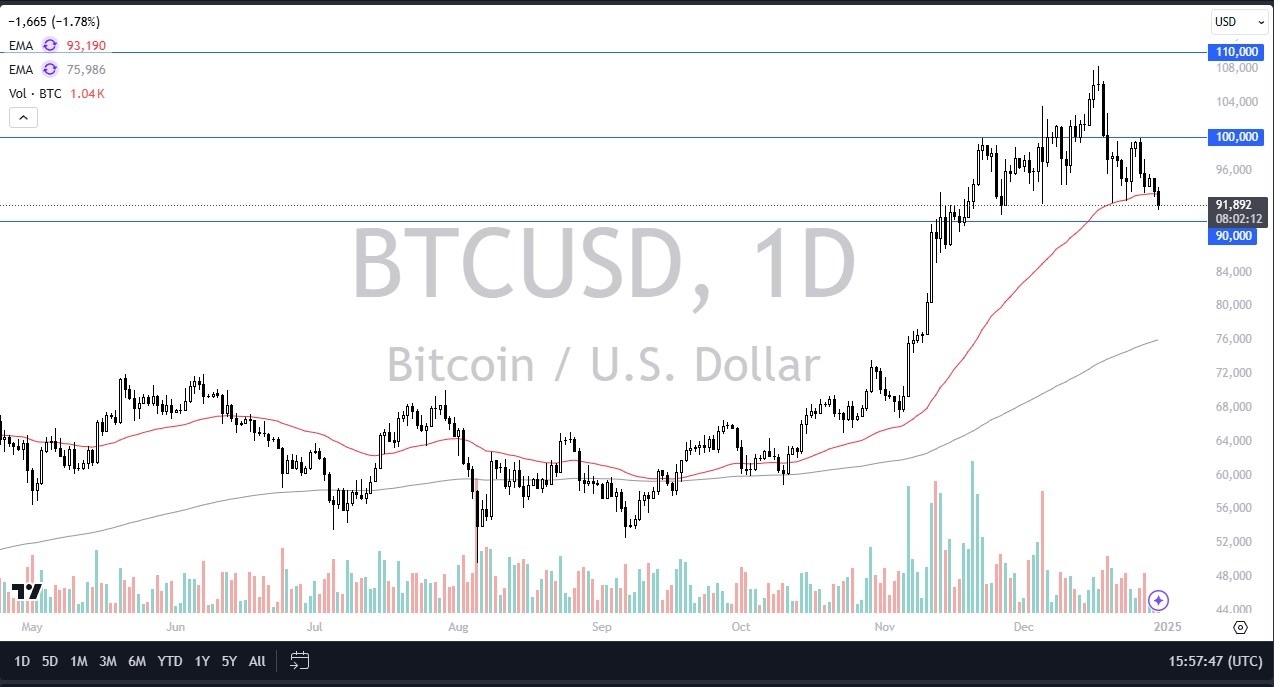

BTC/USD Forecast: Bitcoin Continues to Test Support

Bitcoin is currently trading sideways near a crucial support level as traders assess the overbought conditions and the implications of rising U.S. interest rates. Despite the recent volatility, the long-term outlook for Bitcoin remains bullish.

Market Analysis

In my daily analysis, I've observed that Bitcoin is experiencing some struggles. The market has been noisy lately, likely a correction after Bitcoin's significant rally earlier this year. While the ETF has been fully implemented, professional traders typically do not chase market moves. Instead, they prefer to wait for stabilization before investing. This is why Bitcoin has been trading within the same range for the past six weeks.

Technical Insights

From a technical analysis perspective, the long-term outlook is bullish, but short-term movements indicate some sideways action. This is understandable given that market participants are viewing Bitcoin as overbought, coupled with the reality of higher interest rates in the U.S. Currently, the risk-free rate is around 4.6%, which influences institutional traders' decisions. They prefer guaranteed returns over taking risks.

Although Bitcoin is likely to outperform the risk-free rate in the long run, the current market sentiment suggests caution towards risk assets, including Bitcoin. Therefore, the strategy moving forward is likely to involve buying on dips as the market eventually stabilizes.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!