Summary:

Bitcoin's 150% rally in 2024 attributed to regulatory optimism, macro improvements, and investor enthusiasm

Analysts predict Bitcoin could reach $200,000 to $250,000 by 2025

Historically, Bitcoin reaches new highs every 4 years

Regulatory developments have driven Bitcoin's price surge in 2024

Near-term risks include a potential correction after hitting an all-time high of $108,000

Bitcoin’s stunning gains this year have been largely driven by optimism surrounding US regulatory developments. Analysts are predicting that the cryptocurrency may have significant room for growth in 2025.

Bitcoin's Impressive 2024 Rally

Bitcoin experienced a 150% rally in 2024, positioning itself as one of the top market performers. This surge can be attributed to three bullish factors:

- Regulatory optimism

- An improved macro environment

- Mounting investor enthusiasm

Looking ahead, Bitcoin is expected to continue its bullish trend in 2025, with analysts projecting a price range between $200,000 (€193,000) and $250,000 (€241,000).

The Bullish Bitcoin Cycle May Continue

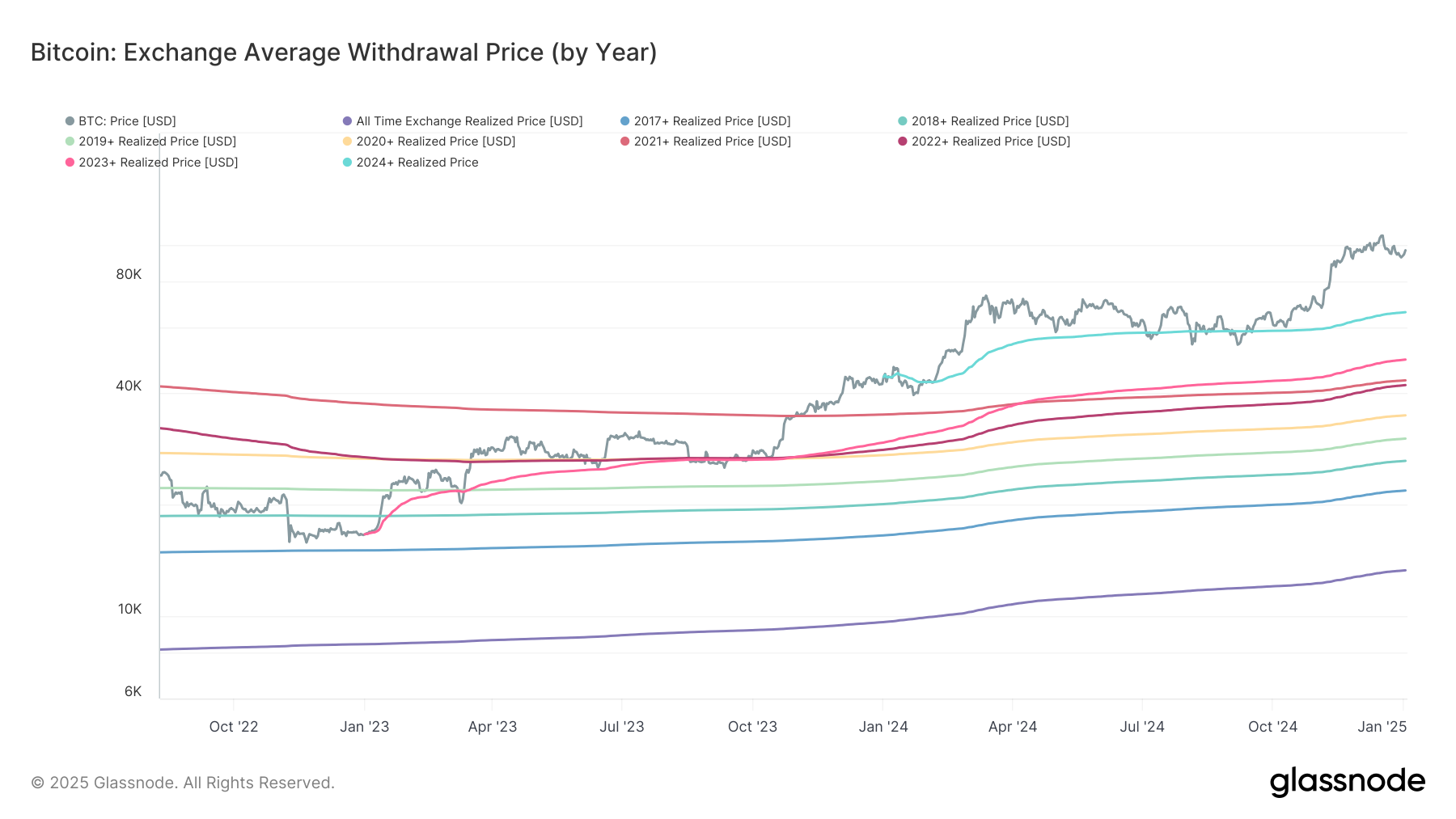

Historically, Bitcoin has reached new highs every 4 years during its past bullish cycles since 2017, with gains of 2300% and 1700% followed by setbacks of 70% to 80%. Since its low of $16,000 (€15,500) two years ago, Bitcoin has surged approximately 600%, indicating substantial potential for further growth.

Tom Lee from Fundstart Global Advisors predicts Bitcoin could reach $250,000 in 2025, while Standard Chartered projects it to hit $200,000 next year. Generally, cryptocurrencies tend to follow a bullish trend during easing monetary cycles of central banks, which increases investor appetite for risky assets.

The US Regulatory Tailwind

Regulatory developments have been the primary drivers of Bitcoin’s price surge in 2024. Bitcoin's price saw a substantial rally, surpassing the critical resistance level of $52,000 (€50,200) in February, following the SEC’s approval of a spot Bitcoin ETF.

Bitcoin traded between $52,000 and $72,000 (€69,600) until November, when Donald Trump’s victory in the US presidential election catalyzed further gains. Trump's pledge to implement crypto-friendly policies boosted investor sentiment, leading Bitcoin to breach the psychological threshold of $100,000 (€96,600) in early December after Trump announced plans to nominate Paul Atkins, a pro-crypto former SEC commissioner, as the next SEC Chair.

Analysts Optimistic on Bitcoin Prospects for 2025

Analysts believe that the bullish trend will likely continue in 2025 with a clearer regulatory environment and increased institutional capital. The Trump administration's policies could provide ongoing regulatory support for cryptocurrencies, with plans to adopt Bitcoin as part of US strategic reserves possibly pushing Bitcoin to $1 million.

Near-term Retreat Risks

Despite the long-term bullish outlook, there are near-term correction risks. Bitcoin prices retreated sharply from an all-time high of above $108,000 (€104,300) to around $94,000 (€90,800), likely due to profit-taking and risk-off sentiment coinciding with a pullback in global stock markets. Immediate support appears to be around $90,000 (€87,000), and a breakdown below this could see Bitcoin testing $73,000 (€70,500).

Comments