Summary:

Bitcoin bounces slightly to $101,500, but mining stocks plunge.

CoinDesk 20 Index drops 5.6%, with losses in AI-related tokens.

$1 billion in leveraged crypto positions liquidated.

Nvidia's 17% fall impacts market, emphasizing correlation with bitcoin.

Major mining stocks like Riot and MARA suffer steep losses of 8.7% and 16%.

Bitcoin (BTC) managed a slight recovery from its lowest levels of the day, trading recently at $101,500, up from earlier lows around $98,000, but still down 3% over the past 24 hours. In contrast, bitcoin mining stocks faced a significant decline, unable to recover from their plunge after concerns arose from Chinese AI startup DeepSeek, questioning the value of miners as data center investments.

The broader market, as measured by the CoinDesk 20 Index, fell 5.6%, impacted by double-digit losses in AI-related tokens such as Render (RNDR) and Filecoin (FIL), with Solana also dropping over 10%.

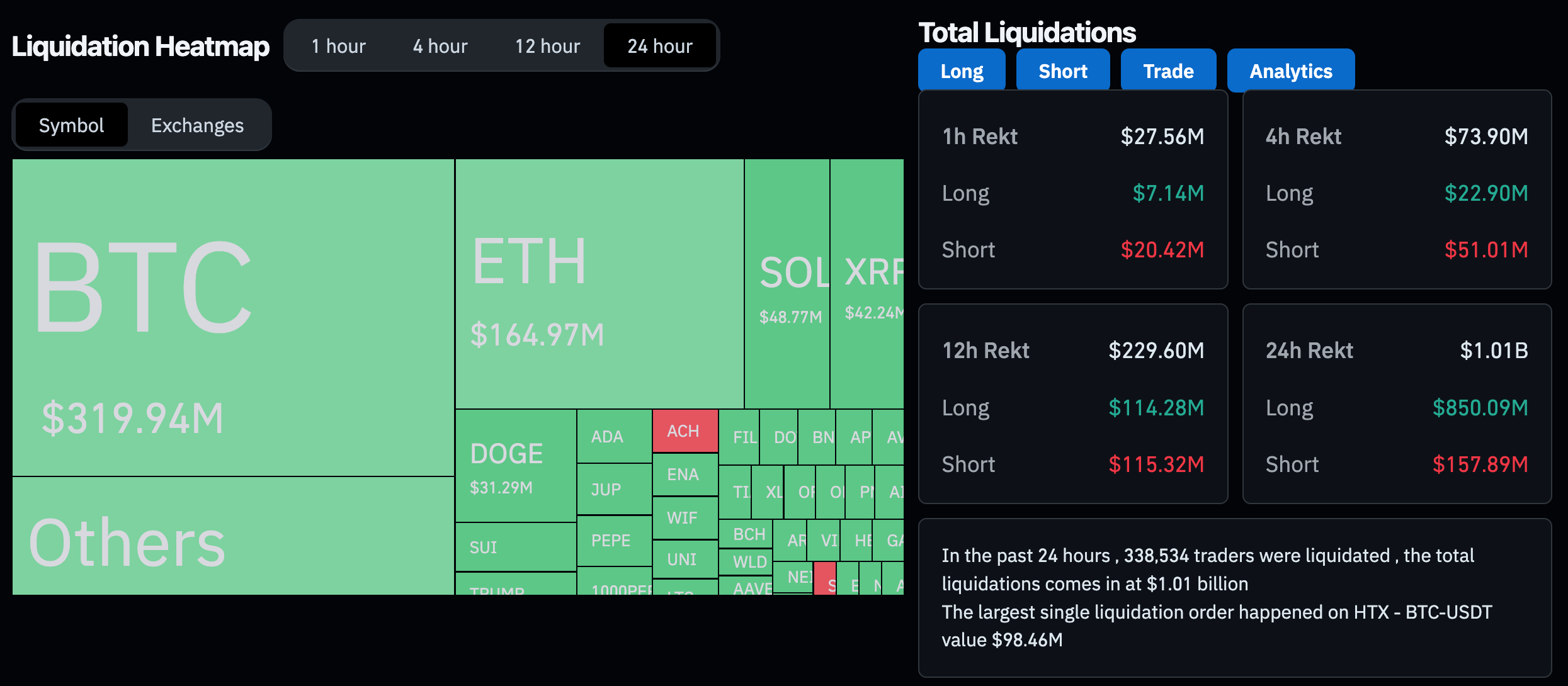

The market turmoil led to the liquidation of nearly $1 billion in leveraged derivatives positions across various crypto assets, as reported by CoinGlass.

The Nasdaq ended the session down 3%, with Nvidia leading the losses, plunging 17% and erasing $465 billion in market value in a single day. This event highlighted the tight correlation between bitcoin and tech stocks, according to Goeffrey Kendrick, head of digital asset research at Standard Chartered Bank.

Crypto-related stocks were not spared either, with Coinbase (COIN) and Galaxy (GXY) closing down 6.7% and 15.8%, respectively. MicroStrategy, the largest corporate holder of bitcoin, fared slightly better with only a 1.5% decline.

Crypto Mining Stock Rout

Bitcoin mining stocks experienced even steeper declines, with major players like Riot Platforms (RIOT) and MARA Holdings (MARA) dropping 8.7% and 16%, respectively. Miners that pivoted to high-performance computing for AI training, such as Core Scientific (CORZ), TeraWulf (WULF), Bitdeer (BTDR), and Cipher Mining (CIPH), saw declines of 25%-30%.

Aurelie Barthere, principal research analyst at Nansen, noted that the crypto market and AI-linked stocks had built up significant 'good news' pricing and were due for a profit-taking correction.

Looking ahead, market participants are focusing on this week's Federal Reserve meeting and earnings reports from major tech firms. While corporate earnings have been strong, upcoming reports from Nvidia and other tech giants will need to exceed expectations to maintain momentum.

The recent selloff could present an attractive entry point for altcoin investors, particularly in higher-beta tokens like Solana (SOL), which have seen more significant sell-offs compared to bitcoin.

Read more: Bitcoin's DeepSeek-Triggered Selloff Is a Buy the Dip Opportunity, Analysts Say

Comments