Summary:

Calendar expiring futures are seeing a surge in popularity due to increasing institutional investor interest.

Bitcoin's open interest now shows a greater reliance on calendar expiring contracts, suggesting a shift in investor preference toward traditional futures contracts.

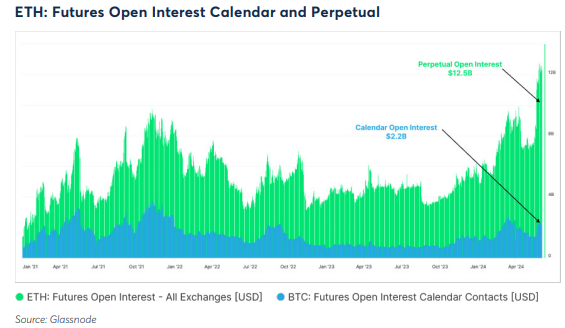

Ethereum's market, however, remains dominated by perpetual open interest.

The upcoming Ethereum ETF launch in July raises questions about whether this dynamic might shift in Ethereum's market.

CME's Bitcoin futures dominance is evident, representing over one-third of all open futures contracts positions.

CME's trade volume is also growing, reaching a multi-year high.

Bitcoin Futures: Institutional Surge and Ethereum ETF's Potential Impact

The first half of 2024 has witnessed significant developments in the digital assets market, especially for Bitcoin and Ethereum. A recent report by Glassnode and CME highlights the evolving landscape of futures markets.

Traditionally, perpetual open interest dominated the market. However, 2024 has seen a notable increase in calendar expiring futures, driven by a surge in institutional investor interest, primarily through CME Group Instruments.

Bitcoin's open interest now shows a greater reliance on calendar expiring contracts, suggesting a shift in investor preference toward traditional futures contracts.

Ethereum's market, however, remains dominated by perpetual open interest. The upcoming launch of the Ethereum ETF in July raises questions about whether this dynamic might shift in Ethereum's market.

CME's Bitcoin futures dominance is evident, representing over one-third of all open futures contracts positions. CME's trade volume is also growing, reaching a multi-year high.

This report highlights the growing influence of institutional investors in shaping the futures market, particularly through CME's offerings. The upcoming Ethereum ETF launch suggests potential shifts in market forces and could further impact the trajectory of both Bitcoin and Ethereum futures markets.

:max_bytes(150000):strip_icc()/WhattoExpectFromBitcoinandCryptocurrencyMarketsin2025-12ed9a9f2e8c42a5b2477933ea62fe0d.jpg)

Comments