Summary:

Bitcoin reserves on exchanges have hit a six-year low, now at 2.58 million BTC.

Approximately $31 billion worth of BTC has left exchanges since February.

Falling exchange reserves signal a potential supply shock due to increased holding behavior.

Institutional investors now control 4.6% of Bitcoin's supply through ETFs, worth about $58 billion.

Recent inflows into Bitcoin ETFs reached $235.2 million in one day.

Bitcoin reserves on exchanges have plummeted to a six-year low, indicating a shift in investor behavior towards holding rather than actively trading. As of now, around 2.58 million BTC is held on exchanges, a stark decline despite Bitcoin's price hovering around $62,300.

Exchange Reserves and Market Dynamics

Bitcoin exchange reserves represent the total amount of BTC in wallets controlled by exchanges. Currently, this figure is at its lowest since 2018, even with Bitcoin's price surging over 100% year-to-date. Analyst “The DeFi Investor” noted that since February, approximately $31 billion worth of BTC has exited exchanges.

“Most people underestimate how big the demand for Bitcoin is,” says The DeFi Investor.

Implications of Falling Reserves

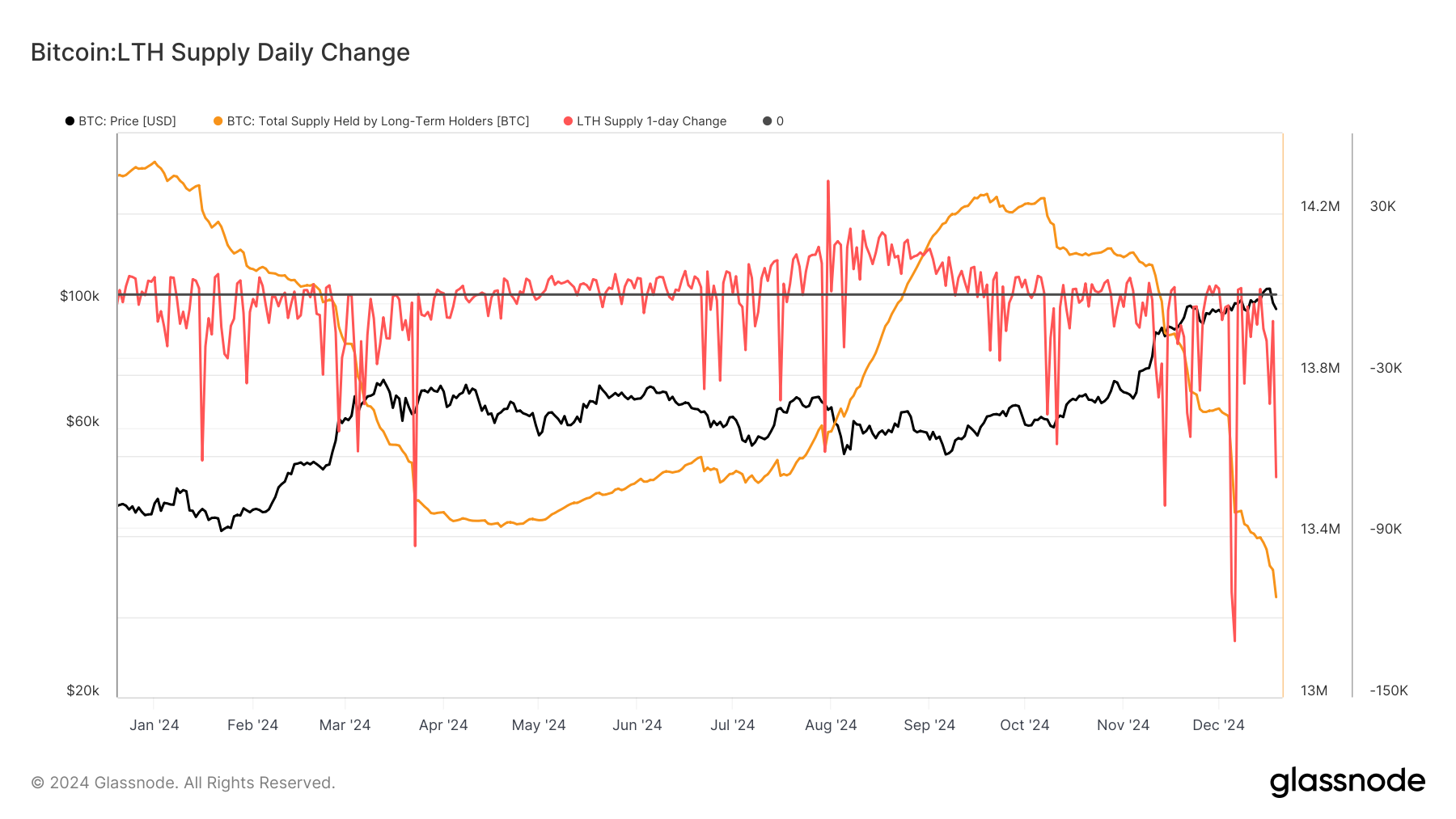

The decline in exchange reserves is typically seen as a bullish sign, suggesting a lack of intent to sell as more investors choose to hold their assets long-term. This trend is often associated with retail investors opting for cold storage solutions.

The Role of Institutional Investors

This market cycle also highlights the influence of institutional investors. Spot Bitcoin ETFs listed in the U.S. currently hold 4.6% of Bitcoin's supply, valued at around $58 billion. Recent data shows that on a single Monday, these ETFs recorded $235.2 million in inflows, with major players like BlackRock and Fidelity leading the way.

With exchange reserves dwindling and institutional interest on the rise, market speculation suggests that a supply shock may be on the horizon.

Comments