Summary:

Bitcoin recovered to around $68,800 following Trump's lead in polls.

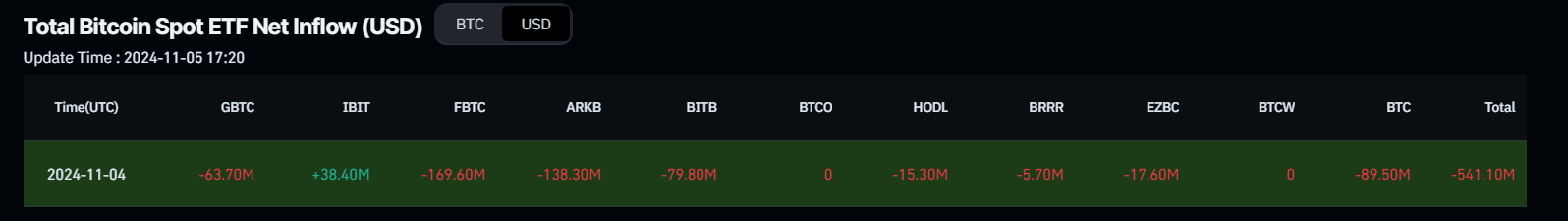

US spot Bitcoin ETFs saw an outflow of $541.10 million.

Grayscale’s report shows October trends align with a “Trump trade.”

Bitcoin's performance may reflect expectations of a pro-Bitcoin regulatory environment.

If BTC breaks above $69,519, it could retest its ATH of $73,777.

Bitcoin Price Today: $68,800

- Bitcoin recovered slightly on Tuesday as Donald Trump took the poll lead.

- US spot Bitcoin ETFs registered an outflow of $541.10 million on Monday.

- Grayscale’s report highlights that cross-asset returns in October mirror trends usually associated with a “Trump trade.”

Bitcoin (BTC) slightly recovered to around $68,800 on Tuesday, following a shift in the United States presidential race that saw former President Donald Trump regain the lead after significant outflows from US spot Bitcoin ETFs on Monday. Grayscale’s report indicates that cross-asset returns in October align with patterns typically seen during a “Trump trade.” This includes growing positions in the dollar, crypto, and expectations of higher Treasury yields, gaining momentum as Trump’s lead strengthened in prediction markets ahead of the election.

Donald Trump Takes the Lead as Bitcoin Recovers

Bitcoin price recovered slightly on Tuesday, coinciding with Trump’s lead in polls. This followed a substantial outflow of $541.10 million from spot ETFs on Monday, as reported by Coinglass data. Analysts suggest that the crypto community views Trump’s proposals as more detailed compared to his opponents.

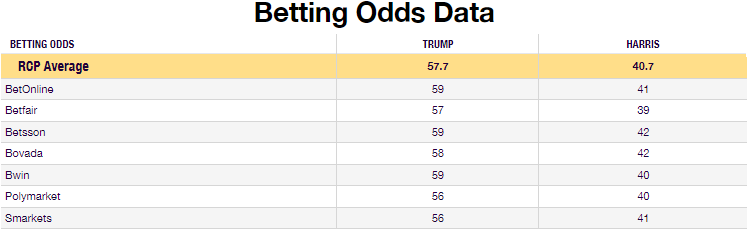

According to an analyst at FXStreet, on the election day, PredictIt shows Trump back in the lead, though by a slim margin. Other platforms indicate stronger odds for Trump’s victory, with RealClearPolling’s averages currently placing Trump at 57.7% and Harris at 40.7%.

Polls suggest a closer race than betting odds indicate, with various polls showing Trump and Harris in a tight competition.

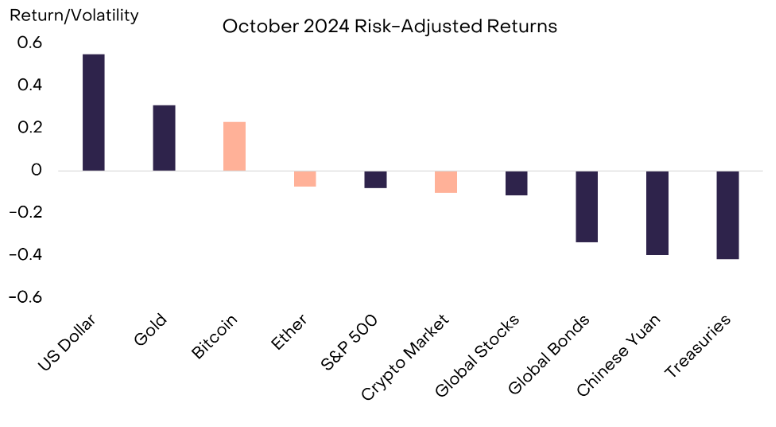

Grayscale’s report suggests that while it’s difficult to ascertain whether markets are pricing in a higher probability of a Trump win, the observed cross-asset returns in October align with a “Trump trade.” This trade includes long positions in the dollar, crypto, and expectations of rising Treasury yields, bolstered by Trump’s lead in prediction markets. However, a Harris victory could reverse these gains, potentially causing significant market fluctuations.

From a macro perspective, the US Dollar appreciated while the Chinese Yuan depreciated, perhaps reflecting higher perceived tariff risks. Bond yields increased, and the price of gold also rose, indicating expectations for larger budget deficits and more inflation under a Trump presidency. During this period, Bitcoin appreciated 9.6%, ranking among the better-performing assets on a risk-adjusted basis.

The former president has shown enthusiasm for Bitcoin and crypto, suggesting expectations of a pro-Bitcoin regulatory environment under his presidency. Additionally, Bitcoin’s performance may be reacting to potential macro policy changes anticipated with a Trump administration.

The outcome of the US election could significantly impact the digital assets industry, as the next president and Congress may enact crypto-specific legislation and alter tax and spending policies affecting broader financial markets. Grayscale Research emphasizes that changes in Senate control could be particularly relevant for crypto, as the Senate confirms key regulatory appointments.

Bitcoin Price Forecast: Signs of Recovery

Bitcoin encountered resistance at its all-time high (ATH) of $73,777 on October 29, declining 6.65% over the following six days. However, it showed signs of recovery on Tuesday after finding support around $67,000 on Monday.

If BTC fails to recover and continues to decline, it may retest the critical psychological level of $66,000. The Moving Average Convergence Divergence (MACD) indicator suggests a bearish crossover, indicating potential downward momentum, while the Relative Strength Index (RSI) indicates some recovery signs among bulls.

If BTC breaks and closes above the October 21 high of $69,519, it could rise to retest its ATH at $73,777.

Bitcoin, Altcoins, Stablecoins FAQs

- Bitcoin is the largest cryptocurrency by market capitalization, designed as a decentralized form of money.

- Altcoins refer to any cryptocurrency apart from Bitcoin, with Ethereum sometimes considered the exception.

- Stablecoins are cryptocurrencies designed to have stable prices, often pegged to assets like the US Dollar.

- Bitcoin dominance indicates Bitcoin's market share relative to all cryptocurrencies, often rising before a bull run.

Information on this page contains forward-looking statements and should not be seen as investment advice. Always conduct thorough research before making investment decisions.

Comments