Summary:

Bitcoin began as a cypherpunk experiment in 2009 and is now a globally recognized asset.

The SEC approval of Bitcoin and Ethereum ETFs has allowed traditional investors to engage with cryptocurrencies.

Andrew Bailey's book, Resistance Money, emphasizes Bitcoin’s role in bypassing traditional financial systems.

Bitcoin was initially stigmatized but gained popularity, especially during the mid-2010s.

Political engagement on crypto is rising, with Trump's pro-Bitcoin stance influencing voters.

The Evolution of Bitcoin

Bitcoin, the digital currency that began as a cypherpunk experiment in 2009, has faced a turbulent path to acceptance. Initially dismissed as a niche, unregulated asset prone to illegal transactions, Bitcoin has evolved into a globally recognized asset over the past 15 years. This shift has been highlighted by significant milestones, such as the recent SEC approval of Bitcoin (BTC) and Ethereum (ETH) ETFs, allowing traditional investors to engage with cryptocurrencies in a regulated environment.

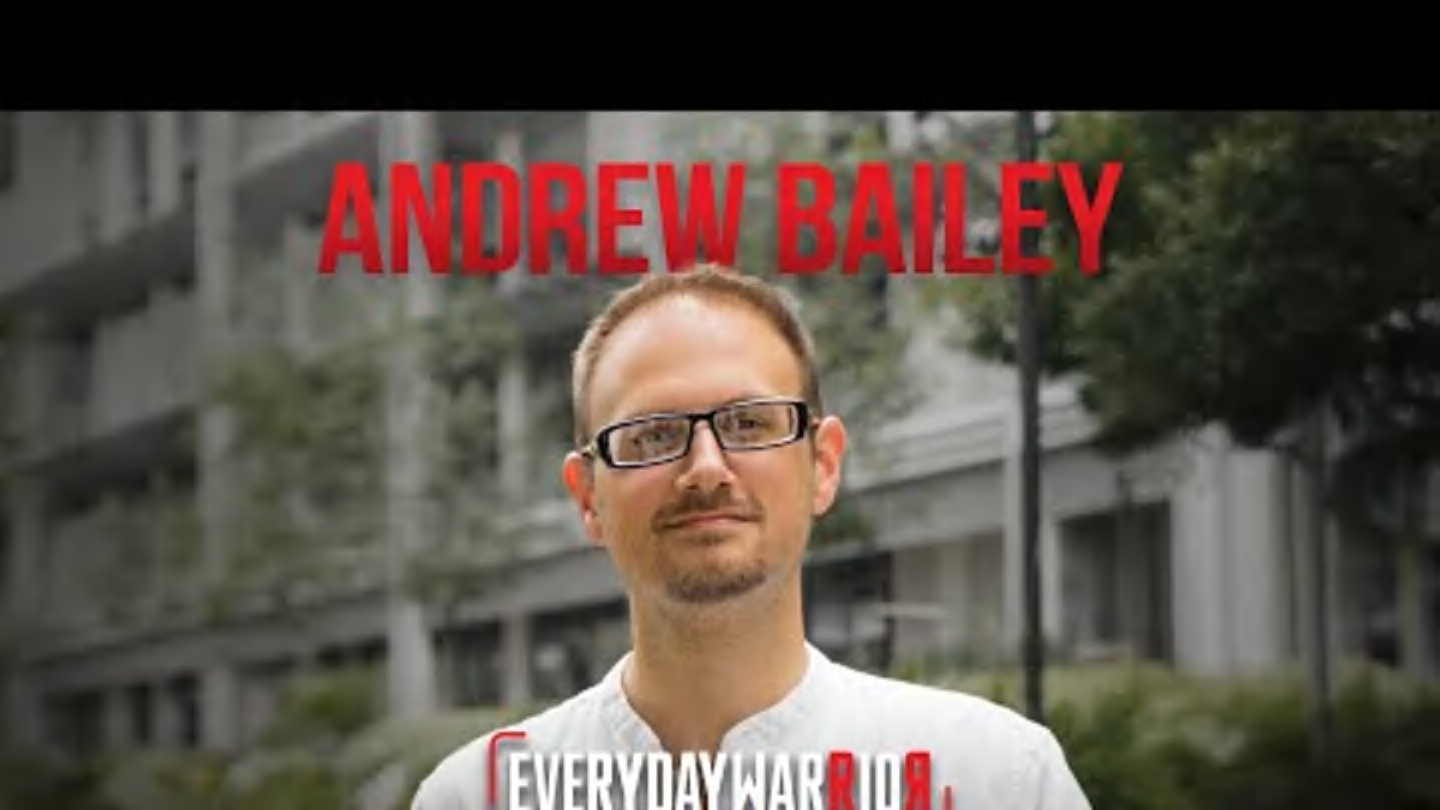

Philosophical Insights from Andrew Bailey

The philosophical and practical dimensions of Bitcoin's journey are explored in Resistance Money: A Philosophical Case for Bitcoin, a book by Andrew Bailey, Professor at Yale-NUS College and Senior Fellow at the Bitcoin Policy Institute. Bailey’s analysis emphasizes Bitcoin’s potential to bypass traditional financial and governmental systems, showcasing both technological innovation and ideological foundations that have solidified Bitcoin as a symbol of financial resistance.

The Birth of Bitcoin

Bitcoin's inception traces back to January 3, 2009, when Satoshi Nakamoto launched the Bitcoin network following the release of a white paper on October 31, 2008. Early adopters viewed it as a decentralized form of money, immune to traditional banking systems and state control. Bailey reflects on those initial years, portraying Bitcoin as the embodiment of the cypherpunk dream: digital cash that operates without third-party oversight.

Overcoming Stigmas

For years, Bitcoin remained on the periphery of the financial world, often stigmatized as an asset used by criminals or as speculative digital gold. The early 2010s were marked by catastrophic events like the Mt. Gox collapse, which drew negative attention from financial leaders. Bailey notes that institutional resistance stemmed from Bitcoin's challenge to the financial status quo: “Bitcoin routes around the makers, managers, and intermediaries—the essence of traditional financial power.”

Mainstream Acceptance

Despite skepticism, Bitcoin surged during the mid-2010s, flirting with $20,000 per coin in 2017. It wasn't until recent years that the broader financial world began acknowledging Bitcoin's permanence, especially following the SEC’s approval of ETFs in 2024, indicating traditional powerhouses conceding to the crypto market's influence.

Political Engagement

Bitcoin's trajectory towards mainstream acceptance has influenced financial markets and entered politics. The 2024 presidential race has brought crypto policy to the forefront, with Trump's pro-Bitcoin stance suggesting that crypto adoption is now a pivotal issue in swing states. His pledge to position the U.S. as a leader in Bitcoin policies resonated with many attendees at a major Bitcoin conference in Nashville.

Public Understanding and Resistance Money

Despite significant milestones, the general public's understanding of Bitcoin and crypto remains limited. Approximately 50 million Americans have owned crypto, but a proper understanding and long-term investment remain niche. Bailey emphasizes that Bitcoin is not just an investment vehicle but a form of ‘resistance money’, safeguarding individuals in authoritarian regimes and ensuring privacy against institutional misuse.

Conclusion: A Long-term Game

As Bitcoin becomes embedded in mainstream financial instruments, its evolution from outsider status to a challenger of central banks is evident. Bailey asserts that Bitcoin is a long-term game best understood through its core principles: autonomy, resistance, and freedom. Whether through the adoption of ETFs or the political discourse, Bitcoin's trajectory stands as a testament to its foundational ethos—a new form of money that has weathered significant resistance to reach the mainstream.

Comments