Summary:

Bitcoin jumped over 5%, reaching $57,444 after last week's decline.

Last week, Bitcoin experienced its worst performance since August 2023, dropping 9%.

Stocks like Coinbase and MicroStrategy also saw gains amid the market rebound.

Analysts warn that Bitcoin lacks major catalysts, making it sensitive to macroeconomic conditions.

Historically, September is a weak month for Bitcoin and other risk assets.

Bitcoin Bounces Back Above $57,000

Bitcoin surged over 5% on Monday evening, climbing above $57,000 as Wall Street rebounds from its worst week of the year. The flagship cryptocurrency was last seen at $57,444.00, marking a 5.6% increase according to Coin Metrics.

Recent Performance

Last week, Bitcoin faced a significant decline, dropping 9%, its worst weekly performance since August 2023. In contrast, stocks like Coinbase and MicroStrategy rose 5.2% and 9.2%, respectively, as the S&P 500 broke a four-day losing streak and the Nasdaq Composite gained over 1%. However, all three major averages experienced their worst weekly performance of 2024.

Market Conditions

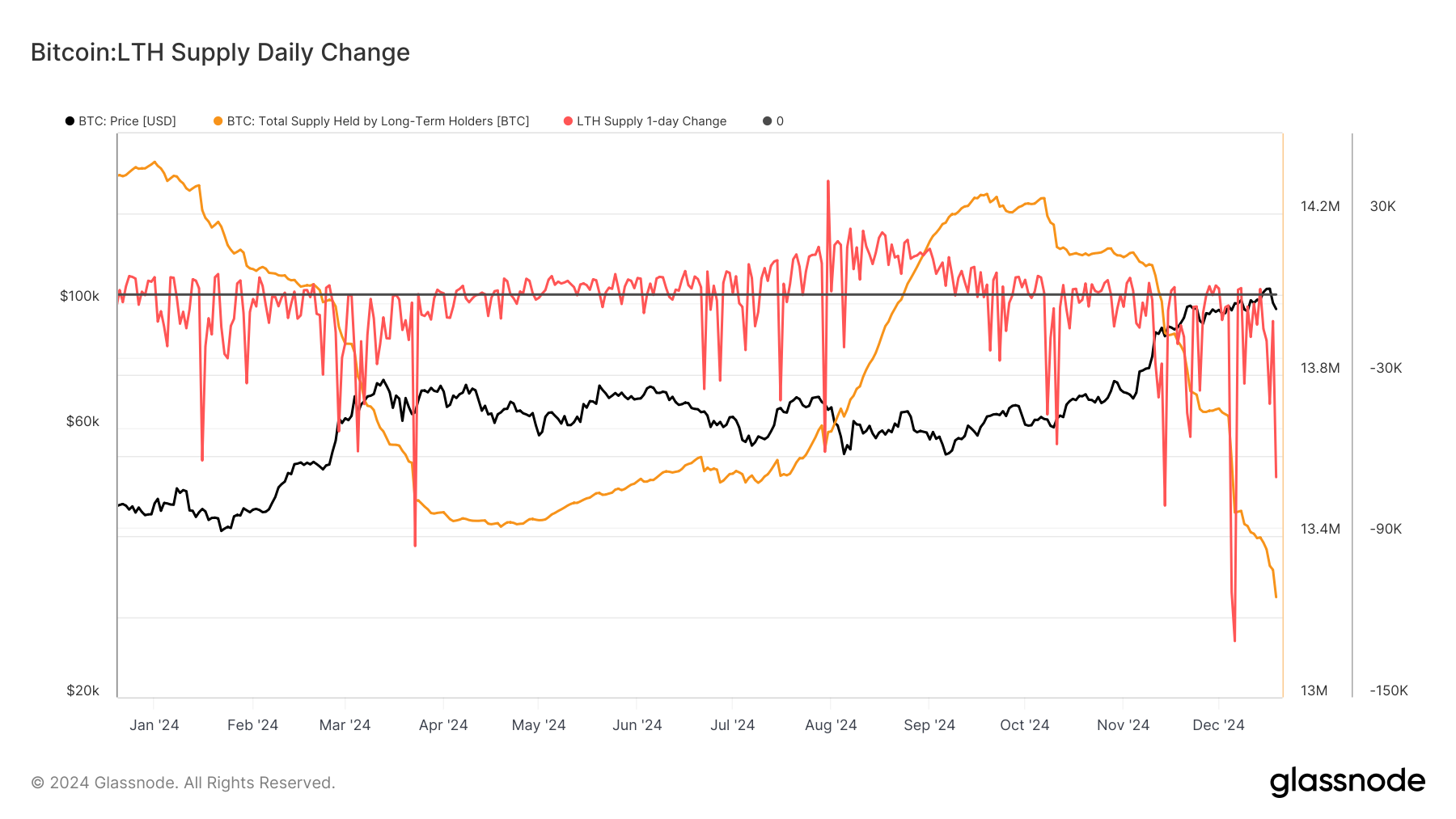

Bitcoin has been largely range-bound throughout the year, briefly dipping below the $55,000 mark last week. Analysts caution that the cryptocurrency currently lacks major catalysts, making it sensitive to macroeconomic factors.

September has historically been a challenging month for Bitcoin and other risk assets. According to Bitfinex analysts, stability in U.S. equity markets is crucial for Bitcoin to gain upward momentum. They noted that a recovery in equity markets could alleviate selling pressure on Bitcoin, creating a more favorable environment for recovery.

Conclusion

As Bitcoin continues to navigate through these fluctuating market conditions, investors remain watchful of external factors that could influence its price trajectory.

Comments