Summary:

2025 expected to see a significant increase in crypto ETFs under new SEC leadership.

Analysts predict Solana and XRP as top contenders for upcoming ETF launches.

Legal hurdles may delay ETF approvals for Solana and XRP due to their classification as unregistered securities.

Demand for Bitcoin ETFs has outpaced traditional ETFs, driving prices to new heights.

The influx of crypto ETFs may not attract investors due to lesser-known altcoins.

Solana and XRP Expected to Join ETF Wave in 2025

Analysts from Bloomberg, Eric Balchunas and James Seyffart, predict a significant increase in cryptocurrency ETFs as the leadership of the Securities and Exchange Commission (SEC) shifts under President-elect Donald Trump. This change is anticipated to facilitate the approval of more spot crypto ETFs, including those for Solana and XRP.

What are Spot Crypto ETFs?

Spot crypto ETFs are financial assets that track the price of underlying cryptocurrencies, allowing investors to gain exposure without owning the currencies directly. Recent approvals for Bitcoin and Ethereum ETFs have set a precedent for others.

The Odds Are Improving

“Everybody’s odds just went up,” Balchunas stated, noting that XRP and Solana are among the most sought after for upcoming launches. However, he cautions that the approval of these ETFs may face delays due to ongoing legal challenges, particularly since the SEC has classified both cryptocurrencies as unregistered securities.

Regulatory Environment and Future Prospects

For Solana and XRP to be approved as commodity-based ETFs, the SEC would need to reconsider its stance on these assets. This is viewed as possible with Paul Atkins, a crypto advocate, set to chair the SEC.

Unlike Solana and XRP, Bitcoin and Ethereum are already classified as commodities, which positions them favorably for ETF approvals. Other cryptocurrencies like Litecoin are also expected to follow in the approval process.

Market Dynamics and Investor Interest

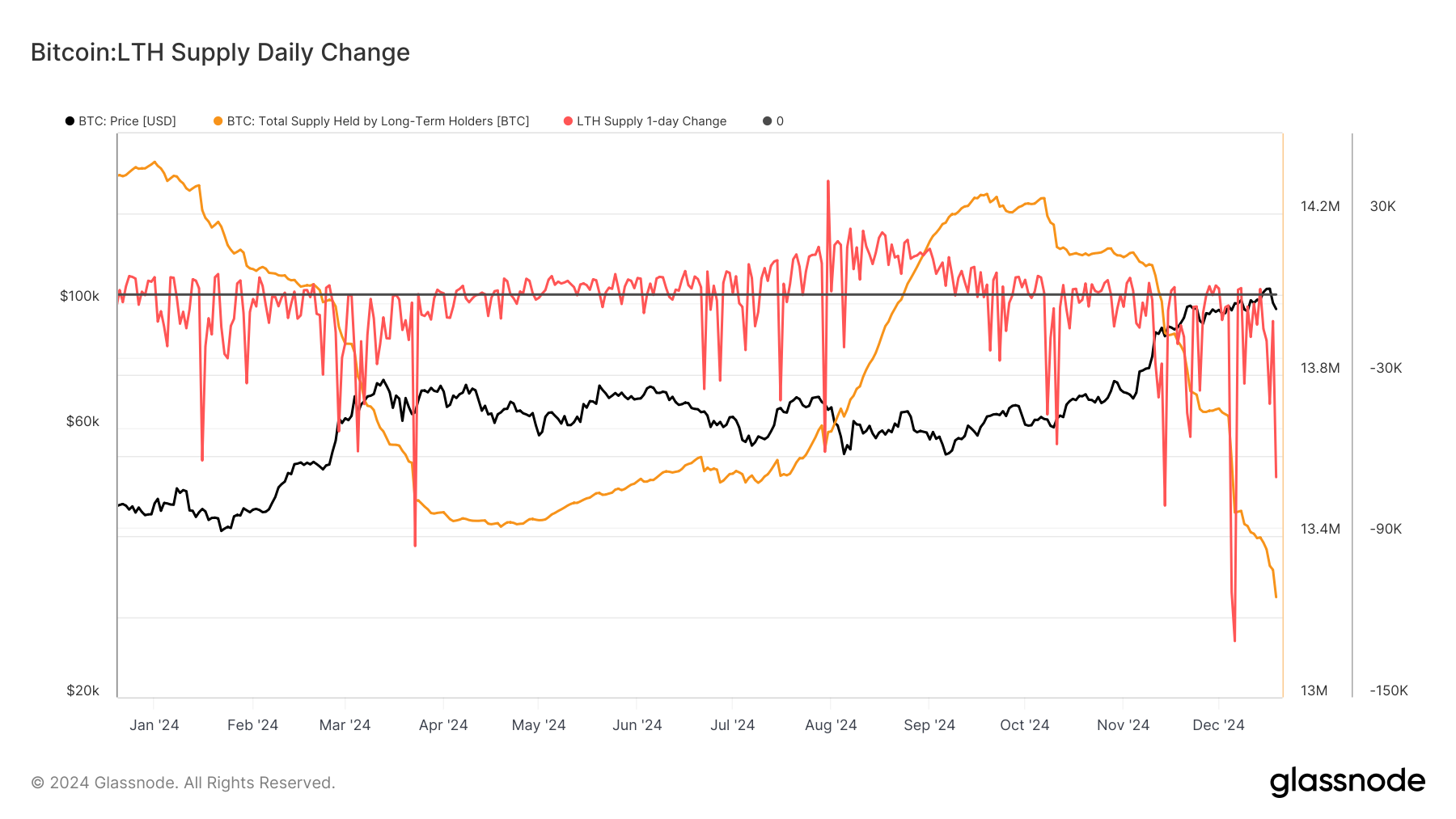

Investment firms such as Grayscale, Bitwise, and VanEck are already in the process of filing for new spot crypto ETFs. The recent surge in demand for Bitcoin ETFs has elevated their performance significantly compared to traditional ETFs, pushing Bitcoin to new heights.

Despite this, Balchunas warns that many of the upcoming crypto ETFs might not attract significant investor interest due to the lesser-known status of their underlying altcoins. He describes the influx of new crypto ETFs as “spaghetti thrown at the wall,” suggesting that only a few may achieve notable success.

Balchunas concludes with a strong belief that Bitcoin will dominate the ETF market, potentially capturing three-quarters of all assets within five years.

Comments