Summary:

Bitcoin and XRP prices surge as excitement builds for Trump’s pro-crypto agenda.

U.S. Strategic Bitcoin reserve odds rise to 62%, signaling potential regulatory shifts.

XRP has skyrocketed 500% since Trump’s election win, driven by easing regulatory hopes.

Expect new all-time highs for both Bitcoin and XRP with Trump’s impending policies.

Tokenization efforts position Ripple and XRP to redefine global finance.

It's the biggest news in crypto - Bitcoin and Ripple's XRP price have surged this week as excitement grows for the first pro-crypto president - Donald Trump, who is about to announce several game-changing pro-crypto Executive Orders on the first day of his administration.

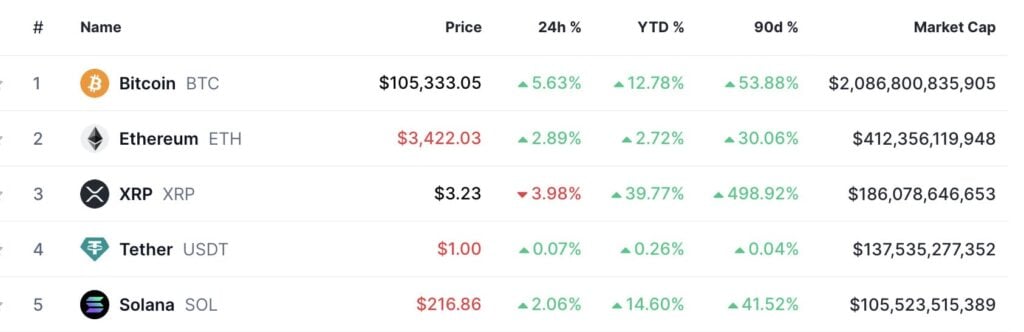

The Bitcoin price, back above $105,000 per Bitcoin, has more than doubled in the past year, pushing the total cryptocurrency market—including Bitcoin, Ethereum, XRP, Solana, and others—toward a staggering $4 trillion. Today’s report covers all the Bitcoin and XRP news as the price of Bitcoin and XRP prepares to hit new all-time highs. Let’s get into it.

The Bitcoin price jumped 5% overnight to $105456, source: Bitcoin Liquid Index

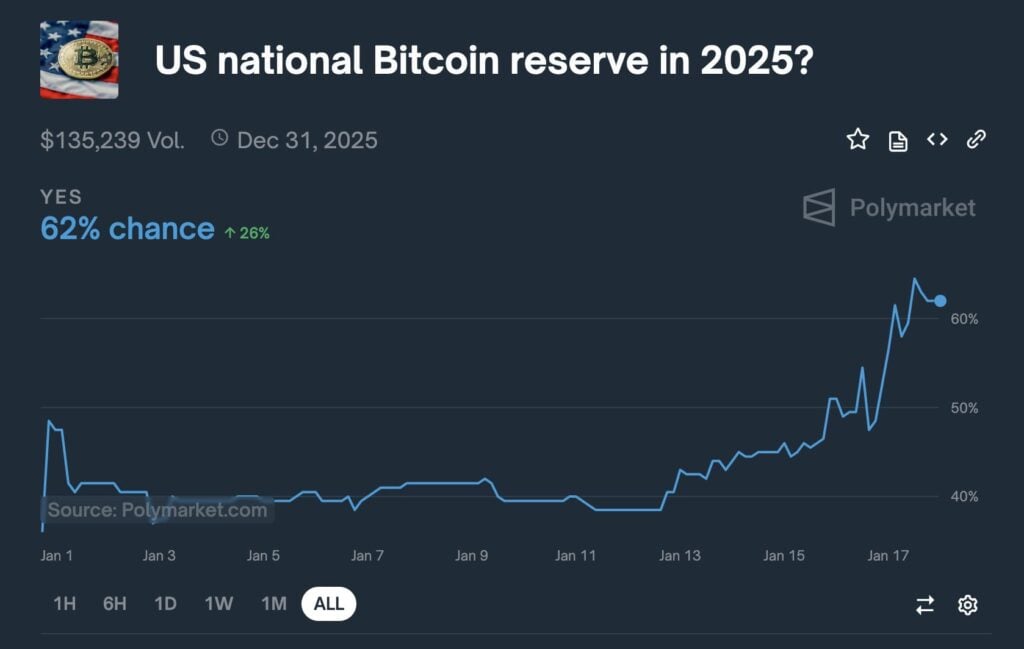

The rally comes as traders grow optimistic about Trump’s proposed U.S. Strategic Bitcoin reserve, now seen as a near certainty. This is reflected in the rising odds on the betting site Polymarket. The odds that the U.S. will create a National Bitcoin Reserve have climbed to 62%, up 20% this week.

The odds that the U.S. will create a National Bitcoin Reserve are climbing fast. Source: Polymarket

XRP to lead America-first Crypto Strategic Reserve?

Leaked reports this week suggest the Trump administration may expand its crypto reserve plans, emphasizing U.S.-developed cryptocurrencies such as Ripple’s XRP and Solana. This “America-first strategic reserve” would reportedly back Solana, a blockchain rival to Ethereum; USDC, a stablecoin issued by Circle and supported by Coinbase; and XRP, created by Ripple to streamline cross-border payments.

The New York Post and Forbes citing anonymous sources, claimed Trump is “receptive” to the idea following discussions with Ripple CEO Brad Garlinghouse and Coinbase CEO Brian Armstrong.

Ripple CEO Brad Garlinghouse was photographed with Trump at Mar-a-Lago. Were they discussing an American Crypto Strategic Reserve?

Earlier this month, Circle CEO Jeremy Allaire revealed on X that the company had contributed $1 million worth of USDC to Trump’s inaugural committee, joining other firms seeking favor with the incoming administration.

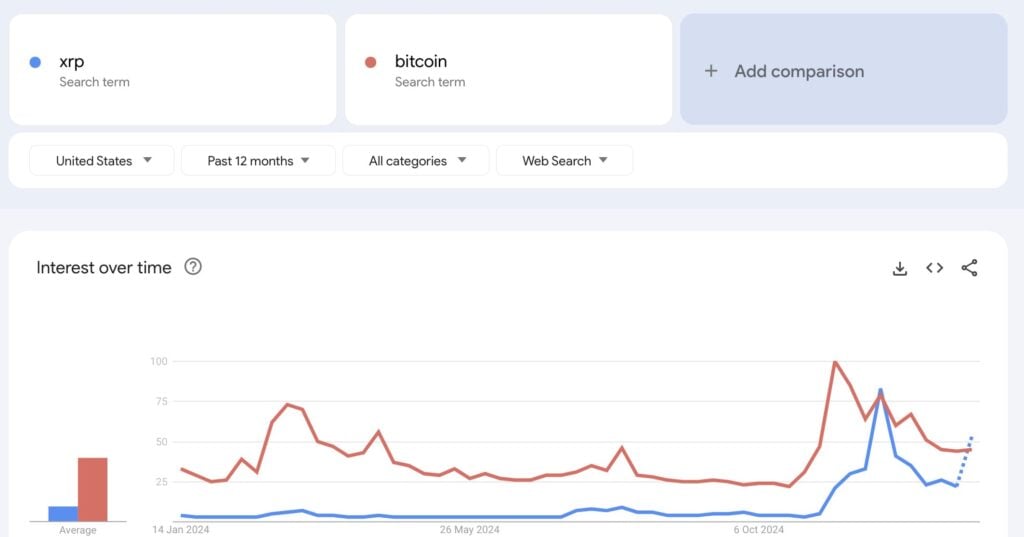

Ripple’s XRP has skyrocketed 500% since Trump’s November election win, fueled by hopes that the administration will ease regulatory pressures on the company. Google Searches for XRP have skyrocketed past Bitcoin as retail investors flock to buy XRP.

Google Searches for XRP have surpassed Bitcoin for the first time, Source: Google Trends

This week’s rumors that XRP will be added to an American Crypto Reserve pushed the price even higher, before a period of profit-taking today.

XRP is down 3% in 24 hours, but up an astonishing 498% over the last 90 days. Source: Coinmarketcap.

“Compared to other cryptocurrencies, XRP has shown phenomenal strength. While others have experienced pullbacks, or gone sideways, XRP has been on an absolute tear and now appears ready to surpass its all-time high,” said Jason Jones, an analyst at Brave New Coin.

Regulatory Environment Will Favor Ripple’s XRP Under Trump

The recent regulatory landscape for cryptocurrencies has been turbulent, shaped by aggressive enforcement under SEC Chair Gary Gensler. Gensler’s tenure has been defined by stringent actions, including high-profile cases such as the SEC Vs Ripple, creating an uncertain environment for digital assets.

With Donald Trump’s election victory, however, the crypto world anticipates a significant shift toward a more favorable regulatory climate. Trump’s appointment of Paul Atkins, known for his crypto-friendly stance, as the new SEC Chair signals a potential easing of regulatory burdens. Atkins is expected to push for clearer guidelines and policies that foster innovation, potentially providing a significant boost for Ripple’s XRP and other crypto entities.

What to Expect From Trump’s Pro-Crypto Agenda

President Trump has pledged bold action to reshape crypto regulations, with promises of Executive Orders aimed at making the sector a priority for innovation. Highlights of his agenda include:

- Loosening Regulations

Crypto-focused restrictions could be lifted or eased as early as Day One of Trump’s administration. - Reversing Biden-Era Policies

- Eliminating the rule requiring banks to treat digital assets as liabilities on their balance sheets.

- Revoking Biden’s AI Executive Order, criticized by tech leaders for stifling innovation.

- Promoting Crypto Freedoms

Reducing compliance burdens to encourage startup growth and entrepreneurial activity in the digital asset space. - Streamlined Federal Oversight

Advocating for a unified, transparent framework to replace the patchwork of federal and state regulations. - Regulatory Clarity

Addressing the unpredictability that has hindered market stability, laying the groundwork for long-term growth. - XRP ETF Approval

The anticipated approval of new spot XRP ETFs, and new spot Litecoin ETFs could occur as early as 2025, offering new investment avenues. - Bitcoin Strategic Reserve

Trump’s administration is expected to explore the creation of a national Bitcoin reserve, intended to safeguard against fiat instability and global economic uncertainty. This move will position the U.S. as a leader in the digital economy and drive Bitcoin prices even higher, with analysts already revising upward their 2025 Bitcoin price projections.

XRP’s Primary Use Case: A Double-Edged Sword

To understand why the future is so bright for Ripple and XRP, it is important to understand the background. Every year, banks and financial institutions spend hundreds of billions of dollars on fees for transferring funds globally, often waiting days for transactions to settle. It is an antiquated system crying out for innovation, and XRP was designed to fill that gap.

XRP facilitates fast, secure transactions between financial institutions at a fraction of the cost of traditional methods. While Bitcoin is sometimes proposed as an alternative, XRP outshines it in this context: Bitcoin is slower, more expensive, and lacks scalability. The XRP network processes thousands of transactions per second compared to Bitcoin’s meager seven.

Thanks to these advantages, XRP has gained real-world traction. Its underlying network, RippleNet, is used by financial institutions worldwide. Considering legacy systems cost banks $193 billion in fees last year, the potential for disruption is enormous. If XRP captures a significant market share, the network fees alone could be substantial. Moreover, banks transacting on RippleNet would need to buy and hold XRP, creating a supply crunch and potentially boosting its value further.

Is There a Crack in this Narrative?

Look, we get it, the pitch is compelling, which is why Ripple and XRP are generating so much buzz. However, a closer look reveals some significant flaws in these assumptions.

- Fee Collection Is Minimal by Design

The core value proposition of XRP is its ability to reduce fees drastically. While this makes XRP attractive to financial institutions, it also means the total value of fees collected by the network will always be small. - RippleNet Doesn’t Require XRP

A common misconception is that using RippleNet mandates using XRP. In reality, most of RippleNet’s functionality operates independently of XRP.

While XRP’s design and use case position it as a potential disruptor in the financial sector, its long-term value depends on widespread adoption of the token itself—not just the RippleNet network. Without mandatory reliance on XRP, its role in revolutionizing global transactions remains uncertain. Luckily, there’s a solution.

The team of gigabrain talents at Ripple are a step ahead and have been busy laying the groundwork for the next big opportunity in global finance: Tokenization. With Ripple’s XRP right at the heart of the system, this is the key to why Ripple’s XRP token is set to outperform all bullish expectations and go on to set new all-time XRP price highs throughout 2025.

Ripple and XRP: Transforming Finance Through Tokenization

Here’s the solution to the above problem. Ripple, having spent over $100 million fighting the SEC to establish that $XRP is not a security, is shifting from defense to offense. Here’s how Ripple and XRP are set to transform global finance through tokenization.

Building a New Financial System

While most fintech companies focus on improving outdated systems, Ripple took a bold step: it built an entirely new one from the ground up. The XRP Ledger (XRPL) has become a cornerstone of innovation, optimized for payments and tokenization. Ripple is no longer just challenging incumbents; it’s prompting them to respond with billion-dollar acquisitions and expanded product offerings.

Ripple’s vision extends beyond the $500 billion fintech market. The next frontier? Tokenization. With over $55 trillion of assets in the U.S. alone that could be tokenized, Ripple is seizing a generational opportunity. This shift positions Ripple and XRP to grow from billions to trillions, redefining the scope of global finance.

Key Investments and Strategic Growth

Ripple has strategically fortified its infrastructure through high-profile acquisitions, including Metaco and Standard Custody, which strengthen its custody solutions stack for tokenized assets. The launch of Ripple USD (RLUSD), a NYDFS-regulated stablecoin, represents a pivotal milestone in Ripple’s tokenization strategy.

The XRP Ledger’s design enables not only fast, low-cost payments but also tokenization at scale. To maximize its potential, Ripple is leveraging a simple yet powerful strategy: work with winners. By forming partnerships with leading players, Ripple positions itself as the best-equipped entity to capitalize on the 100x growth opportunity in tokenization.

Ripple is at the forefront of a revolution in finance. By combining asset tokenization, strategic acquisitions, and a powerful blockchain in XRPL, it is redefining how value is created, transferred, and stored.

Bullish Outlook for XRP and the Crypto Market

That’s all for today’s XRP news. It’s a lot! These potential changes create a strong bullish narrative for XRP and the broader cryptocurrency market. Trump’s pro-crypto stance, combined with regulatory clarity and institutional support, will provide the tailwinds needed to usher in a new era of growth for digital assets.

To get there, we’ll need an intense crypto bull run that will capture the imagination of the world and drive prices to astronomical levels. Expect the Bitcoin price and Ripple’s XRP price to hit new all-time highs immediately.

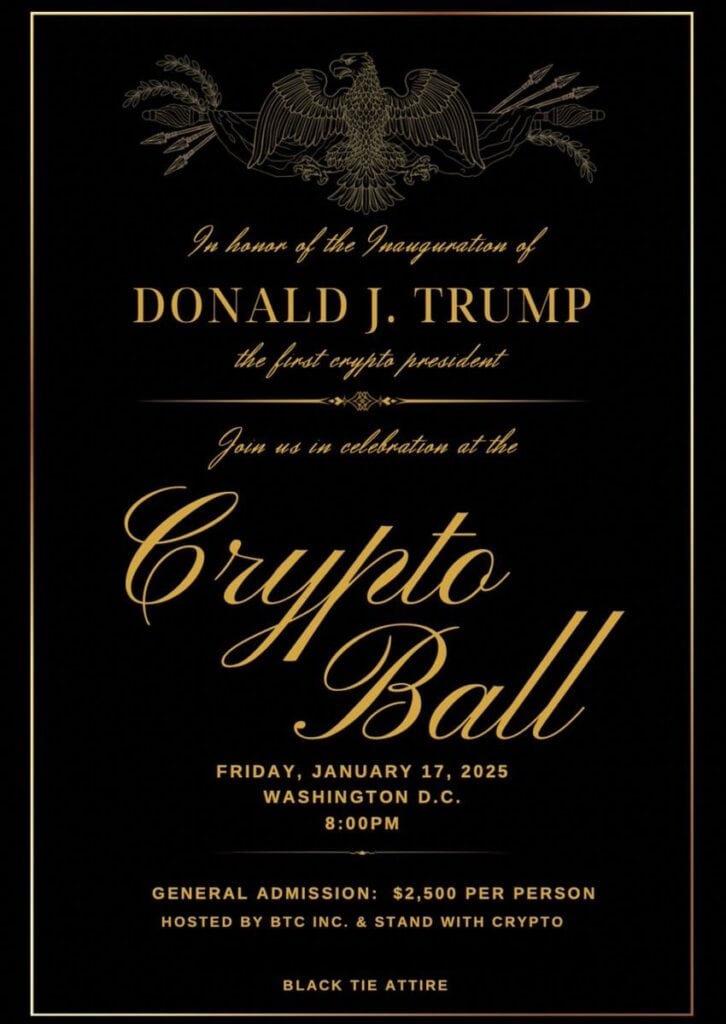

Tonight’s Crypto Ball will be highly bullish for Bitcoin and XRP, Source: X

:max_bytes(150000):strip_icc()/GettyImages-2193501631-c446740e38964f4dbaa2d24a6fcbc5e3.jpg)

Comments