The Bitwise Bitcoin ETF Advantage

The Bitwise Bitcoin ETF (NYSEARCA: BITB) has gained significant attention in the crypto investment landscape due to its low fees, impressive tracking performance, and increasing Assets under Management (AuM), currently standing at $2.36 billion. With its first six months fee waiver, BITB is a top choice for investors looking for direct exposure to Bitcoin.

Transparency and Leadership Bitwise not only leads in the ETF space but was also the first to publish on-chain wallet addresses, showcasing a commitment to transparency that aligns with blockchain principles. This dedication has positioned Bitwise as a frontrunner in the crypto ETF market, recently filing for a spot XRP ETF as well.

Performance Comparison

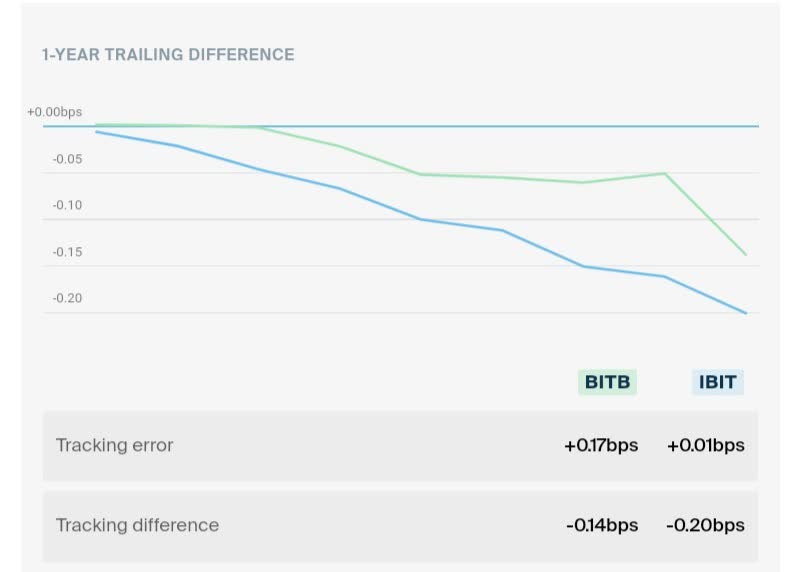

In comparison with the largest spot Bitcoin ETF, Blackrock’s iShares Bitcoin Trust ETF (IBIT), which boasts $22.51 billion in AuM, BITB has a tracking difference of -0.14 bps, outperforming IBIT's -0.20 bps. This efficient trade execution minimizes market impact, reducing price slippage and transaction costs.

Bitcoin's Resilience

Despite perceptions of Bitcoin being uncorrelated with traditional financial markets, it is influenced by broader macroeconomic factors. Historical events like the COVID-19 crash illustrate Bitcoin's volatility, where it dropped over 60% in a week, only to rebound sharply afterward, reaching $69,000 in 2021.

The daily net flows of spot Bitcoin ETFs indicate strong demand, even amidst heavy outflows triggered by negative market sentiment. For instance, a record outflow of $563.7 million occurred on May 1, linked to the Federal Reserve's decisions. However, subsequent announcements helped restore positive net flows, totaling $378.3 million.

Investment Considerations

Investing in Bitcoin through ETFs like BITB mitigates risks associated with direct ownership, such as volatility and the potential for asset loss or theft. Bitwise manages custody, providing a safer alternative to self-custody.

Moreover, the current geopolitical tensions and macroeconomic outlook make gaining exposure to Bitcoin a strategic move. The dual strengths of Bitcoin's recovery from downturns and its performance in favorable conditions enhance its appeal as a rewarding investment.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” - Benjamin Graham

Risks and Future Outlook

Short-term volatility remains a concern for traditional investors; however, I maintain a bullish outlook on Bitcoin and BITB's performance in the medium to long term. The ongoing post-halving supply cut dynamics further support this optimism as Bitcoin continues to bounce back above key support levels.

With Bitwise’s expansion into other crypto ETPs and its acquisition of ETC Group, the potential for growth in AuM and the maintenance of low fees positions BITB favorably in the evolving crypto landscape.

Investors should consider BITB as a no-brainer for those willing to take on risks in exchange for potential high rewards in Bitcoin exposure.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!