MARA Holdings: A Bitcoin Mining Giant

MARA Holdings (NASDAQ: MARA) stands out as one of the largest Bitcoin mining companies globally, boasting an impressive BTC HODL stash of 26,200 coins. Despite being in a relatively young industry with a market cap of only $24 billion, MARA has shown significant resilience and growth potential.

A Strong Performance Track Record

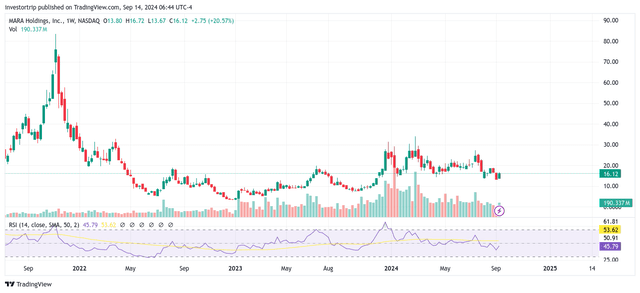

My journey with MARA began in the summer of 2020 when the stock was priced under $5. Following the 3rd Bitcoin halving, MARA's stock surged during the 2020-21 crypto bull run, hitting a high of $48 by March 2021 and later peaking at $75 in November 2021. Despite recent volatility, MARA shares have appreciated 752% over five years, vastly outperforming the S&P 500 Index, which saw only an 86% increase.

Current Market Conditions

As of now, MARA shares are at a favorable position in the weekly RSI range, indicating a potential dip buying opportunity as we approach an extremely bullish Q4.

Key Catalysts for Q4 2024

Several upcoming events could drive MARA's stock price higher:

- Interest Rate Cuts: Potential cuts during the September FOMC meeting.

- CZ's Prison Release: Anticipated release on September 28.

- Uptober: A historically bullish month for crypto.

- U.S. Elections: Presidential elections on November 5.

Promising Q2 2024 Results

In Q2 2024, MARA reported a revenue of $145.1 million (up 78% YoY) despite a quarterly loss of $199.7 million due to decreased Bitcoin valuation. The company produced 2,058 BTC and aims to expand its hash rate to 50 EH/s by the end of 2024.

Why MARA Shares Are Attractive

I believe MARA shares are undervalued, especially considering its potential revenue of $1 billion in 2025. With a P/S ratio of around 6, MARA is cheaper than in previous years, making it an opportune time for investors to buy. Historically, MARA shares traded at a P/S ratio of over 300 during the 2021 bull market.

Misunderstood by Investors

Many investors overlook MARA's potential as a Bitcoin payment processing and holdings company. As the Bitcoin network grows, MARA could generate significant revenue through transaction fees. The company’s strategy of share dilution is a common concern, but it remains essential for growth in the early stages.

Preparing for a Potential Short Squeeze

With a 27.51% short interest, MARA is ripe for a short squeeze as prices rise, especially with the upcoming bullish sentiment in Q4. It's crucial for traders to take profits quickly, as MARA is known for its volatility.

Risk Factors to Consider

- Declining Bitcoin Mining Profitability: Profitability could suffer during stagnant Bitcoin prices.

- Depressed Bitcoin Prices: MARA's stock is closely tied to Bitcoin’s price movements.

- Share Dilution: Continuous share dilution poses risks for long-term investors.

- Environmental Risks: Negative perceptions regarding Bitcoin mining's environmental impact could affect MARA's reputation.

- Natural Disasters: Events like hurricanes could disrupt mining operations.

My Strategy Moving Forward

I remain bullish on MARA and plan to HODL my shares while considering bullish call options. Specifically, I’m looking at:

- October 25th $30 calls

- December 20th $40 calls

- March 21, 2025 $35 calls

MARA is a compelling investment for those willing to navigate its volatility and recognize the value of miners in the Bitcoin ecosystem.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!