Summary:

MVRV (Market Value to Realized Value) is a key metric for Bitcoin valuation.

A MVRV ratio above 1 indicates Bitcoin is overvalued, while below 1 suggests undervaluation.

MVRV has significant predictive power regarding market cycles.

Investors can use MVRV to identify buying opportunities and assess market sentiment.

Understanding MVRV: A Crucial Bitcoin Metric

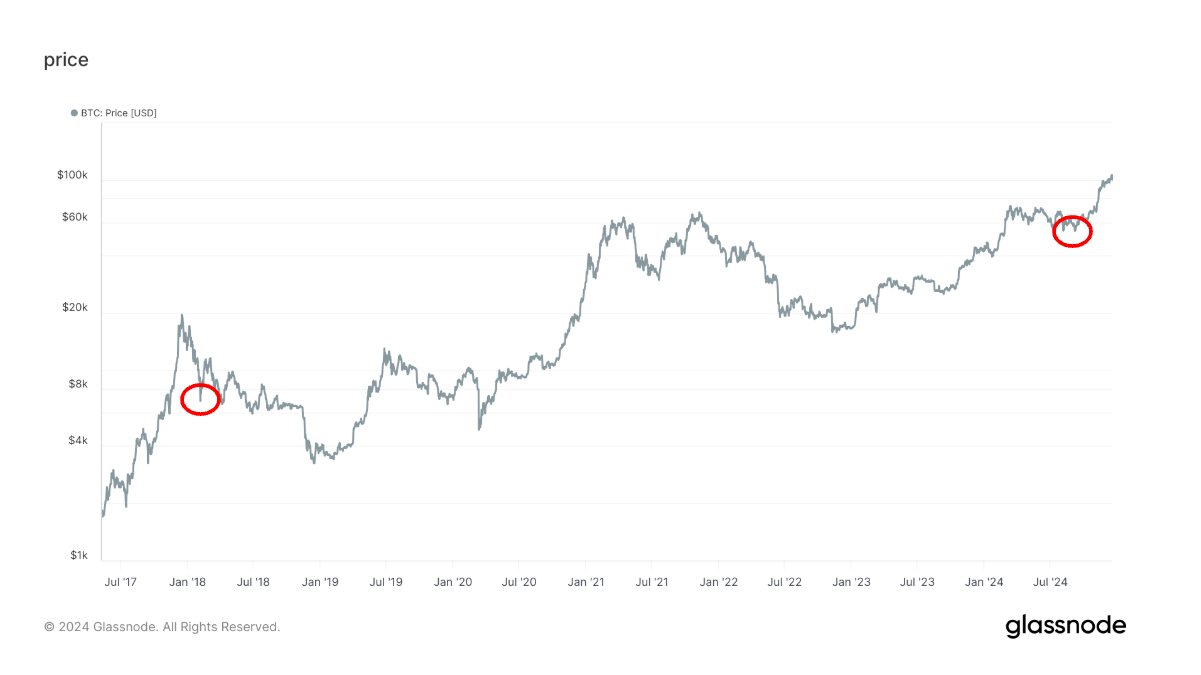

MVRV (Market Value to Realized Value) is an essential metric that provides insights into the valuation of Bitcoin. It is computed by dividing the market capitalization of Bitcoin by its realized capitalization. This metric helps investors gauge whether Bitcoin is overvalued or undervalued in the market.

What Does MVRV Indicate?

- A MVRV ratio above 1 suggests that Bitcoin is currently overvalued, while a ratio below 1 indicates it is undervalued.

- This metric can serve as a useful tool for determining potential price corrections or surges, aiding investors in making informed decisions.

Historical Context

Historically, MVRV has shown significant predictive power regarding market cycles. For instance, during bullish phases, MVRV tends to rise, while in bearish phases, it often drops, indicating a potential buying opportunity for savvy investors.

Using MVRV in Investment Strategies

Investors can utilize MVRV to:

- Identify potential buying opportunities during periods of undervaluation.

- Assess market sentiment by analyzing shifts in the MVRV ratio.

- Make strategic decisions about when to enter or exit positions in Bitcoin.

By keeping an eye on MVRV, investors can better navigate the volatile landscape of cryptocurrency and enhance their investment strategies.

Comments