Hindsight is 20/20, and if we could turn back time, our portfolios would likely include Nvidia, Tesla, and — of course — Bitcoin.

The meteoric rise of Bitcoin has evoked a range of emotions among investors. While some are euphoric, others are left regretting their missed opportunities, especially recalling times when Bitcoin traded at just a few thousand dollars. Even the sub-$30,000 prices throughout 2023 now seem like a bargain in hindsight.

A Little Bitcoin Has Gone a Long Way

I recall a conversation with a wealth manager friend who was hesitant about Bitcoin but acknowledged that a modest allocation — perhaps 5% or less of a portfolio — could be prudent for those who believe in its potential.

After examining the impact of such an allocation, it's clear: a little Bitcoin has made a significant difference for those who took the plunge.

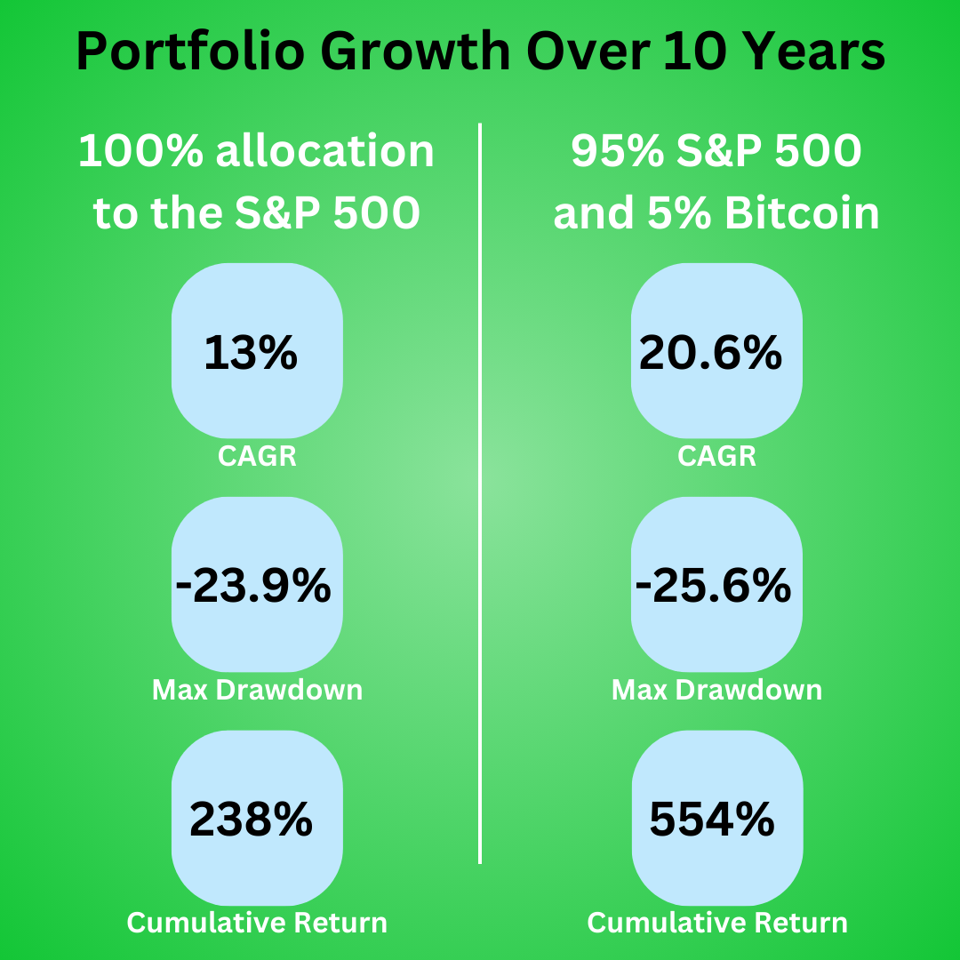

In our example, we allocated 5% of a $10,000 portfolio to Bitcoin while the rest went into the S&P 500. This resulted in a portfolio value growing to over $65,000 compared to approximately $34,000 for an all-stock approach. This means a cumulative return of 554% versus 238% for the all-stock portfolio.

Digging Into the Details

Turning $10,000 into more than $30,000 in a decade is impressive. The impact of a small allocation to a high-performing asset underscores the long-term compounding effects when that asset becomes a major winner.

In terms of risk, the all-stock portfolio experienced a maximum decline of nearly 24% during the 2022 bear market, while the portfolio with a 5% Bitcoin allocation faced a slightly larger drop of 25.6%. Interestingly, if Bitcoin had gone to zero, the portfolio would still have achieved a 12.6% compound annual growth rate, just shy of the 13% CAGR from the all-stock strategy.

The key takeaway? Most investors would willingly accept a minor increase in downside risk for the substantial upside potential that Bitcoin offered over the last decade.

What Good Is Hindsight?

The purpose of this analysis is not to make anyone feel regretful about Bitcoin or any other successful asset. Instead, it serves as a reminder to rethink risk. It's essential to take calculated risks when there's strong conviction in a potential asset.

For every success story like Nvidia or Bitcoin, there are countless investments that didn’t pan out. Therefore, investors should be discerning and not simply chase trends seen on social media.

To build conviction, they must approach the markets with an open mind and conduct thorough research. If they feel strongly about an asset after doing their homework, a small, calculated investment can lead to significant long-term gains without risking their entire savings.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!