Summary:

Nicolette Rea highlights the increasing acceptance of cryptocurrency donations in philanthropy.

The SEC decision in May 2024 marked a significant turning point for crypto contributions.

Cryptocurrency offers a way for donors to avoid capital gains tax, maximizing their charitable impact.

Most donations go into donor-advised funds, facilitating quick charitable giving.

Over $2 billion has been donated via cryptocurrency, with 56% of major charities accepting it.

As the Community Foundation Tampa Bay’s Director of Donor Relations and Associate Counsel, Nicolette Rea has seen a remarkable shift in charitable giving with the rise of cryptocurrency donations. In her nearly five years at the Foundation, she has noted a growing acceptance of various assets to enhance philanthropy's impact.

The Rise of Cryptocurrency Donations

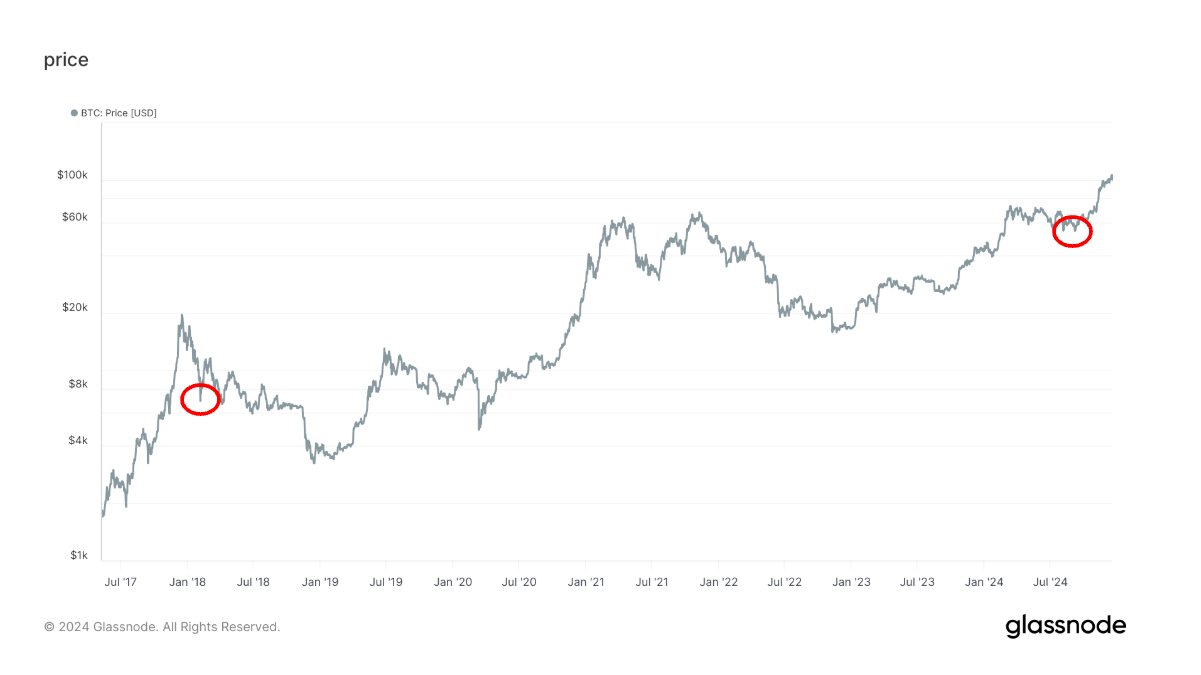

Cryptocurrency donations were once rare, but a pivotal SEC decision in May 2024 sparked a surge in donor interest. Rea recalls, "It wasn’t very common and then, in the span of one week, I got many calls asking questions about cryptocurrency." Now, cryptocurrency is a staple in donors' portfolios, and the Foundation encourages these non-cash assets as they often yield greater gifts without the burden of capital gains tax.

The Impact of Non-Cash Assets & Donor Advised Funds

Rea emphasizes that cryptocurrency is not only tax-efficient but also significantly benefits the community. Most donations are funneled into donor-advised funds, which act like charitable checking accounts, allowing donors to invest and grow their contributions tax-free. Rea states, "It’s really rewarding because those types of gifts make a huge impact on the community."

An example of this impact is seen in a local grassroots nonprofit that faced challenges after losing part of its food supply. Thanks to the effectiveness of donor-advised funds, Rea was able to connect them with donors quickly, demonstrating the immediate benefits of these contributions.

The Future of Cryptocurrency in Charity

Looking ahead, Rea is optimistic about the role of cryptocurrency in charitable donations. She urges philanthropists to consider crypto as a viable option and consult with their tax advisors. According to The Giving Block, over $2 billion has been donated via cryptocurrency as of January 2024, with 56% of the largest charities now accepting it. Rea concludes, "It’s worth a conversation and it's great for charities and donors to know that it is possible."

Community Foundation Tampa Bay Director of Donor Relations and Associate Counsel Nicolette Rea

Community Foundation Tampa Bay Director of Donor Relations and Associate Counsel Nicolette Rea

Comments