Summary:

Trump's plans for a U.S. bitcoin strategic reserve could unlock trillions in wealth.

Bitcoin price has surged past $100,000, influenced by Trump's announcements.

Michael Saylor predicts the reserve could generate $16 trillion to $81 trillion.

New appointments aim to foster innovation in the digital asset space.

Senator Cynthia Lummis proposes purchasing 200,000 bitcoins annually.

Trump Fuels Bitcoin Surge

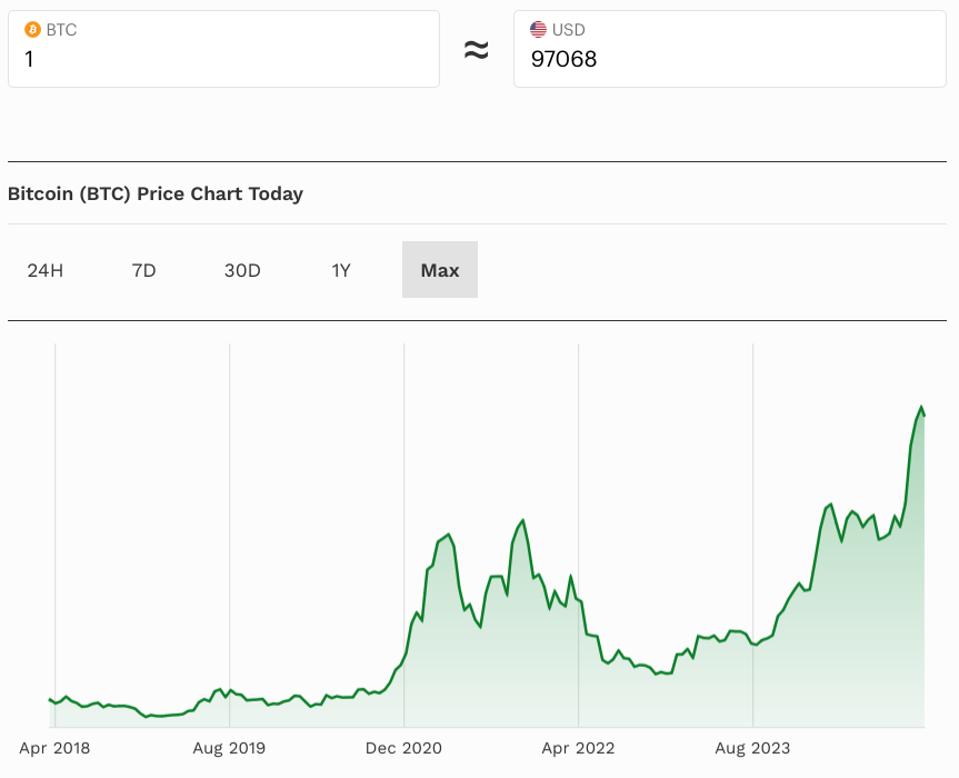

Donald Trump, the U.S. president-elect, has dramatically influenced the bitcoin price, which has soared to record highs this year—crossing the $100,000 mark—following his announcement of plans to establish a U.S. bitcoin strategic reserve. This move is seen as a catalyst for a capital markets renaissance, with predictions that it could unlock trillions in wealth.

The Vision for a Bitcoin Reserve

Michael Saylor, founder of MicroStrategy, has pitched the idea that a strategic digital asset policy could enhance the U.S. dollar, mitigate national debt, and position the United States as a leader in the 21st-century digital economy. His proposal outlines the potential for a U.S. bitcoin reserve to generate between $16 trillion and $81 trillion, which would significantly help offset the national debt, currently over $36 trillion.

Appointments and Policy Changes

In a recent update, Trump has appointed Bo Hines as the executive director of a new presidential council of advisers for digital assets. This council aims to foster innovation and support industry leaders in the digital asset space. Additionally, Stephan Miran, a pro-bitcoin former Treasury official, will chair the Council of Economic Advisors, advocating for crypto regulation in the U.S.

The Market Impact

As the bitcoin market continues to boom, it is expected to create massive demand for U.S. Treasuries and expand global digital capital markets from $2 trillion to $280 trillion, with U.S. investors capturing a significant portion of this wealth. Notably, Tether, a stablecoin issuer, has significantly contributed to this trend, recording profits of $10 billion in 2024.

Future Predictions

Senator Cynthia Lummis has proposed a bill for the U.S. Treasury to purchase 200,000 bitcoins annually until a reserve of 1 million bitcoins is achieved. This ambitious strategy is part of a broader vision to enhance the U.S.'s position in the global digital finance landscape.

In summary, Trump's strategic embrace of bitcoin could redefine the financial landscape, creating unprecedented opportunities for investors and significantly impacting the U.S. economy.

Comments