Summary:

Semler Scientific adds 303 Bitcoin to its treasury, totaling 1,873 BTC valued at over $189 million.

Reported a BTC Yield of 78.7%.

Ranks as the 14th largest Bitcoin holder among publicly traded companies.

Adopted Bitcoin treasury strategy in May, likening Bitcoin to digital gold.

MicroStrategy and Metaplanet also significantly invest in Bitcoin.

Semler Scientific Joins the Bitcoin Standard

Healthcare technologies company Semler Scientific has made headlines by adding 303 Bitcoin to its corporate treasury, in a move that aligns with a growing trend among companies accumulating this digital asset.

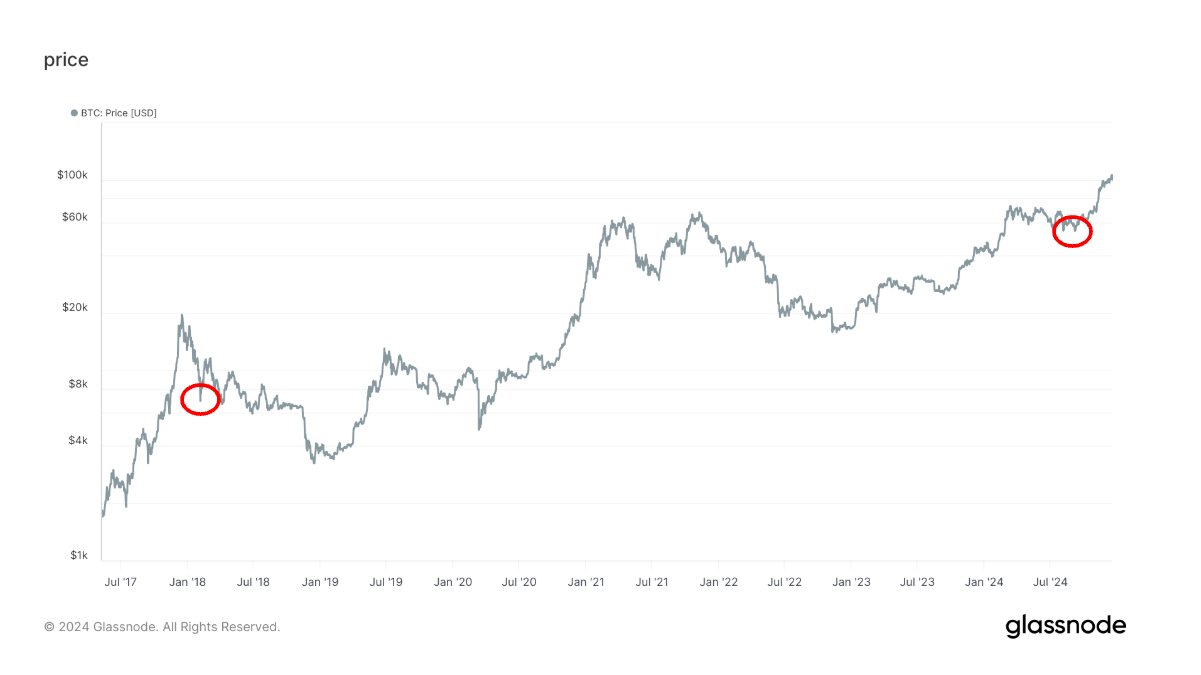

From November 25 to December 4, Semler acquired these Bitcoins at an average price of $96,779 each, as detailed in a recent statement from the company. Chairman Eric Semler expressed satisfaction with a reported BTC Yield of 78.7%.

Currently, Semler holds a total of 1,873 Bitcoin, which is valued at over $189 million at prevailing market prices. This significant accumulation places Semler as the 14th largest holder among publicly traded companies, according to data compiled by Bitcoin Treasuries.

Over the past year, Semler has strategically added to its Bitcoin holdings, including a notable purchase of 215 Bitcoin in early November. The company utilizes a performance metric known as “BTC Yield”, which tracks the ratio of its Bitcoin holdings to its shares of common stock.

Semler first adopted this treasury strategy in May, emphasizing Bitcoin's potential as a store of value akin to digital gold. This sentiment was echoed recently by Federal Reserve Chair Jerome Powell, highlighting Bitcoin's increasing acceptance in the financial landscape.

Semler is not alone in this initiative; other companies like MicroStrategy and Japan's Metaplanet are also significantly investing in Bitcoin. MicroStrategy, for example, holds over $40 billion worth of Bitcoin and employs the BTC Yield metric to evaluate its performance. Meanwhile, Metaplanet has reported substantial gains from its investments in Bitcoin, further illustrating the asset's appeal during the current bull market.

As for Semler Scientific, the firm's stock, traded on the NASDAQ, has seen a nearly 33% increase this year, although it recently experienced a 7.6% drop, closing at $58.55.

Comments