Summary:

MicroStrategy transferred 1,652 BTC worth $114.38 million to a new wallet.

The company holds a total of 252,220 BTC, valued at $17.56 billion.

Plans to raise $42 billion to increase Bitcoin holdings over the next three years.

MicroStrategy is the largest public corporate holder of Bitcoin, with approximately $18 billion on its balance sheet.

Bitcoin price is currently down 0.15% to $69,470 after reaching highs of $73,600.

MicroStrategy Moves 1,652 BTC

According to recent on-chain data, MicroStrategy has transferred 1,652 Bitcoin, valued at approximately $114.38 million, to a new wallet. This significant transfer, reported by Lookonchain, has caught the attention of the crypto community. MicroStrategy, renowned for its substantial Bitcoin holdings, is strategically managing its digital assets.

Despite the transfer, MicroStrategy's total Bitcoin stockpile remains unchanged from what it reported at the end of September. Currently, the company holds 252,220 BTC, worth around $17.56 billion, with an average buying price of $39,266, resulting in an unrealized profit of $7.65 billion.

Future Plans for Bitcoin Expansion

MicroStrategy is not slowing down. The company has announced ambitious plans to fund $42 billion over the next three years to increase its Bitcoin holdings. To achieve this, it has hired banks to assist in raising funds through the sale of additional shares and fixed-income instruments.

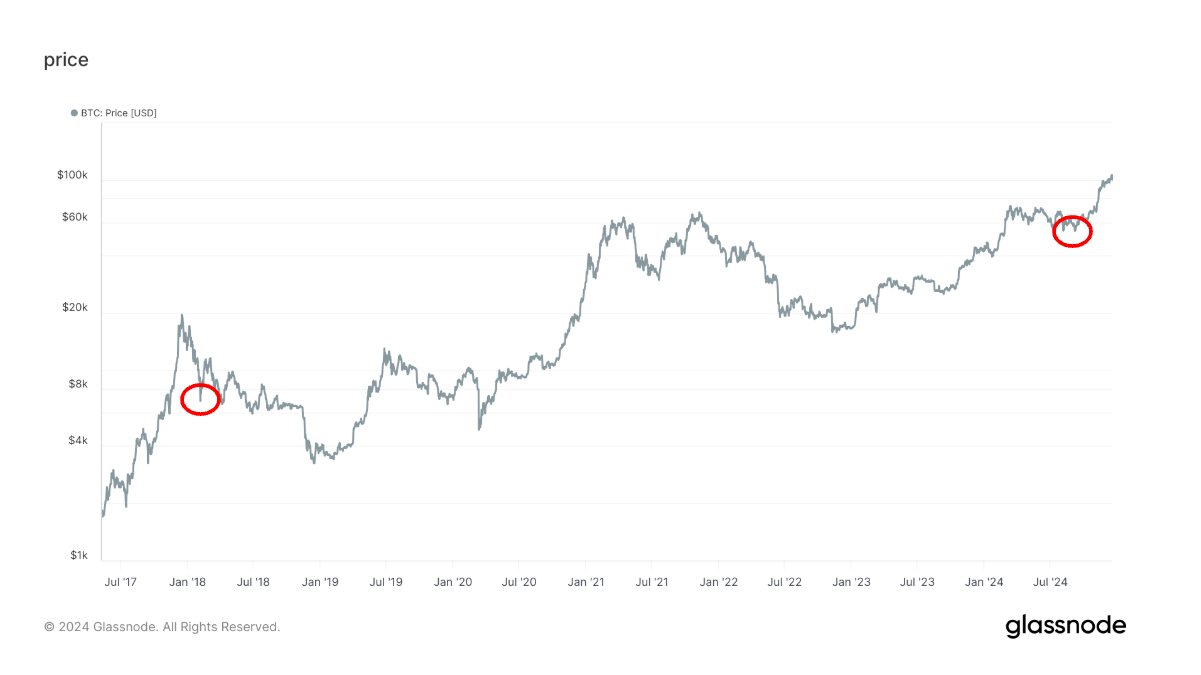

At present, Bitcoin has seen a slight decline, down 0.15% in the last 24 hours to $69,470, following a peak of $73,600 earlier this week. Since 2020, Bitcoin's price surge has led to a nearly 2,000% increase in MicroStrategy's share price.

MicroStrategy's Financial Strategy

MicroStrategy positions itself as the largest public corporate holder of Bitcoin, with around $18 billion on its balance sheet. The plan to raise $42 billion will involve selling stock in an at-the-market offering, potentially generating $21 billion from shares and a similar amount from fixed-income instruments. The company has successfully raised billions through the sale of convertible senior notes and stock sales in recent times, further enhancing its Bitcoin reserves.

Comments