How MicroStrategy and Others Are Taking on Billions in Debt to Buy More Bitcoin

Michael Saylor has raised $6 billion in convertible bonds, with $18 billion more to come. His strategy is unprecedented — here’s how it works.

Have Michael Saylor and MicroStrategy (MSTR) stumbled onto an infinite money glitch? It would be hard to blame anyone for thinking so. While the Saylor-led company began buying bitcoin (BTC) more than four years ago, over the past 10 months, MicroStrategy has used a unique strategy to raise over $6 billion for the express purpose of adding more bitcoin to its balance sheet, which as of Dec. 15 stood at 439,000 tokens worth $46 billion at the current price of about $106,000.

MicroStrategy did not raise these funds by taking out loans or by issuing more company shares (though it has separately issued billions of dollars worth of equity). Rather, the firm sold convertible notes — debt securities which can be converted into equity on specified dates or under special conditions. And it's not done yet: Saylor and company intend to raise at least another $18 billion through such bonds over the next three years, according to a plan laid out in October.

Demand for this convertible paper has been so high that other companies, including bitcoin miner MARA Holdings (MARA), have adopted a similar playbook to raise billions to add to their own stacks.

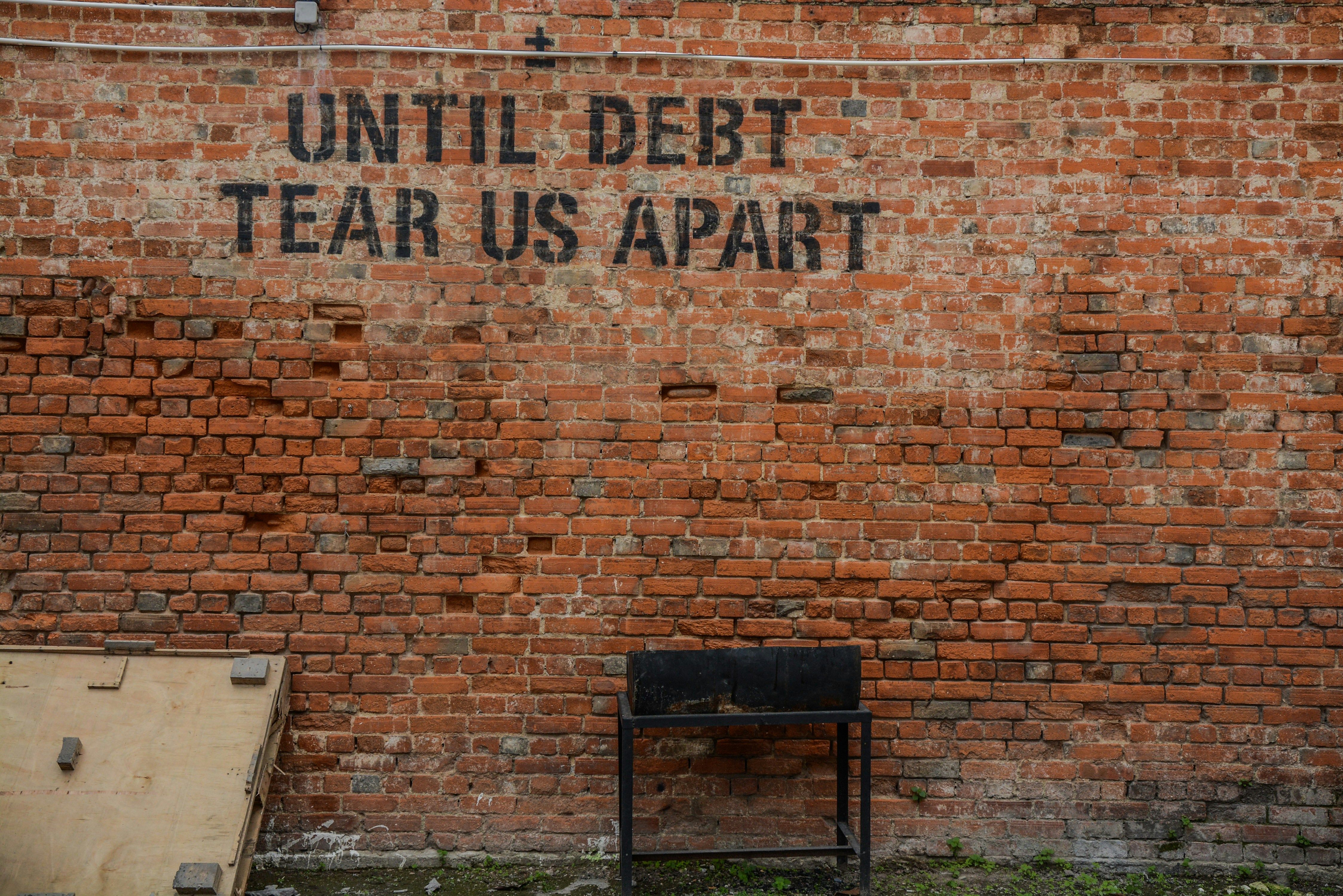

But that raises a question: Could issuing so much debt eventually become dangerous for these firms, and for the crypto market at large?

"If bitcoin faces a prolonged period of low/declining prices, [the companies] could have to issue more equity and dilute shareholders at an inopportune time … [or] sell the bitcoin for less than they bought," Quinn Thompson, founder of crypto hedge fund Lekker Capital, told CoinDesk. Thompson added, though, that he doesn't expect the companies to become insolvent.

How convertible notes work

Convertible notes are a financial tool that allows companies to quickly raise funds without needing to provide collateral (as they would for a loan) or to immediately dilute their stock. These bonds are priced based on the interest rate baked into them, the firm’s underlying stock, the volatility of that stock, and the firm’s creditworthiness.

For example, in November, bitcoin mining firm Bitdeer (BTDR) raised $360 million by issuing convertible notes with an interest rate of 5.25%. These will mature on Dec. 1, 2029, at a price of $15.95 per share — which is approximately 42.5% higher than what these shares were trading for on Nov. 21 when the convertible notes were priced.

In other words, instead of simply buying the company’s shares on the open market, investors can earn a solid yield by holding these notes while also benefiting if the stock surges. Even better, convertible notes come with downside protection. On specific dates, such bonds can be redeemed in cash for an amount equal to the original investment plus interest payments. Put differently, investors are almost guaranteed to get their money back even if the stock plunges before the note matures.

MicroStrategy’s situation is rather unique in that the firm has found demand for convertible bonds at a 0% interest rate even though benchmark U.S. interest rates are closer to 5%. Why? Volatility. Being essentially a leveraged play on bitcoin, MicroStrategy common stock most recently has been trading with a 30-day average implied volatility of 106, compared to the S&P 500, which usually trades at roughly 15.

The stock volatility affects price action in MSTR's convertible bonds, and sophisticated market participants are able to score sizable profits by trading that volatility in a market-neutral fashion.

“I was on the phone with a convertible note [arbitrage] trader… just to sort of understand what he’s going through with all of this,” Richard Byworth, a convertible bond expert and managing partner at asset management firm Syz Capital, told the On The Margin podcast.

There’s thus a huge demand for MicroStrategy’s convertible notes, allowing the firm to sell a significant amount — five issuances in a year, which is unprecedented. At press time, the company had six outstanding convertible notes, with maturations between 2027 and 2032. Two of these have 0% interest rates, while others yield 0.625%, 0.875%, and 2.25%. Because these rates are so low, MicroStrategy is managing to sell equity at a massive premium compared to its current stock price, while only paying a blended 0.811% interest rate on its debt, or $35 million annually, an amount easily covered by the firm’s revenue.

Convertible notes mania

In addition to the mentioned bitcoin miners, there's medical device company Semler Scientific (SMLR), which made public its bitcoin treasury strategy in late May. While the firm has only purchased bitcoin with cash already on its balance sheet and capital raised through share sales, its stock was granted an options market recently, making note offerings much more attractive to investors.

Bitcoin miners took on roughly $5.2 billion in debt from June to Dec. 5 alone, according to the MinerMag. Some of these convertible notes have been issued with 0% interest in the case of MARA and Core Scientific, while others like Bitdeer, IREN, and TeraWulf have issued them at rates ranging from 2.75% to 8.5%.

Not every company is employing the strategy for the same reasons. MARA and Riot Platforms (RIOT) are following MicroStrategy’s footsteps by using the proceeds from convertible notes to add more bitcoin to their balance sheets, but Core Scientific wants the funds for operating expenses and potential acquisitions. Bitdeer, on the other hand, aims to further develop its mining rig manufacturing business.

Bill eventually comes due

Convertible notes, however, are not free money. Once the notes reach full maturity, holders can decide to convert them for equity at an agreed-upon price per share or redeem them for cash if the stock has underperformed expectations.

The danger is that the stock prices of these firms could drop significantly, incentivizing holders to redeem their notes for cash instead of shares. In MicroStrategy’s case, that could compel the company to sell some of its bitcoin holdings to pay investors back, while bitcoin mining firms could be forced to sell off various mining assets. In a worst-case scenario, firms could end up facing bankruptcy.

Forced selling of bitcoin isn't necessarily the end of the world, especially if the company’s average purchase price is lower than the price it sells at. MicroStrategy’s stash, for instance, was acquired for $61,725 per bitcoin on average, providing some breathing space. The trouble is bitcoin is known for plunging 80% every few years. Just this year — even during a bull market — the price declined nearly 40% at one point.

MicroStrategy’s bonds are staggered, meaning they all have different maturation years, which reduces the company’s risk. It won’t need to repay all that debt all at once. Bitcoin and MSTR would need to stay down for a significant number of years for the firm’s situation to get really dicey. The fact that most of MicroStrategy’s notes already meet the requirements for conversion is another point in the company’s favor.

In a sense, MicroStrategy is a grizzled veteran of this strategy. It’s possible that newcomers like the bitcoin miners could find themselves far more exposed, having taken on large liabilities closer to a potential cycle top.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!