Summary:

Microsoft shareholders rejected a Bitcoin proposal, potentially impacting corporate adoption.

A successful Bitcoin proposal could lead to a wave of corporate Bitcoin adoption.

The National Center For Public Policy Research targets Amazon next for Bitcoin adoption.

The $100,000 Bitcoin mark could influence other companies to reconsider their asset strategies.

Recent investments in Bitcoin by biotech companies may spark further corporate interest.

On December 10, Microsoft (NASDAQ: MSFT) shareholders voted against a proposal to add Bitcoin (CRYPTO: BTC) to the company's balance sheet. While Microsoft's board recommended a no vote, the rejection was not unexpected.

The Ripple Effect of Microsoft's Decision

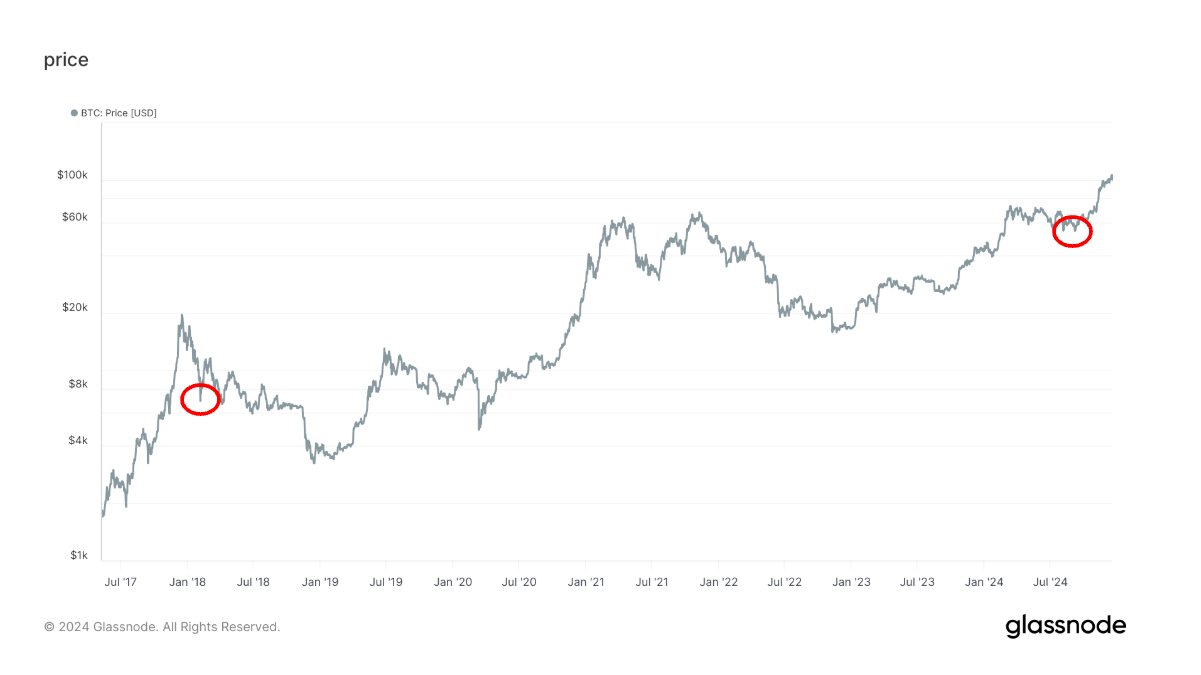

What if the proposal had passed? It could have set a precedent for other major corporations to follow suit, leading to a surge in Bitcoin adoption across corporate America. Such a wave of Bitcoin buying would likely have driven prices higher, potentially creating new Bitcoin millionaires.

The Next Target: Amazon

The push for Bitcoin adoption isn't stopping with Microsoft. The National Center For Public Policy Research, which backed the proposal, has set its sights on Amazon (NASDAQ: AMZN) next. Shareholders will vote on a similar proposal in April, urging Amazon to consider Bitcoin as a treasury asset.

The Market Sentiment

With Bitcoin breaking through the $100,000 mark and optimism surrounding the incoming Trump administration, other companies may also consider adding Bitcoin to their balance sheets. Companies that resist could face backlash from their shareholders, as this new trend could become a way to enhance shareholder value.

Current Bitcoin Holders

Currently, the largest publicly traded companies holding Bitcoin are crypto-related, including Coinbase Global (NASDAQ: COIN) and MicroStrategy (NASDAQ: MSTR). While a few exceptions exist, like Tesla (NASDAQ: TSLA), most companies buying Bitcoin are directly linked to the crypto industry. For instance, Coinbase needs to buy Bitcoin due to its trading platform's operations.

New Players in the Game

However, this landscape may soon change. On November 20, three biotech companies announced plans to invest $1 million each in Bitcoin to tap into its future upside potential and enhance shareholder value. If successful, this could inspire other companies to follow their lead.

Implications for Investors

What does all this mean for you as an investor? If you hold Bitcoin and aspire to become a crypto millionaire, you should actively support the success of Bitcoin shareholder activism. Every public company that buys Bitcoin contributes to driving its price higher, enhancing your investment's value.

Comments