Summary:

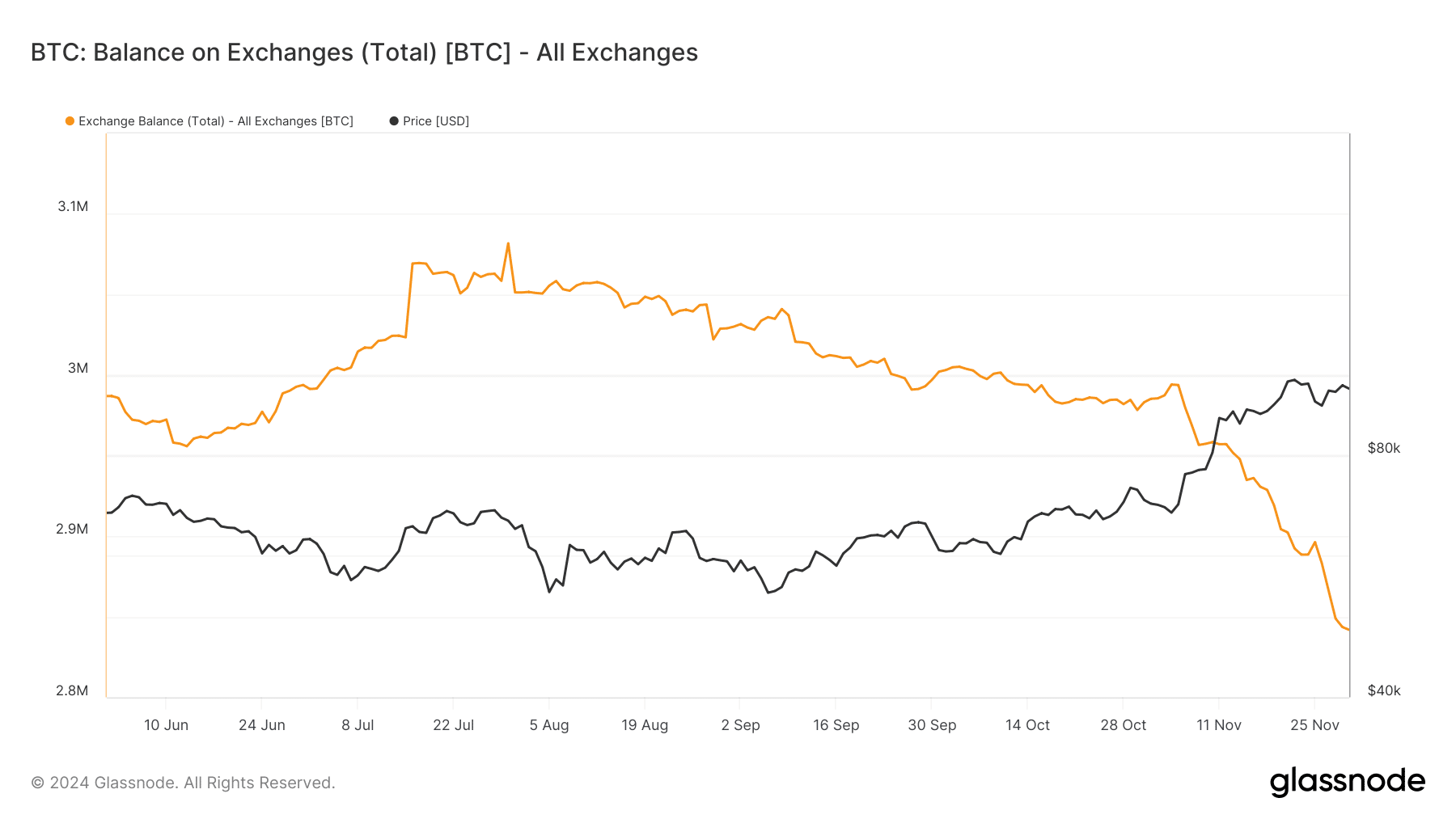

55,000 BTC withdrawn from exchanges in 72 hours signals strong demand.

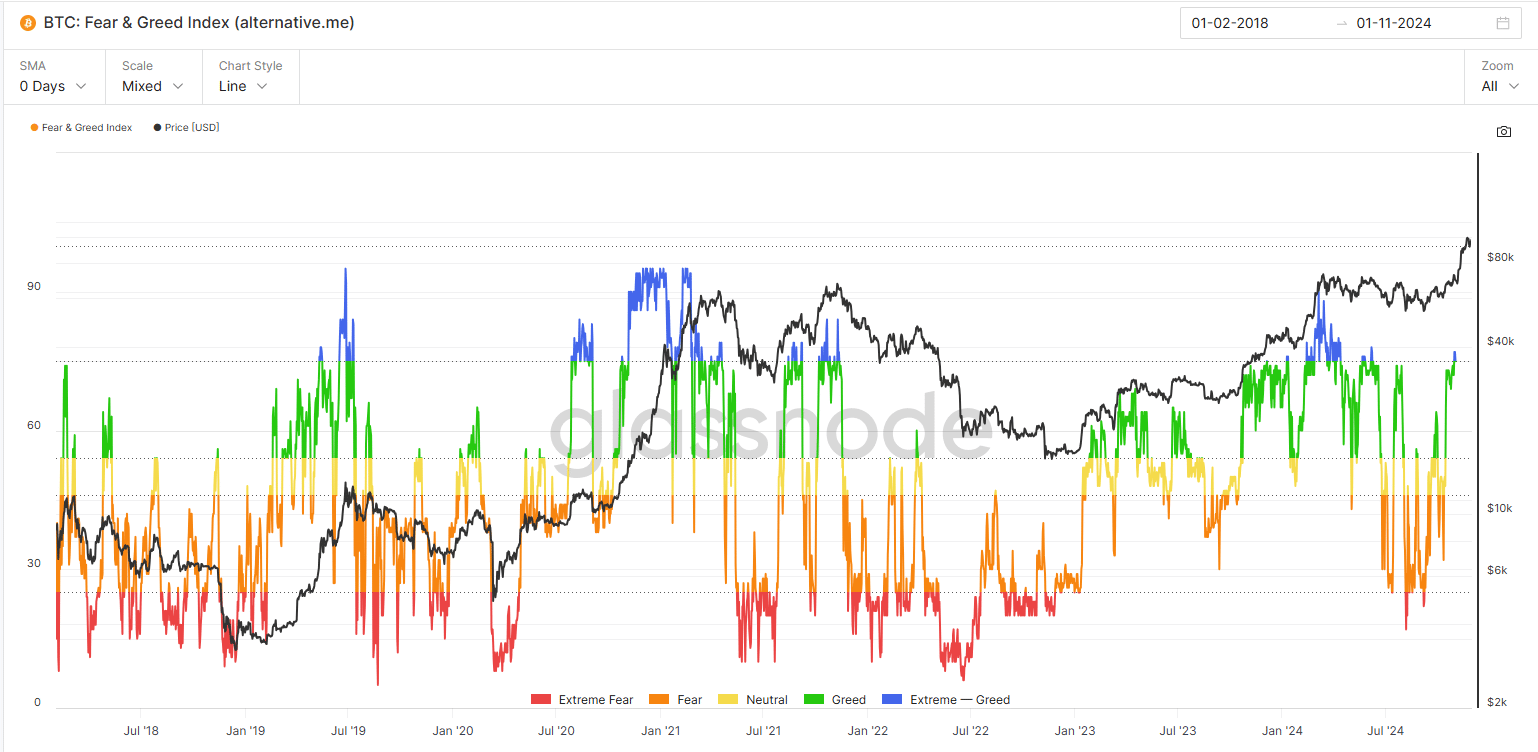

Fear & Greed Index shows extreme greed, indicating potential market volatility.

Exchange reserves below 2.8M BTC reflect a shift towards self-custody.

Recent price trends suggest a supply squeeze, often preceding bull runs.

Risks of leveraged liquidations increase with extreme greed sentiment.

Over 55,000 BTC (valued at $5.34 billion) were withdrawn from exchanges in a mere 72 hours, marking a significant moment in the cryptocurrency landscape. This massive exodus highlights strong accumulation and demand among investors.

The Bitcoin Exodus

The sharp decline in Bitcoin’s exchange balance, now below 2.8M BTC for the first time since 2018, reflects strategic moves by investors. This withdrawal aligns with increased on-chain activity, suggesting a shift towards self-custody as trust in centralized platforms diminishes.

The rising price trend indicates a potential supply squeeze, as such withdrawals have historically preceded bull runs, reducing immediate sell pressure on exchanges.

Riding the Wave of “Extreme Greed”

The Bitcoin Fear & Greed Index has surged into the “extreme greed” territory, with a reading above 80, a level not seen since the 2021 bull run. While this sentiment could signal a potential rally, it also raises caution as extreme greed often precedes volatility and corrections.

With Bitcoin recently surpassing $99,000, the market is entering uncharted territory. The decrease in exchange reserves reflects a supply squeeze, dominated by long-term holders.

Catalysts, Sustainability, and Risks

The recent rally in Bitcoin can be attributed to three main factors:

- Tightening supply as exchange reserves fall below 2.8M BTC

- Increased institutional participation

- Macroeconomic uncertainty driving demand for digital assets

However, risks remain, as the “extreme greed” sentiment raises the likelihood of leveraged liquidations, potentially triggering sharp corrections. Sustaining this rally will depend on continued institutional inflows and the ability to navigate volatile sentiment shifts without destabilizing the market.

Comments