Summary:

Japan's ODEX applies to list Bitcoin futures, marking a significant milestone in Asia's Bitcoin adoption.

Bitcoin's price increased to $64,321, with an 18% surge in trading volume post-announcement.

Market volatility increased, with fluctuations between $64,000 and $65,000 shortly after the news.

Technical indicators show a bullish trend with significant price movements and rising RSI.

Positive sentiment spills over to AI tokens like FET and AGIX, indicating broader market optimism.

On March 4, 2025, Japan's Exchange ODEX made headlines by applying to be the first exchange in the country to list Bitcoin futures. This bold move represents a pivotal moment for Bitcoin adoption in Asia.

Market Response to the Announcement

This announcement came amidst significant volatility in Bitcoin's price. At the time, Bitcoin was trading at $64,321, reflecting a 3.5% increase from the previous day's close of $62,154. The trading volume surged by 18%, reaching $34.2 billion within the first hour after the announcement. Notably, the BTC/JPY trading pair's volume increased by 22% to ¥3.8 trillion. Furthermore, active addresses on the network rose by 12%, indicating a growing interest from potential investors in Japan.

Immediate Trading Implications

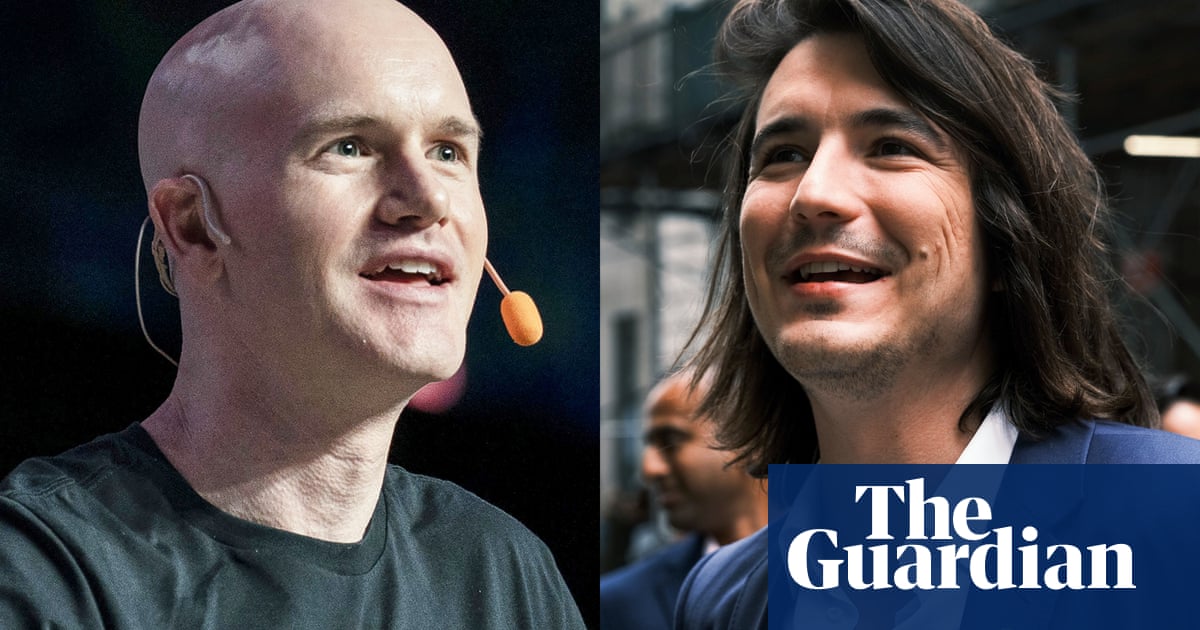

The news led to increased market volatility, with Bitcoin's price fluctuating between $64,000 and $65,000 shortly after the announcement. Exchanges reported a notable rise in trading volumes, with Coinbase seeing a 15% increase to $2.3 billion and Kraken reporting a 14% increase to $1.9 billion. The Crypto Fear & Greed Index also jumped from 62 to 70, suggesting a shift towards greed and optimism about Bitcoin's future in Japan.

Technical Analysis Insights

From a technical analysis perspective, Bitcoin's price exhibited a bullish trend following the announcement. The price broke above the $64,000 resistance level and experienced a retest as support shortly after. The Relative Strength Index (RSI) rose from 68 to 74, indicating strong bullish momentum despite overbought conditions. Additionally, the Moving Average Convergence Divergence (MACD) indicated a bullish crossover, further confirming the upward trend.

Broader Market Sentiment

Interestingly, while there was no direct impact on AI-related tokens from the ODEX announcement, the overall positive sentiment in the crypto market benefited tokens like Fetch.AI (FET) and SingularityNET (AGIX), which saw price increases of 5% and 4%, respectively. This suggests that the enthusiasm surrounding Bitcoin may also positively influence other sectors.

Conclusion

The application by ODEX to list Bitcoin futures is a significant milestone that could reshape the Japanese cryptocurrency landscape and stimulate further investment and interest in the market. As Bitcoin's price remains volatile, traders and investors are keenly watching for potential opportunities arising from this historic moment.

Comments