Summary:

Bitcoin's worst weekly performance linked to a strong dollar and tariff plans.

Long-term tailwinds for Bitcoin remain despite short-term challenges.

Bitcoin began the week at $102,000 but fell below $97,000 shortly after.

Fed's cautious approach leads to expectations of unchanged interest rates.

Pro-crypto legislation may take time as Congress prioritizes other issues.

Tariffs and a Strong Dollar Challenge Digital Asset Stability Amid Economic Policy Shifts

Bitcoin has faced significant volatility recently, largely attributed to the strong dollar and President Trump's potential tariff plans. Following a remarkable rise of over 45% after the November 5 presidential election, Bitcoin's momentum has stalled, leading to concerns about its future performance.

Key Takeaways

- Bitcoin experienced its worst weekly performance due to a strong dollar and Trump's tariff proposals.

- Despite short-term challenges, long-term structural tailwinds for Bitcoin and digital assets remain intact.

Bitcoin began the week positively, reclaiming $102,000 but quickly fell below $97,000, signaling a struggle to maintain its value. Zach Pandl, head of research at Grayscale Investments, noted, “Bitcoin’s problem at the moment is the strong dollar,” highlighting the impact of the Federal Reserve's recent signals that have bolstered the dollar.

Trump's consideration of a national economic emergency to implement universal tariffs could lead to inflationary pressures, creating further uncertainty in the market. Initial optimism about a pro-crypto environment under Trump's administration may be dampened by these conflicting signals.

Continued High Interest Rates

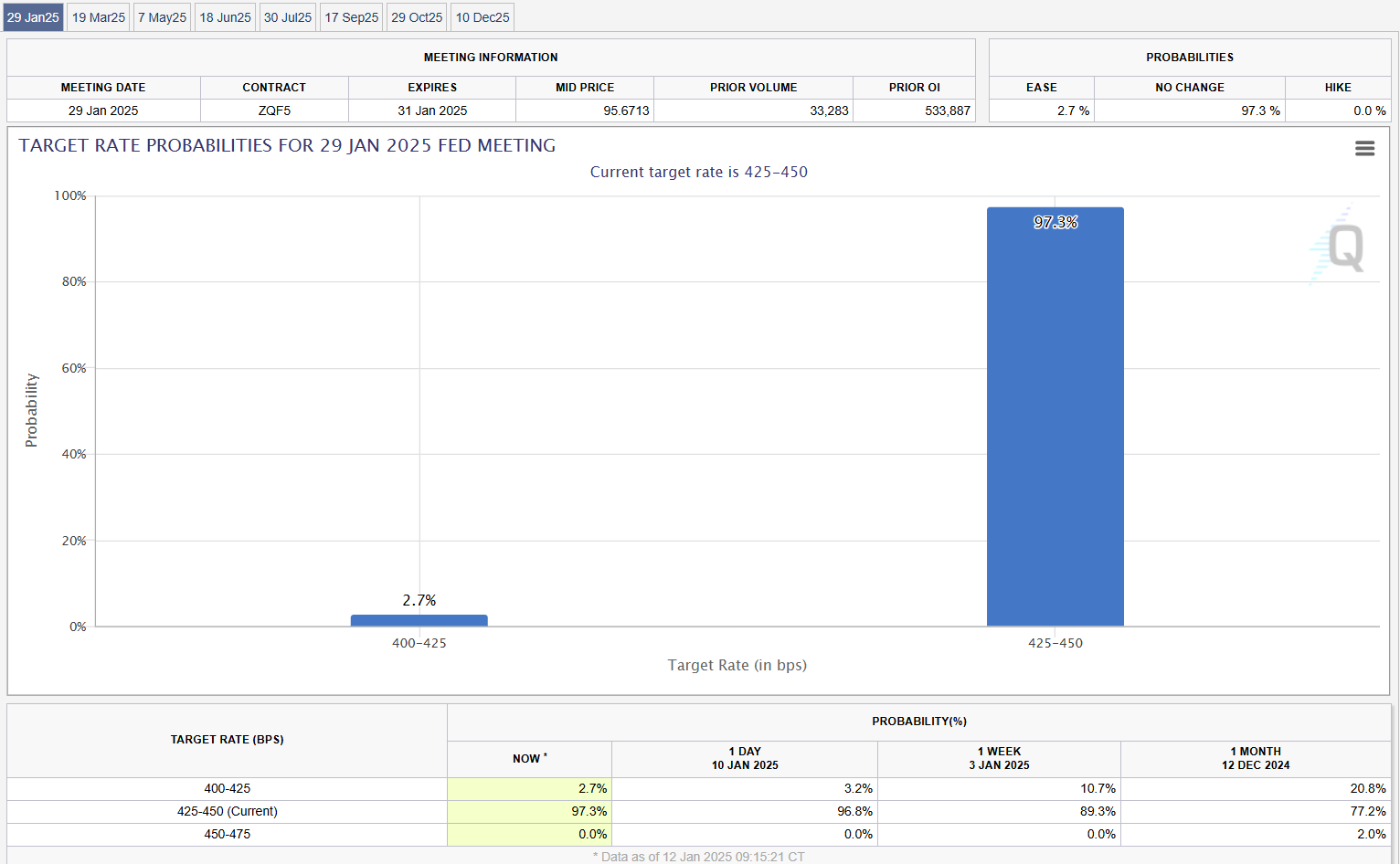

Recent strong payroll numbers suggest that the Federal Reserve may not be as urgent in cutting rates, with market participants now predicting a 97% likelihood of unchanged rates in the upcoming January meeting. The Fed's cautious stance amidst ongoing inflationary pressures could lead to choppy conditions for risk assets like Bitcoin, despite the potential for long-term growth.

Pro-Crypto Legislation May Take Time

Analysts from JPMorgan and NYDIG suggest that while there is a generally positive outlook for digital assets, pro-crypto legislation is unlikely to see immediate action in Congress due to other priorities. However, there is confidence that digital assets will eventually regain attention, leading to potential frameworks for stablecoins and market structure.

Data from CME FedWatch Tool shows market expectations for interest rates.

Comments