Summary:

Bitcoin market trends indicate expectations for prices to reach record highs after Trump's inauguration.

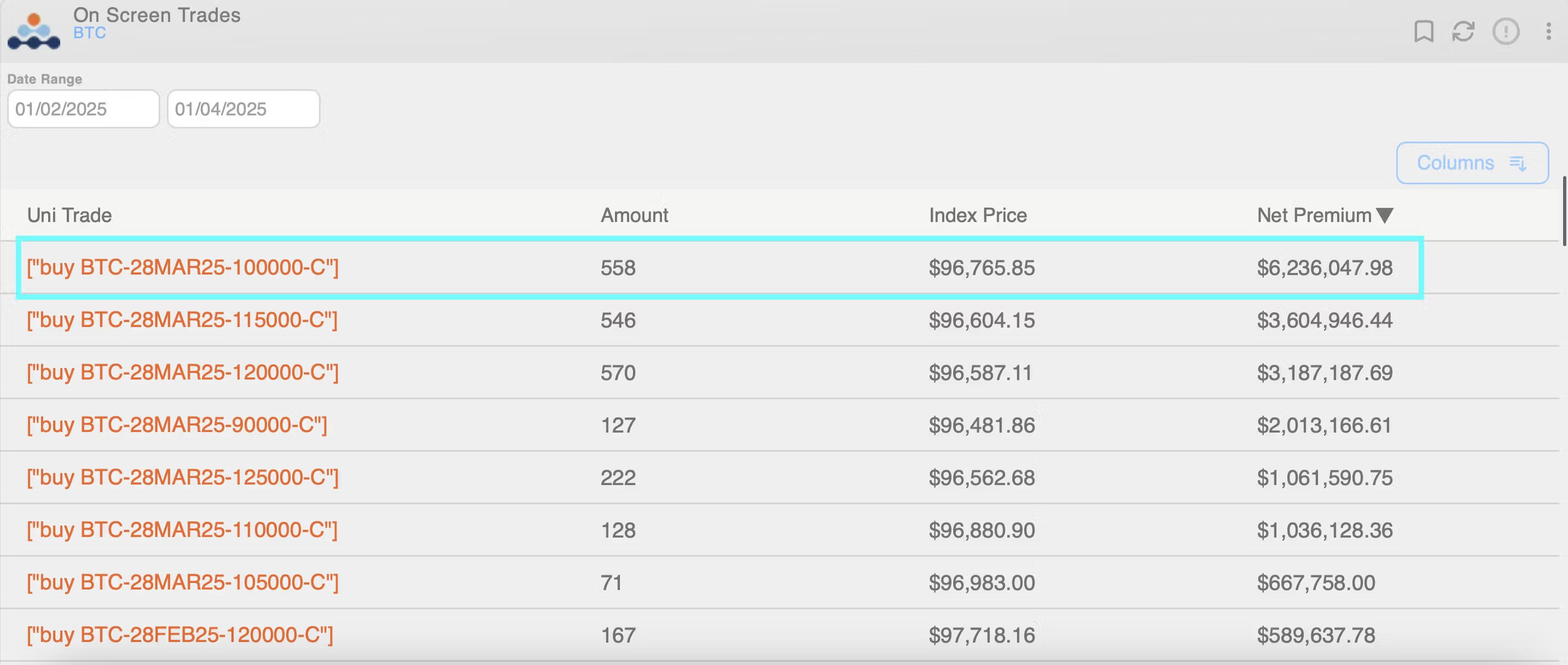

A trader on Deribit spent over $6 million on $100,000 strike call options set to expire on March 28.

Traders are net buyers at the $120,000 strike, showing strong anticipation of a price rally.

Bitcoin is currently trading above $99,500, marking an 8% recovery from its recent low.

Expectations for pro-crypto regulatory changes have bolstered market sentiment since Trump's election.

Anticipation for Bitcoin's Price Surge

Bitcoin (BTC) market trends are showing strong expectations for prices to hit record highs following President-elect Donald Trump’s inauguration on January 20.

On Saturday, a trader on the crypto exchange Deribit made a bold move, spending over $6 million to purchase a $100,000 strike call option set to expire on March 28. According to data from Amberdata, this trade signals a belief that Bitcoin will breach new highs shortly after Trump takes office.

Bullish Sentiment in the Market

Moreover, traders are also net buyers at the $120,000 strike, indicating strong anticipation of a rally that could push prices above this level. The $120,000 call option is currently the most popular option on Deribit, boasting a notional open interest of $1.52 billion.

A call option provides the buyer with the right to purchase the underlying asset at a specified price at a later date, suggesting that the buyer is bullish on the market, aiming for significant gains from an expected price increase.

Market Movement and Predictions

The renewed interest in call options comes as Bitcoin attempts to regain the $100,000 mark. At the time of writing, the leading cryptocurrency is trading above $99,500, reflecting an 8% recovery from its December 30 low of $91,384.

Greg Magadini, director of derivatives at Amberdata, commented that the period surrounding the inauguration is likely to be a prime time for bullish announcements and policies that could act as catalysts for Bitcoin's price to rise.

Supporting this view, CF Benchmarks, a regulated cryptocurrency index provider, echoed similar sentiments but cautioned about potential delays in policy development that might temper the overall bullish mood. They noted that a restructured SEC under pro-cryptocurrency leadership could reduce enforcement risks and bolster innovation, thereby enhancing investor confidence.

Historical Context and Recent Trends

Since Trump's election win in early November, expectations for pro-crypto regulatory changes have positively influenced the crypto market sentiment. Bitcoin surged from approximately $70,000 to new lifetime highs above $108,000 shortly after the election. However, the rally has recently lost momentum, likely due to year-end profit-taking and hawkish Fed rate projections.

Comments