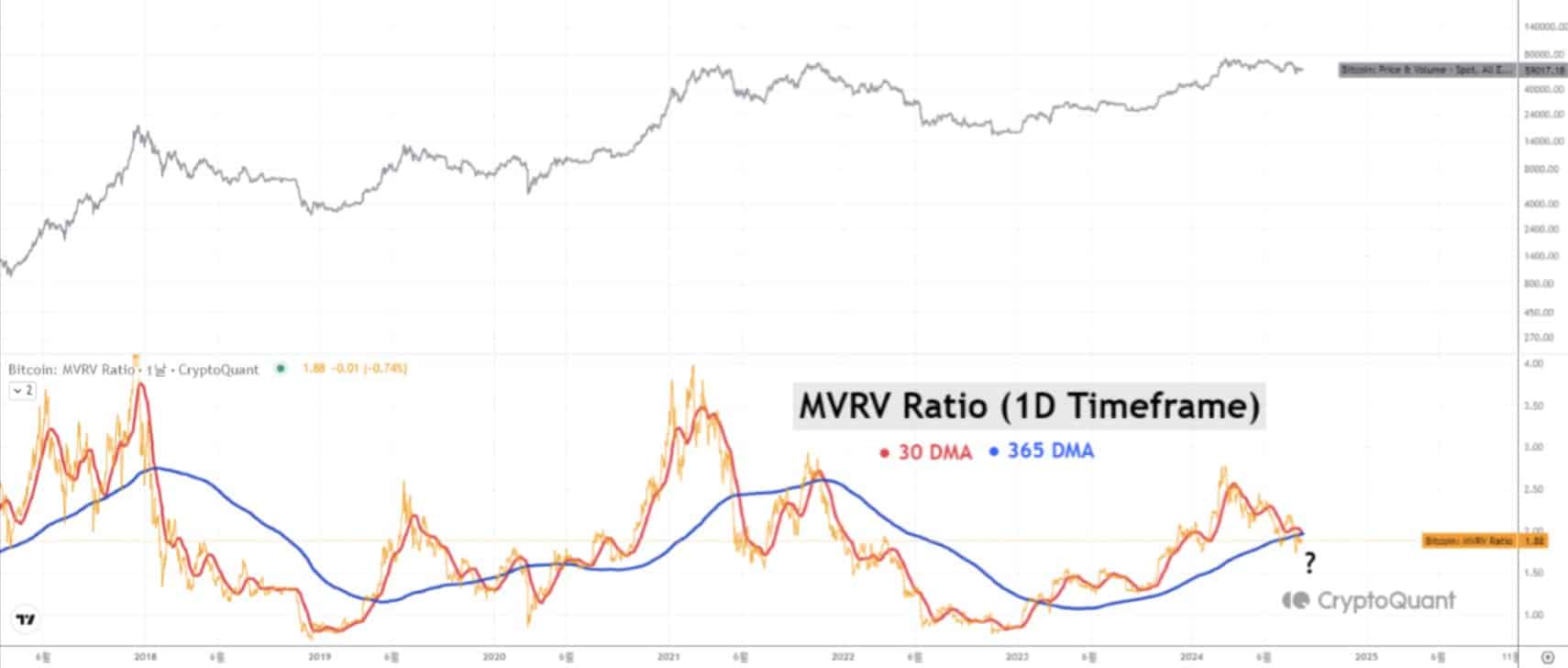

Bitcoin’s MVRV Ratio at Risk of Death Cross

Bitcoin recently hit a new all-time high in 2024, attracting significant interest from institutions, governments, and large investors. The rise of Bitcoin ETFs has led to institutional ownership climbing to 27%. However, a concerning trend has emerged: the MVRV ratio indicator is at risk of a Death Cross, which could indicate a bearish trend if certain metrics align.

In previous cycles, a Death Cross in MVRV momentum has often led to prolonged bearish phases. It's crucial to monitor whether the 30-day moving average continues its decline.

Source: CryptoQuant

A further drop could signify bearish outcomes. Conversely, if the 30 DMA finds support at the 365 DMA and begins to rise, it may suggest a potential price increase for BTC.

Bitcoin and Gold Correlation

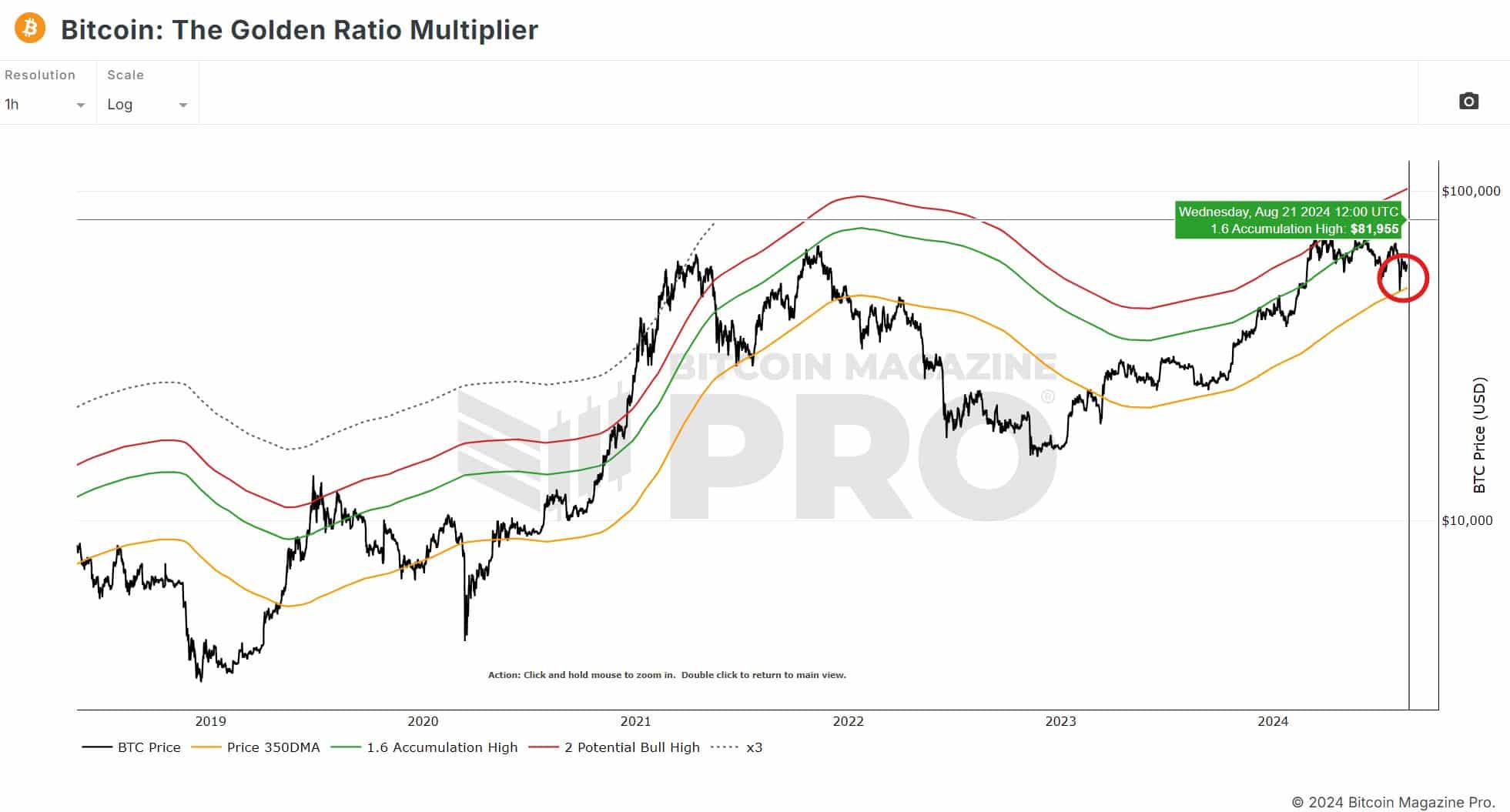

The current Bitcoin-to-Gold ratio stands at 23.4, below its 2021 high. If this ratio drops below 20, it could signal bearish trends for Bitcoin. However, an advance above 32.5 might indicate a bullish trend in the BTC-Gold correlation. Recently, Bitcoin bounced off its Golden Ratio Multiplier 350 DMA, which is a bullish sign.

Source: TradingView

Market sentiment remains uncertain, as the past five monthly candles have fluctuated between $50k – $70K. A key question is whether Bitcoin will retest the $51K level or rally towards the 1.6x level at $82K.

Reserves and Institutional Demand

Currently, Bitcoin reserves on all exchanges are at historic lows, while institutional demand is at an all-time high. This situation raises the possibility of a supply squeeze, which could lead to a temporary price dip to gather liquidity before a potential surge. With diminishing BTC supply and rising demand, the market is primed for significant price movements.

Source: Bitcoin Magazine PRO

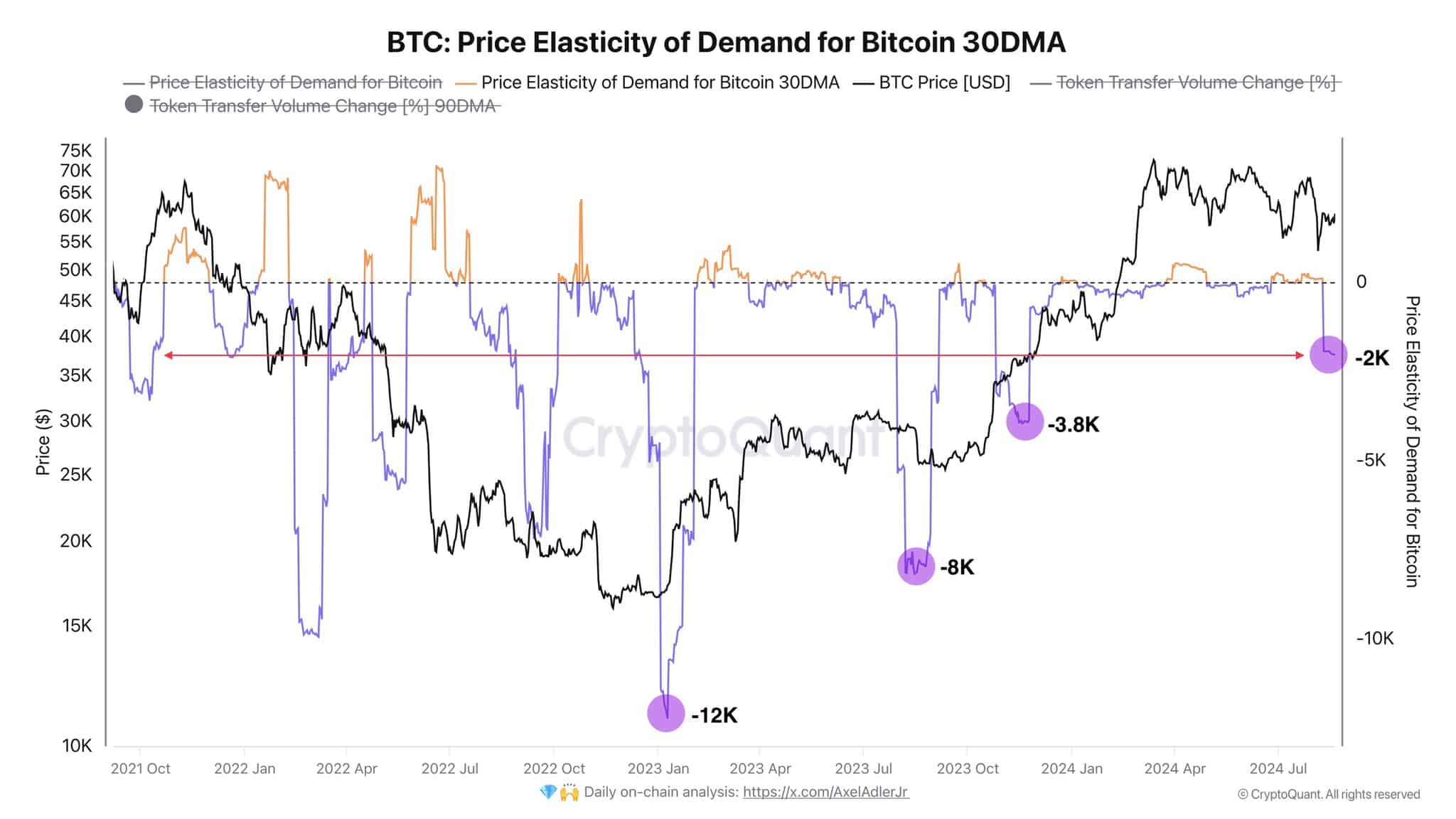

Price Elasticity of Demand for Bitcoin

Bitcoin’s price elasticity of demand indicates that as prices rise, demand (measured by transfer volume) decreases, and as prices fall, demand increases. This inverse relationship suggests that for strong demand to be stimulated, BTC prices may need to drop.

Source: CryptoQuant

This creates a scenario where BTC could turn bearish before experiencing a surge, driven by increased demand at lower prices. Close monitoring of the MVRV Death Cross and the BTC-Gold ratio is essential, as the interplay between different metrics will likely shape Bitcoin’s future price.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!