Summary:

Bitcoin faces a crucial test at the 200 EMA which could determine its next move.

A break above $60,000 could signal a new upward trend for BTC.

Dogecoin shows bullish signs by surpassing its 26 EMA, with resistance at $0.11.

Success for SOL hinges on breaking above the 26 EMA to target $150.

Impending Bitcoin Price Test

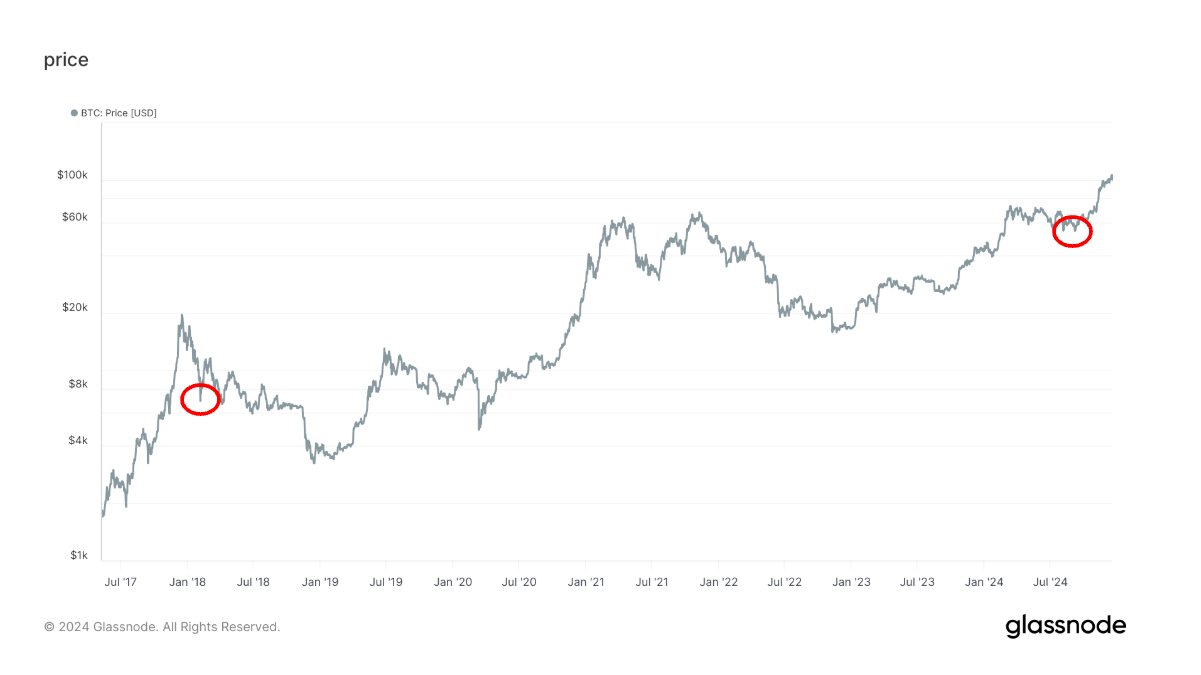

A significant price test for Bitcoin (BTC) is on the horizon, potentially revealing the market's direction. BTC is nearing the 200 EMA, a critical technical level that often serves as a barrier between bullish and bearish market sentiment.

If Bitcoin can break above this barrier, it may signal the start of a new upward trend. Conversely, failure to breach this level could lead to a retracement back to previous price levels, supporting the current downward trend. Key price levels to watch include:

- Psychological barrier near $60,000

- Recent support at $58,300

- Lower support at $54,500 if it fails to break the 200 EMA.

Dogecoin's Bullish Breakthrough

Dogecoin (DOGE) has finally shown signs of life by surpassing its 26-day Exponential Moving Average (EMA), indicating a potential bullish recovery after a prolonged period below critical resistance levels.

The next major resistance zone is around $0.11, near the 50 EMA. If DOGE breaks this level, it could target the 200 EMA at $0.12 and the 100 EMA at $0.14. However, it must hold above $0.09 to maintain its bullish momentum.

Solana's Path to Recovery

Solana (SOL) is approaching $150 and is currently trading near its 26-day EMA. Its ability to continue rising or face a downturn will depend on upcoming price action.

If SOL breaks above the 26 EMA, it may test higher resistance levels in the $140-$150 range, potentially leading to a longer-term rally aiming for the 50 EMA at $147 and the 100 EMA just below $160. However, sellers could push the price back toward recent support at $125–$130 if they reject the price at this point. The RSI remains neutral, indicating potential for both upward and downward movements, and low volume suggests that the next significant move will rely on a surge in buying or selling pressure.

Comments