Ethereum ETF Outflows Hit Record Losses

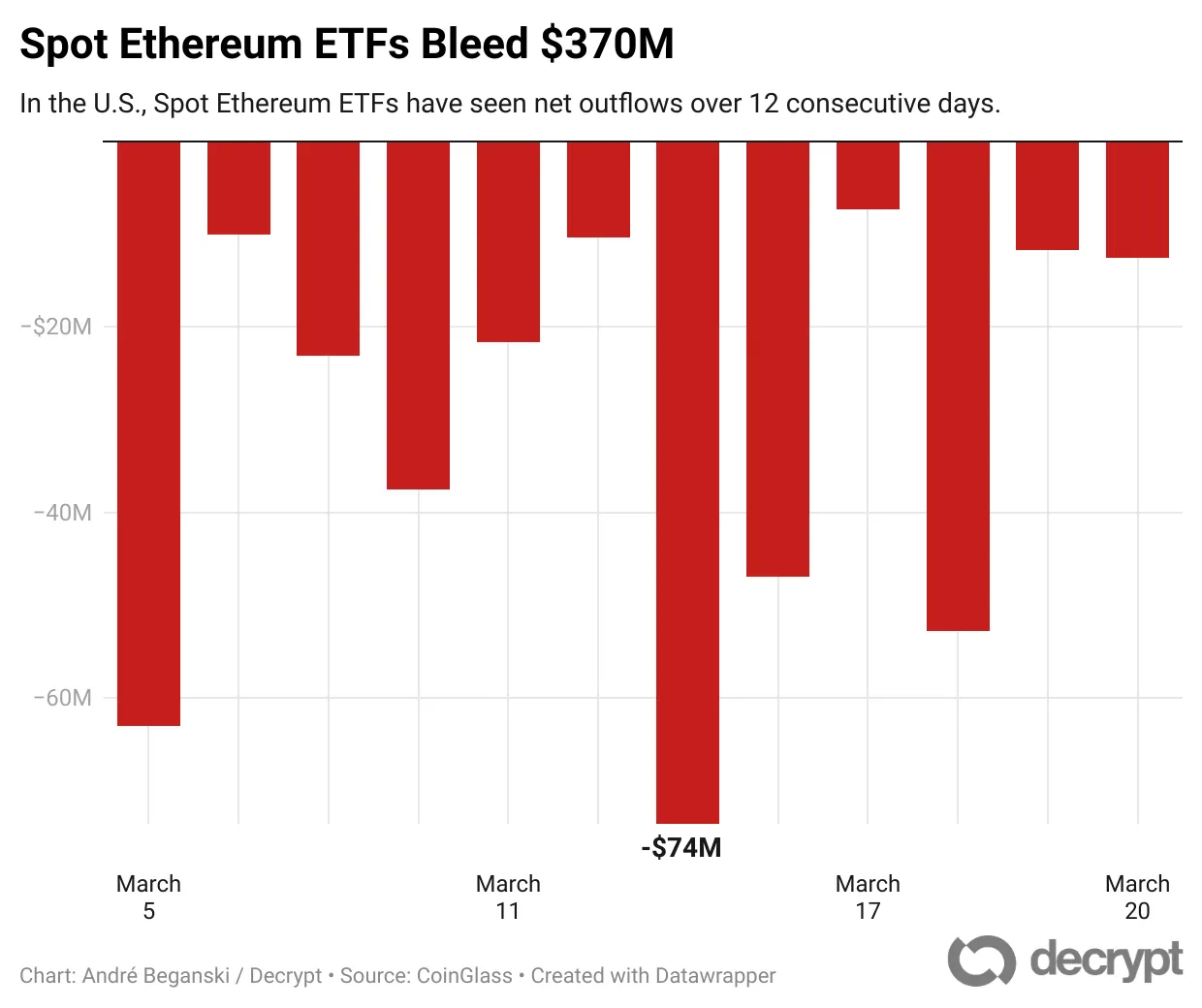

Spot Ethereum exchange-traded funds have experienced a staggering $370 million in asset outflows over the past 12 trading days, marking their longest losing streak to date. This decline comes as the price of Ethereum itself has fallen from approximately $2,200 to around $1,950 on March 5.

The most significant outflows were from the iShares Ethereum Trust (ETHE) and Grayscale Ethereum Trust (ETHE), which accounted for $146 million and $106 million, respectively, according to data from CoinGlass.

Declining Price Amidst Investor Doubts

The recent downturn in Ethereum's price has been attributed to investor skepticism regarding its speed and efficiency compared to other blockchain competitors, coupled with a broader decline in crypto and risk-on assets due to macroeconomic concerns.

In contrast, spot Bitcoin ETFs have seen a resurgence, attracting $660 million this past week, recovering a portion of their recent downturn.

The Staking Dilemma

In an interview at the Digital Asset Summit in New York, Robert Mitchnick, head of digital assets at BlackRock, pointed out that the lack of staking in Ethereum ETFs has contributed to their lackluster performance. He emphasized the importance of staking yields for generating investment returns.

The SEC has acknowledged recent filings from Bitwise, Grayscale, 21Shares, and Fidelity that seek to allow staking in their Ethereum funds, which could potentially improve their attractiveness to investors.

Increasing Staked Ethereum

Currently, the amount of Ethereum being staked has risen to 33.8 million ETH, up from 33.6 million on March 5, when the recent outflow began. Despite these challenges, spot Ethereum funds have recorded $2.45 billion in net inflows since their launch last July.

However, this performance pales in comparison to spot Bitcoin ETFs, which have attracted over $35 billion in net inflows, indicating a growing institutional appetite for BTC while Ethereum's recovery remains sluggish as investors await stronger catalysts.

Comments

Join Our Community

Sign up to share your thoughts, engage with others, and become part of our growing community.

No comments yet

Be the first to share your thoughts and start the conversation!