Summary:

Bitcoin ETFs saw record inflows amid market recovery, signaling investor optimism.

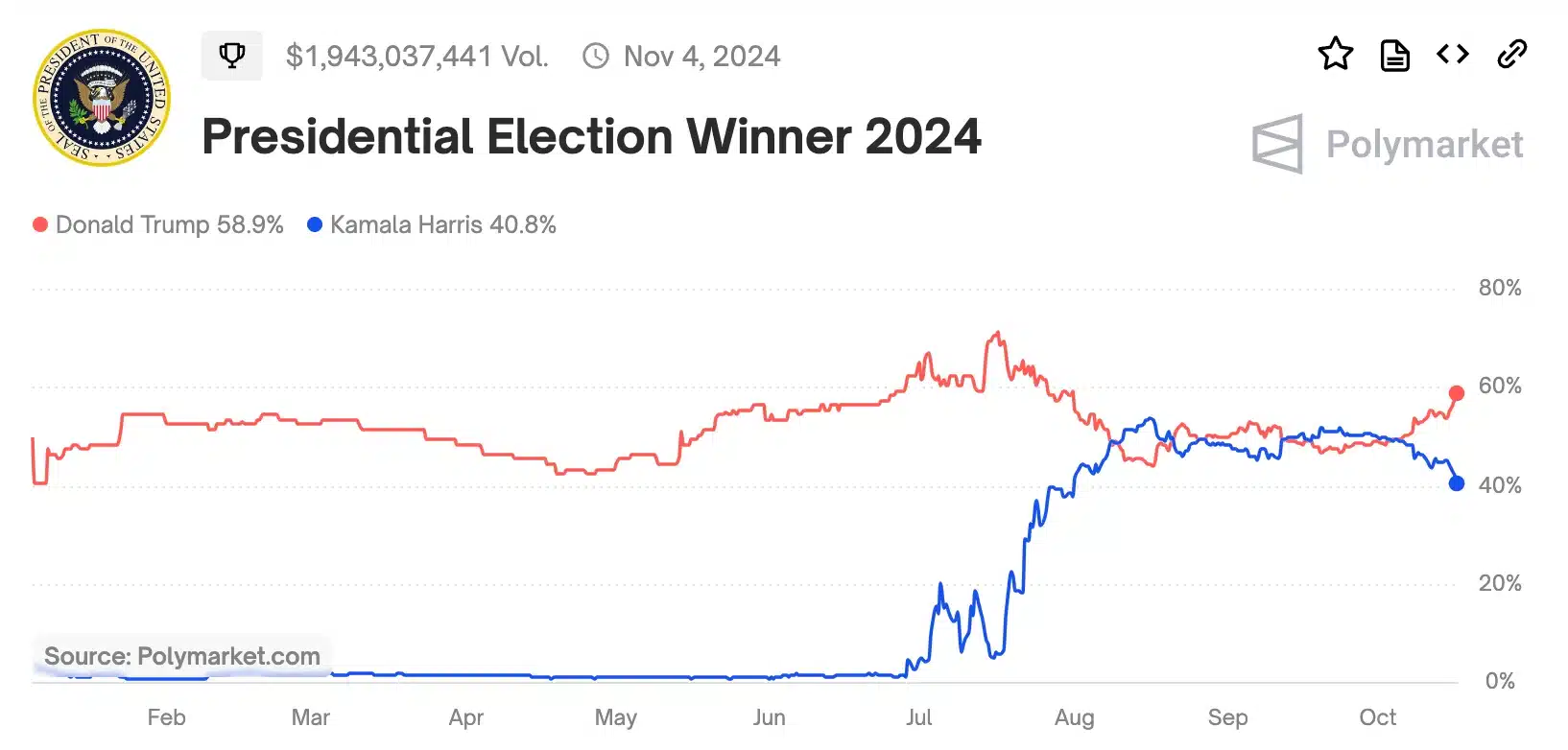

Political shifts favor digital asset inflows, with Republicans viewed as pro-crypto.

On October 15, Bitcoin ETFs recorded $371 million in inflows, led by BlackRock’s IBIT.

CoinShares reports a $407 million uptick in digital asset inflows, linked to potential Republican wins.

Nate Geraci highlights that 34% of voters consider candidates’ crypto positions before voting.

Bitcoin ETFs have been witnessing record inflows amid a broader market recovery, reflecting growing investor optimism in the cryptocurrency space. With political shifts favoring a more pro-crypto stance from Republicans, many are speculating on the potential impacts of a Donald Trump re-election on Bitcoin ETF inflows.

Bitcoin ETF Update

On October 15, Bitcoin ETFs recorded a remarkable $371 million in inflows, with BlackRock’s IBIT leading the charge at $288.8 million. Other notable ETFs included Fidelity’s FBTC at $35 million, Ark 21Shares’ ARK ETF with $14.7 million, and Grayscale’s GBTC at $13.4 million. Notably, while some ETFs did not see inflows, none reported outflows, indicating a growing interest in Bitcoin-based investments.

Just a day prior, Bitcoin ETFs had their highest single-day net inflows since June, totaling $555.9 million, with FBTC contributing $239.3 million—its largest inflow since June 4. This surge comes as Bitcoin trades at $67,823.08, having risen 3.56% in 24 hours and 9.44% over the past week, fueling speculation about another all-time high.

CoinShares Links Inflows to Elections

A recent report by CoinShares highlighted a significant uptick in digital asset inflows, totaling $407 million, attributed to rising investor interest in light of the potential for a Republican win. Investors are increasingly optimistic that a GOP-led administration could lead to favorable regulatory changes for the crypto industry.

The report stated:

“Digital asset investment products saw inflows of US$407m, as investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks.”

The correlation between political developments and capital flows suggests that the upcoming elections are a pivotal factor in shaping the future of digital assets.

Executive Insights

Nate Geraci, President of ETF Store, emphasized the potential impact of the U.S. elections on the digital assets industry, stating:

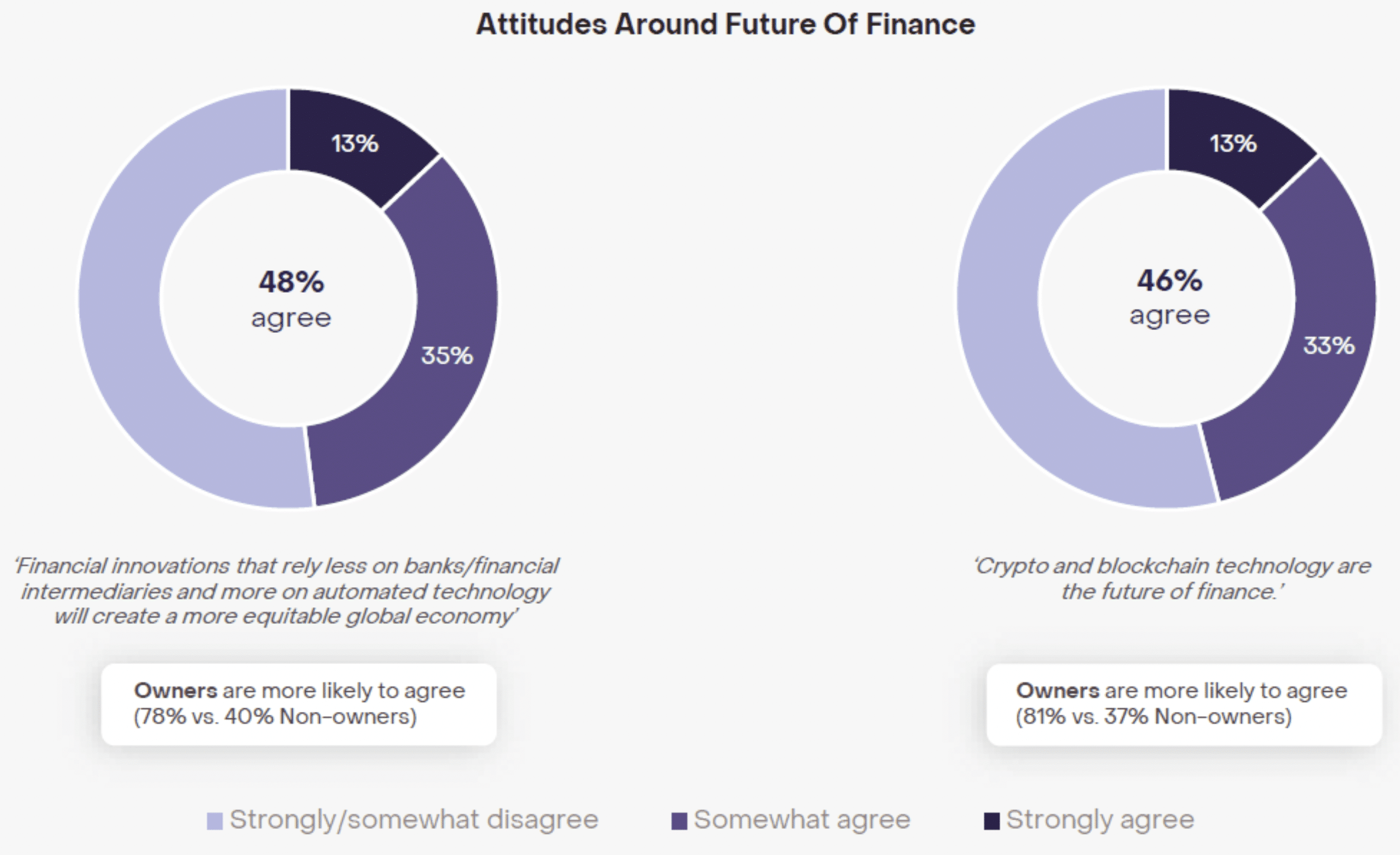

“46% agree that crypto & blockchain are the future of finance. 34% said they were considering candidates’ crypto positions before voting.”

As Trump solidifies his position as the Republican candidate, the final stretch leading to the elections is poised to bring significant developments for the cryptocurrency sector.

Comments