Summary:

206% increase in net gold purchases by central banks in July

Poland leads with 14 tonnes added to its reserves

Uzbekistan and India also significantly increased their gold holdings

Gold remains a preferred asset for central banks amid economic uncertainties

Expectations of continued gold accumulation in the coming months

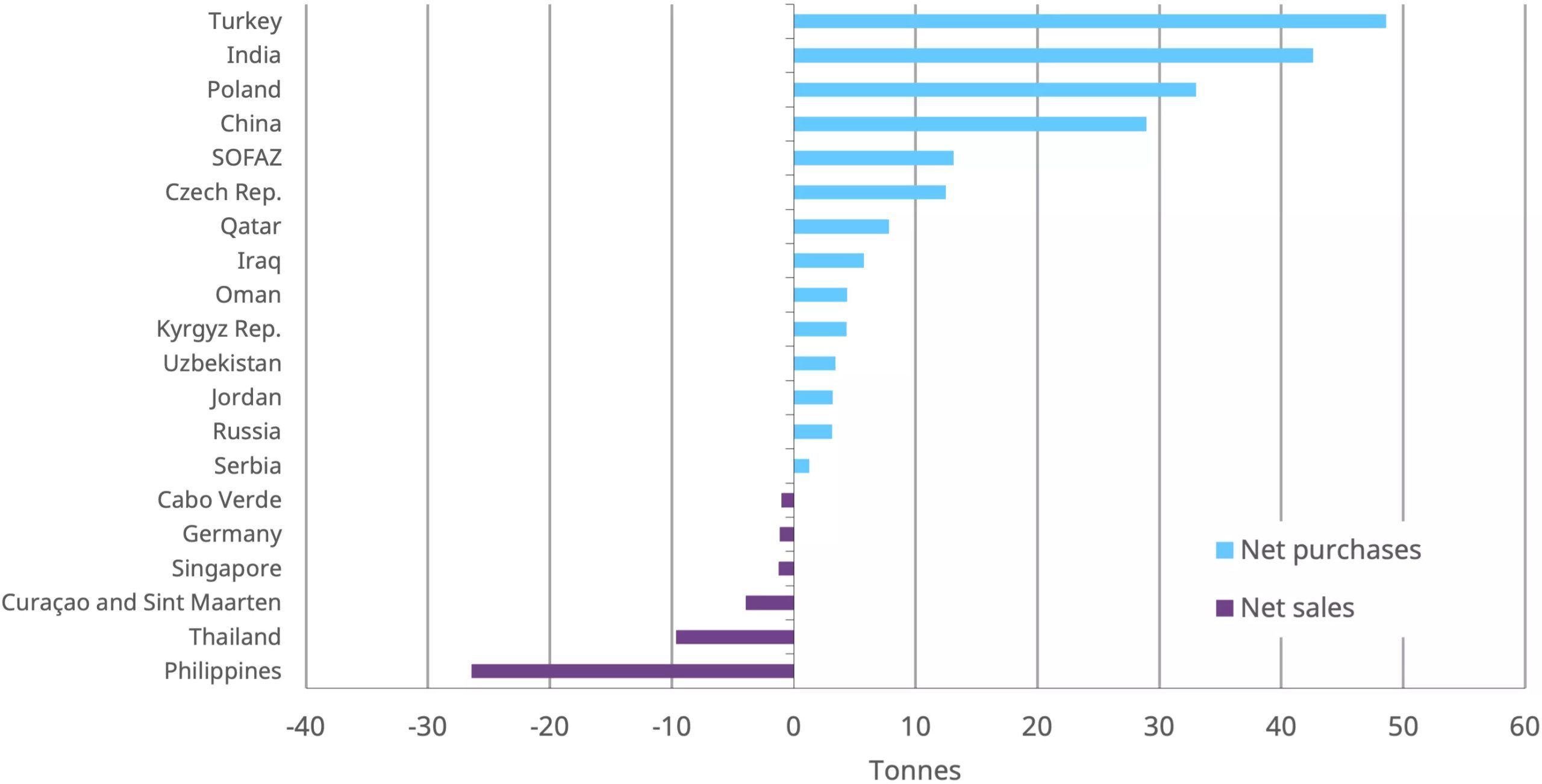

Central banks globally have ramped up their gold purchases significantly in July, despite rising prices, as reported by the World Gold Council. A staggering 206% increase in net gold purchases was observed compared to the previous month, with a total of 37 tonnes added to reserves. This trend indicates a strategic move by central banks to diversify their reserves amid economic uncertainties.

Poland, India, and Uzbekistan Lead the Charge

The National Bank of Poland emerged as the largest buyer, acquiring 14 tonnes, now holding 392 tonnes of gold, which constitutes 15% of its total reserves. Other notable players include the Central Bank of Uzbekistan, which purchased 10 tonnes, and the Reserve Bank of India, adding 5 tonnes for a total of 43 tonnes this year.

Source: World Gold Council (WGC) Central Bank Gold Statistics: July 2024

Despite expectations that rising gold prices would dampen demand, central banks have remained committed to their buying strategies. The World Gold Council emphasizes that the ongoing trend of net purchases reflects an enduring confidence in gold as a reliable store of value, especially during global crises. The report anticipates that this trend will likely continue, highlighting central banks’ focus on stability in an uncertain economic landscape.

Comments