Summary:

Cathie Wood predicts a 5,789% upside for Bitcoin by 2030.

Bitcoin's price target could reach $3.8 million, driven by institutional investment and ETF approvals.

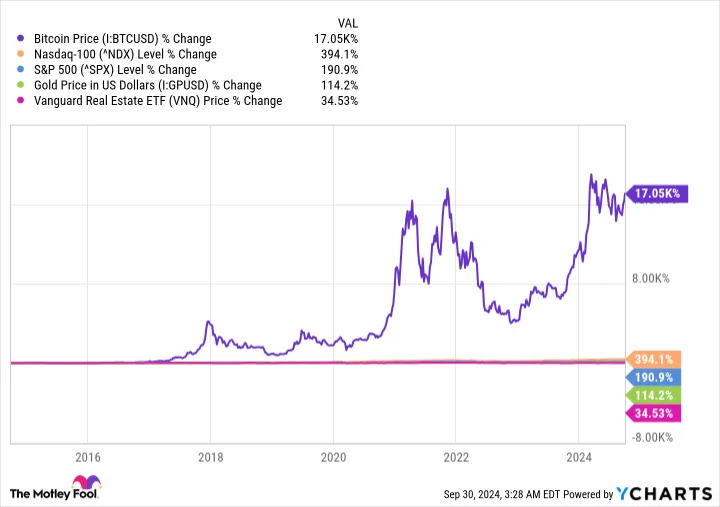

Despite a 17,000% rise over the last decade, Bitcoin remains highly volatile.

Ark identifies emerging market currency, institutional investment, and digital gold as key drivers for Bitcoin's growth.

A more realistic price target could align with gold, suggesting $852,380 per Bitcoin.

Cathie Wood, the founder and chief investment officer of Ark Investment Management, has made headlines with her ambitious prediction for Bitcoin (CRYPTO: BTC). Her recent price target suggests a staggering 5,789% upside by 2030, far surpassing her firm's initial estimate of 2,193%.

Bitcoin's Unique Position in the Market

Bitcoin is the largest cryptocurrency by market capitalization and is considered a decentralized asset, free from the control of any single entity. Built on a blockchain, it offers transparency and autonomy, making it an attractive alternative to traditional currencies. Over the past decade, Bitcoin has skyrocketed over 17,000%, outpacing all other major asset classes, despite experiencing significant volatility with 70% drops on two separate occasions.

Factors Driving Bitcoin's Potential Surge

Ark Investment Management has identified three key catalysts that could drive Bitcoin's price higher:

- Emerging Market Currency: Bitcoin's decentralized nature positions it as a potential alternative to traditional currency in politically unstable regions.

- Institutional Investment: The approval of Bitcoin ETFs provides a regulated avenue for institutions to invest in Bitcoin, potentially increasing demand.

- Digital Gold: Ark posits that a significant portion of investment traditionally allocated to gold could flow into Bitcoin due to its portability and superior performance.

Currently trading at $64,518, Ark believes these catalysts could propel Bitcoin to $1.48 million by 2030, while Cathie Wood's more aggressive target of $3.8 million implies an extraordinary upside.

The Reality of Wood's Forecast

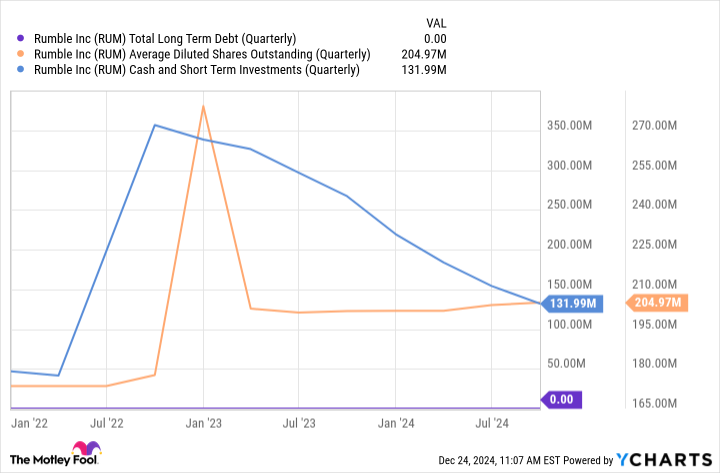

While Wood cites the approval of Bitcoin ETFs as a significant factor behind her $3.8 million target, there are challenges. ETF inflows have slowed, and reaching a market cap of $79.8 trillion would make Bitcoin more valuable than the entire U.S. economy. A more realistic target might align Bitcoin's market cap with gold, suggesting a price of $852,380—still a 13-fold gain from current levels.

Investment Considerations

Before diving into Bitcoin investing, it's essential to consider the high volatility and market risks. While Bitcoin can be a store of value, it is crucial to evaluate its potential against traditional investment options.

Anthony Di Pizio, the author of this analysis, holds no positions in the stocks mentioned, but the Motley Fool recommends Bitcoin and Apple, among others. For those exploring investment opportunities, assessing a diverse portfolio could be beneficial.

Comments